Our collection of resources based on what we have learned on the ground

Resources

infographic

Individual Income Tax Rates in China

- May 2013

- Members Access

The table shows the formula, rates and deductions of Individual Income Tax (IIT) rates in China.

infographic

Countries with Double Taxation Avoidance Agreements with China

- May 2013

- Free Access

The table shows the countries which have double taxation avoidance agreements with China as of January 2013.

webinar

Introduction to Taxes in Vietnam presented by Alberto Vettoretti

- May 2013

- Free Access

Mr. Alberto Vettoretti, Managing Partner of Dezan Shira & Associates China and Vietnam, discusses the key taxes affecting foreign companies and individuals in Vietnam.

webinar

Setting up a Business in Vietnam presented by Alberto Vettoretti

- May 2013

- Free Access

Mr. Alberto Vettoretti, Managing Partner of Dezan Shira & Associates China and Vietnam, discusses the different entry channels for foreign investors interested in setting up a business in Vietnam.

magazine

An Introduction to Development Zones Across Asia

- May 2013

- Members Access

The use of development zones in their different guises has been an effective model essentially brought to prominence by China over the past 25 years to help both foreign investors and domestic companies meet in a relationship that provides tax advant...

magazine

Understanding Permanent Establishments in China

- May 2013

- Members Access

With an increasing number of foreign enterprises starting to conduct business in China, tax liabilities resulting from business activities in China are quickly becoming an issue of key concern. Many foreign enterprises that conduct business in China ...

magazine

An Introduction to Audit in India

- April 2013

- Members Access

To coincide with the commencement of Indiaâs annual audit season, this issue of India Briefing Magazine provides an overview of Indian audit procedures for the non-audit foreign executive based in India, as well as for the CFO at the head office...

podcast

Impact of Chinese Tax Reforms on American Companies presented by Chet Scheltema

- April 2013

- Free Access

Mr. Chet Scheltema, manager of the Beijing Business Development team for Dezan Shira & Associates, discusses his trip to the United States where he visited partners, clients and gave a presentation at Bloomberg’s BNA/CITE Conference in San Francisc...

podcast

Asia Briefing Magazine, March & April 2013 Issue: "Expanding Your China Business...

- April 2013

- Free Access

Christian Fleming, former Managing Editor at Asia Briefing, a Dezan Shira alumni, discusses the evolution of China’s economic growth model compared to Vietnam and India as alternatives in the region.

podcast

China Briefing Magazine, March 2013 Issue: "Trading With China"

- April 2013

- Free Access

Christian Fleming, former Managing Editor at Asia Briefing, a Dezan Shira alumni, discusses tax, customs, licensing and regulatory issues affecting foreign businesses currently trading with China.

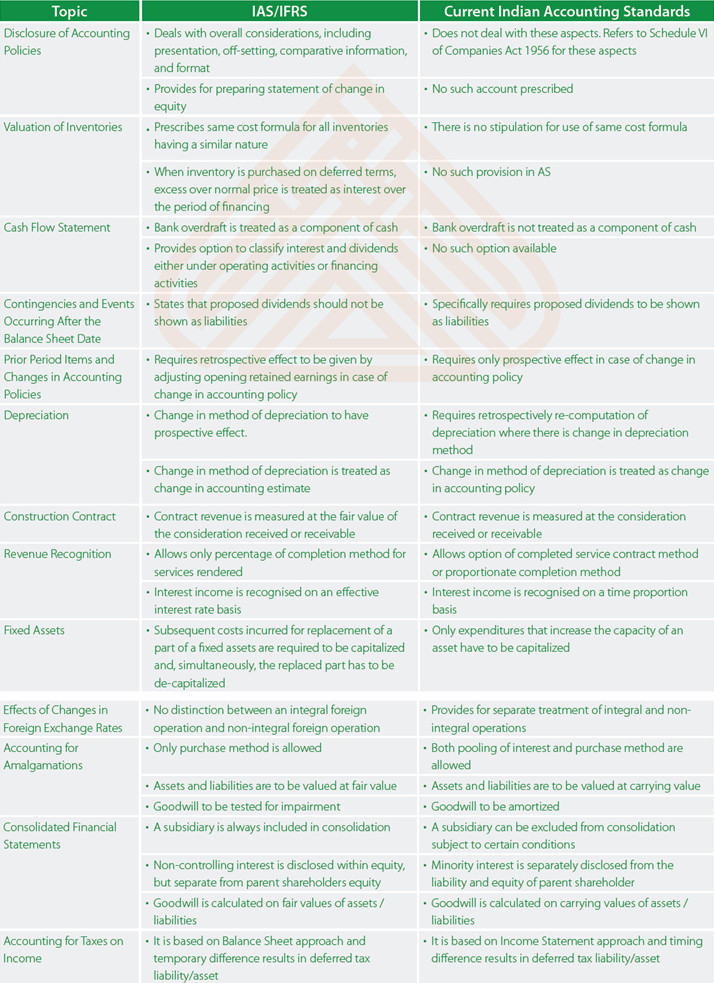

infographic

Differences between Indian and International Accounting Standards

- April 2013

- Members Access

This table compares the differences between Indian accounting standards and International Accounting Standards (IAS)/International Financial Reports Standards (IFRS).

magazine

Merger & Acquisition Regulations in China

- April 2013

- Members Access

In this issue of China Briefing, we return to a popular subject - Chinaâs M&A regulatory framework. With the global economy slowly coming out of recession, and Chinese businesses wanting to expand both domestically and overseas (both issues driv...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us