Our collection of resources based on what we have learned on the ground

Resources

Q&A

How can fraud be avoided in India?

- June 2014

- Free Access

Fraud can be avoided through the use of Audit and Attestation services. Most companies in India are required by law to have an Internal Audit department, which is given independence and which directly reports to the board of the company. Another way ...

Q&A

What is the difference between fraud and error in India?

- June 2014

- Members Access

The key difference between “fraud” and “error” often relates back to the intent to deceive, and distinguishing between the two can be challenging. Auditors are charged with exercising judgment when preparing their opinion for ...

Q&A

How can a company mitigate the risk of fraud in India?

- June 2014

- Free Access

Mitigating the risk of fraud begins with a robust governance structure that includes the audit of budgeting processes, ethics policies, quality control, monitoring procedures by senior management, and rotation procedures. Any weakness in an organizat...

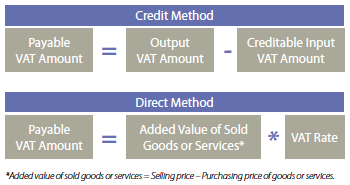

infographic

Two Methods for Calculating VAT in Vietnam

- June 2014

- Free Access

This infographic details the two methods for calculating value-added tax in Vietnam

Q&A

What does the Vietnamese Law on Amendment of Value-Added-Tax entail?

- June 2014

- Members Access

Vietnam’s main value-added tax (VAT) laws are based on The Law on VAT NO.13/2008/QH12 dated June 2, 2008 and Law No.31/2013/QH13 (the Law on Amendment of VAT) dated June 19, 2013. The Law on Amendment of VAT amends and adds to the Law on VAT by...

Q&A

Who can be subjected to value-added tax (VAT) in Vietnam?

- June 2014

- Free Access

Taxable persons in Vietnam are: Organizations and individuals producing or trading in VAT-liable goods and services in Vietnam, regardless of their business lines, forms and/or organizations; and Organizations and individuals importi...

Q&A

What are the value-added tax (VAT) rates for enterprises in Vietnam?

- June 2014

- Members Access

Vietnam has three VAT rates: zero percent, five percent and 10 percent. 10 percent is the standard rate applied to most goods and services, unless otherwise stipulated. Zero percent tax rate The zero percent tax rate applies to exported goods and se...

presentation

Cross Border Transactions Profit Repatriation and Funding of SMEs in China

- May 2014

- Members Access

Hannah Feng, Senior Manager of Corporate Accounting Services, analyses tax implications in five different case studies regarding cross border transactions and repatriation of profits.

magazine

E-Commerce Across Asia: Trends and Developments 2014

- May 2014

- Members Access

In this issue of Asia Briefing Magazine, we provide a comprehensive overview of e-commerce trends across the Asia-Pacific region with a focus on developing markets in Southeast Asia. In addition to analyzing macro-level economic and development indic...

infographic

Unchanged FDI Caps in India

- May 2014

- Free Access

This infographic details the FDI caps that have been kept unchanged by the Indian government after the policy reform 2013.

infographic

Changes to FDI Caps in India's Business Sectors

- May 2014

- Free Access

This infographic details the changes to FDI caps in India’s business sector.

infographic

Single-Brand Retail Trading Investment Routes

- May 2014

- Free Access

This infographic details the investment routes for single-brand retail trading.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us