Our collection of resources based on what we have learned on the ground

Resources

presentation

Exploring China’s Construction Market: Opportunities and Entry Strategies for ...

- November 2016

- Members Access

In this presentation, Thibaut Minot, the International Business Advisory Associate of Dezan Shira & Associates, delivers an insight into China's Construction Market and discusses the opportunities and entry strategies for Belgian Architectural Compa...

webinar

LEA Global World & Asian Conference 2016 - Shanghai Evening

- November 2016

- Free Access

This year's LEA Global World & Asian Conference 2016 gathered leading tax, audit and business experts to Shanghai. The third evening of the conference was filled with networking, dinner and entertainment as Dezan Shira & Associates hosted the attende...

videographic

The Guide to Manufacturing in Indonesia

- November 2016

- Members Access

This Prezi breaks down the characteristics of Indonesia's manufacturing environment and puts them side by side with those of the nation's ASEAN competitors.

Q&A

Why has the Chinese government shifted from the business tax (BT) to the value-a...

- November 2016

- Members Access

In 2016, the value-added tax (VAT) has effectively replaced the business tax (BT) as China’s only indirect tax. The transition is part of an effort by the Chinese government to create a service-oriented economy that is no longer centered ...

Q&A

As of November, 2016, what industries were recently placed under China’s value...

- November 2016

- Members Access

As of November, 2016, the construction, lifestyle, finance, and real estate industries were brought under the value-added tax (VAT) system. While under the business tax (BT), these four service sectors made up 80 percent of total BT revenue.&nb...

Q&A

What are some of the differences between China’s value-added tax (VAT) zero-ra...

- November 2016

- Members Access

Both China’s VAT zero-rates and VAT exemption rates are exempt from output VAT. However, unlike with the exemption VAT, under the zero-rated VAT the input VAT that is attributable to cross-border services can either be refunded or credite...

Q&A

What is the difference between the general fapiao and the special VAT fapiao?

- November 2016

- Free Access

General fapiao are issued after a purchase, and they are split into the categories of personal and company fapiao. These categories allow the government to know who can claim the amount indicated in the purchase. General fapiao are far si...

Q&A

What is the significance of China’s Circular 36?

- November 2016

- Free Access

Circular 36 was the final piece of China’s VAT reform, bringing all industries under the VAT, and effectively eliminating China’s business tax. The VAT reform has been rolled out nationwide, and in 2018 the government is expected to...

presentation

Post-M&A Integration of Privately Held Chinese Companies: Practical Solutions to...

- November 2016

- Members Access

In this presentation, Chet Scheltema, the regional director of Dezan Shira & Associates points out the most common financial challenges and risks companies may face in the Post-M&A Integration. Advice on how to avoid and deal with these challenges is...

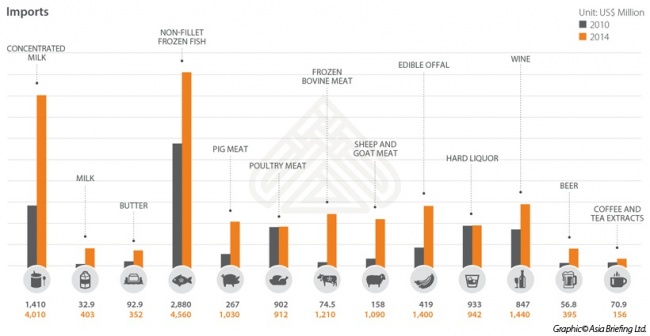

infographic

China's Food & Beverage Imports by Product 2010-2014

- October 2016

- Free Access

This infographic shows the increase of food and beverage imports into China from 2010 to 2014.

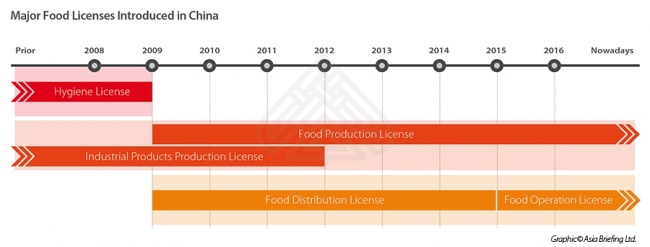

infographic

A Timeline of Major Food Licenses in China

- October 2016

- Free Access

This infographic offers viewers a glance at food licenses that have been introduced in China in recent years.

infographic

Special Licenses and Certificates for Businesses in China's Food Industry

- October 2016

- Members Access

This infographic provides information concerning four special licenses and certificates in China's food industry. Some of these certificates and licenses are required, while others are strongly encouraged by the government for businesses in specific...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us