Our collection of resources based on what we have learned on the ground

Resources

Q&A

How is related parties defined in terms of management under Chinese law?

- January 2014

- Members Access

Related parties are found on the basis that, when the either of the following is appointed by another enterprise, or two enterprises with more than half of their senior management personnel or more than one executive director is appointed by a sam...

Q&A

Under what other conditions would parties be considered as related parties?

- January 2014

- Members Access

If one of the following scenarios is met, then parties shall be considered as related parties: • When one enterprise’s production and operation activities are dependent on intangibles licensed from another enterprise (including indu...

Q&A

What aspect should be cautioned when using holding companies for Chinese or ASEA...

- January 2014

- Free Access

It must be noted that compliance with anti-avoidance tax rules from Hong Kong and Singapore is a must. The key to such compliance is to show that the holding company is a genuine business, i.e.: there must be economic substance to justify this tax...

Q&A

What are the tax incentives for Hong Kong and Singapore holding companies?

- January 2014

- Members Access

Since both Hong Kong and Singapore have double taxations agreements with China and ASEAN countries, the withholding tax rate for profit repatriation to these two locations would normally be reduced. An instance would be that the Chinese withholding t...

Q&A

Why are Hong Kong and Singapore holding companies attractive to foreign investor...

- January 2014

- Free Access

In terms of ease of doing business, both locations take the stance of protecting investors and facilitating cross-border trade, by providing highly transparent business environment and favorable tax regime to businesses. Also, with English being the ...

magazine

Gestione dei Libri Paga in Asia

- January 2014

- Members Access

La riscossione delle entrate fiscali e la gestione della previdenza sociale sono due delle funzioni fondamentali esercitate da un governo. Nel processo di costituzione e nel corso della gestione di un business in Asia, le aziende devono prestare part...

magazine

Payroll Processing Across Asia

- January 2014

- Members Access

In Asia Briefing Magazineâs first issue of 2014, we provide a country-by-country introduction to how payroll and social insurance systems work in China, Hong Kong, Vietnam, India and Singapore. We also compare three distinct models companies use...

podcast

Vietnam Briefing Magazine, February 2014 Issue: ?A Guide to Understanding Vietna...

- January 2014

- Free Access

This issue of Vietnam Briefing aims to clarify the entire VAT, short for value-added tax, process by taking you through an introduction as to what VAT is, liabilities that come with it, and how to pay it properly.

infographic

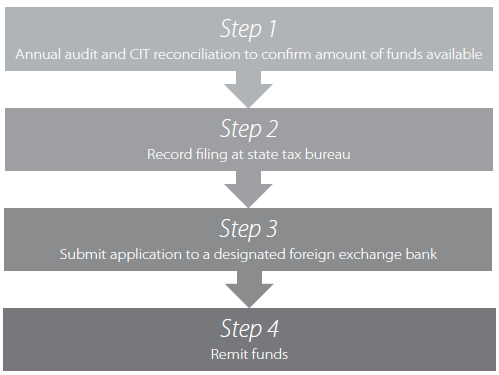

Profit Repatriation Procedure in China

- January 2014

- Members Access

All foreign-invested enterprises in China are required to carry out annual compliance procedures as mandated by various governmental departments. Here are the steps for profit repatriation in China.

infographic

Imposte societarie a confronto: Vietnam e Cina

- December 2013

- Free Access

Questo infographic fa un confronto tra Cina e Vietnam in merito alle: imposte sul profitto d’impresa, sul valore aggiunto e sull’imposizione sul rimpatrio dei dividendi.

infographic

Investire in zone speciali in Cina: le procedure di iscrizione

- December 2013

- Free Access

infographic

Procedure e stima dei tempi per una comune richiesta secondo il nuovo sistema de...

- December 2013

- Free Access

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us