Our collection of resources based on what we have learned on the ground

Resources

infographic

Direct Shipping Model for Setting Up An E-Commerce Platform in Asia

- July 2016

- Free Access

This infographic shows you the process for setting up an e-commerce platform using the direct shipping model, in which a foreign company ships the goods directly from the overseas warehouse.

infographic

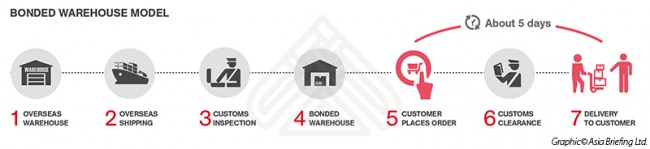

Bonded Warehouse Model for Setting Up An E-Commerce Platform in Asia

- July 2016

- Free Access

This infographic shows you how the bonded warehouse model works for companies which choose to ship their products to the domestic bonded warehouse from their overseas warehouse.

infographic

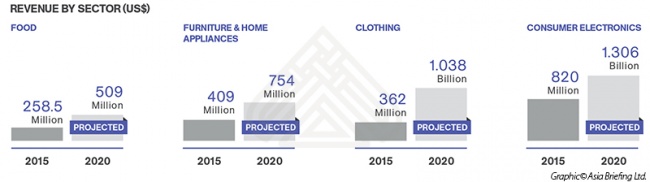

Revenue by Sector in Vietnam

- July 2016

- Members Access

This infographic lists the revenues earned by four main sectors in Vietnam during 2015 and their projected sales in 2020.

report

E-Commerce in Asia

- July 2016

- Members Access

As the digital revolution transforms shopping habits worldwide, emerging markets in Asia stand out as enormous opportunities for foreign investment. Rising internet penetration, a growing consumer base, and rapidly developing logistics infrastructure...

webinar

Investment Opportunities in Vietnam's Healthcare Industry

- July 2016

- Free Access

Dusitn Daugherty, ASEAN Business Intelligence Associate, discusses investment opportunities within Vietnam’s pharmaceutical, medical device, and hospital markets.

webinar

Accounting and Tax Compliance in China

- July 2016

- Free Access

Ines Liu, Senior Associate and member of the International Business Advisory team in Dezan Shira & Associates' Beijing office, discusses accounting and tax compliance in China.

Q&A

What are some potential risks of China's transfer pricing environment?

- July 2016

- Members Access

Although China's transfer pricing legislation has developed over the past 20 years, the country's transfer pricing administration is still considered to be very strict. Chinese tax authorities require taxpayers to make a related party filing in conju...

Q&A

According to Chinese tax law, do foreign businesses need to prepare transfer pri...

- July 2016

- Free Access

According to China tax law, taxpayers who meet certain legislative requirements must prepare annual transfer pricing contemporaneous documentation, which includes a transfer pricing study. Taxpayers who don't meet the requirements are not legally req...

Q&A

What is the importance of inter-company agreements between overseas related part...

- July 2016

- Free Access

In previous years, Chinese tax authorities primarily focused on taxpayers’ transfer pricing issues with respect to their main business operations. However, authorities have recently been paying closer attention to taxpayers’ single relate...

videographic

General Procedure for Company Acquisition

- July 2016

- Free Access

This Prezi presents an overview of the general procedure for company acquisition in China.

videographic

Option 1 Available When Restructuring a China Business

- June 2016

- Free Access

this prezi shows viewers the First Option Available when Restructuring a China Business: Reduction of Operations

videographic

2nd Option Available When Restructuring a China Business

- June 2016

- Free Access

This prezi offers viewers 2nd option: Conversion. On Available When Restructuring a China Business.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us