Our collection of resources based on what we have learned on the ground

Resources

Q&A

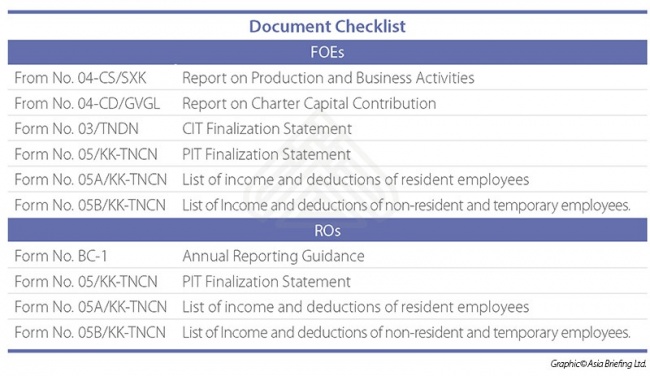

What’s the difference between Foreign Owned Enterprises (FOEs) and Representat...

- January 2016

- Free Access

The process for PIT is similar between them, but the submission deadlines are different. For ROs, the deadline is based on the calendar year and for FOEs, the deadline is based on the fiscal year.

magazine

Annual Audit and Compliance in Vietnam 2016

- January 2016

- Members Access

In this issue of Vietnam Briefing, we address pressing changes to audit procedures in 2015, and provide guidance on how to ensure that compliance tasks are completed in an efficient and effective manner. We highlight the continued convergence of VAS ...

infographic

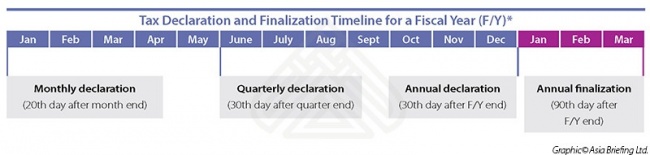

Tax Declaration and Finalization Timeline in Vietnam for a Fiscal Year (F/Y)

- January 2016

- Free Access

Foreign owned Enterprises in Vietnam must conduct CIT finalization at the end of every year.

infographic

Steps in the Vietnam Auditing Process

- January 2016

- Free Access

Auditing in Vietnam can be divided into 3 main steps

infographic

Document Checklist for Foreign Owned Enterprises and Representative Offices for ...

- January 2016

- Free Access

The requisite documentation needed for FOEs and ROs in the auditing process in Vietnam.

infographic

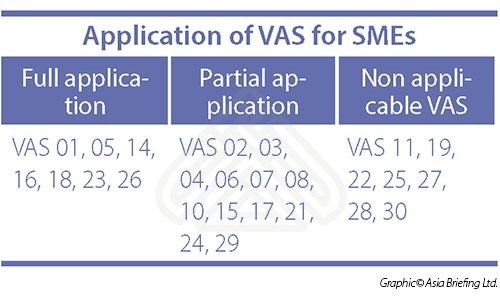

Application of Vietnamese Accounting Standards for Small and Medium Sized Enterp...

- January 2016

- Members Access

Vietnam requires that SMEs comply with a simplified set of accounting standards.

Q&A

What are the penalties imposed in Vietnam if a company fails to comply with repo...

- January 2016

- Free Access

If a company fails to comply with VAT regulations and misses the deadline, penalties will be ensued and in many cases profits will also be affected. In addition, a taxpayer who pays tax later than the deadline has to pay the outstanding tax liabiliti...

Q&A

How has Vietnam become an alternative to China when choosing a destination for i...

- December 2015

- Free Access

China’s business environment has changed rapidly in recent years due to rising labor costs. As a result, more and more foreign investors have started to search for alternative markets. Vietnam stands out as the country most often offered as an ...

Q&A

What industries are of particular interest when considering whether to invest in...

- December 2015

- Free Access

Exports of electronics have provided huge momentum for economic growth in Vietnam. The Vietnamese government offers special incentives to lure large foreign electronics investors such as LG, Microsoft, and Panasonic. That in return has propelled elec...

Q&A

What advantages in tariffs does Vietnam have when trading with China?

- December 2015

- Free Access

Vietnam’s inclusion in the ASEAN-China Free Trade Agreement (ACFTA) amplifies its advantage of geographic proximity to China. As of January 1st, 2012, most Chinese Tariffs levied on Vietnamese imports including on key industries such as copper ...

Q&A

What are Non-Wholly Originating Goods and why are they potentially a concern for...

- December 2015

- Members Access

Non-Wholly Originating Goods refer to exports produced using inputs from outside of a given Free Trade Agreement(FTA). When companies seek to adopt a China plus one production model and integrate Vietnam into existing supply chains, they might consid...

Q&A

What advantages does Vietnam’s Dinh Vu Industrial Zone(DUIZ) have?

- December 2015

- Free Access

Advantages of the DUIZ lie in its proximity to various outlets for exported goods, its well-established facilities and regulatory assistance, as well as easily accessible high skilled labor pools for companies to jump start their manufacturing operat...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us