Our collection of resources based on what we have learned on the ground

Resources

presentation

Indian Income Tax Return Form ITR-3

- April 2017

- Free Access

This is the Indian Income Tax Return Form ITR-3 for individuals and HUFs having income from a proprietary business or profession.

presentation

Indian Income Tax Return Form ITR-4 SUGAM

- April 2017

- Free Access

This is the Indian Income Tax Return Form ITR-4 SUGAM for presumptive income generated from business and profession.

presentation

Indian Income Tax Return Form ITR-5

- April 2017

- Free Access

This form is to be used to file the income tax returns of firms, association of people and body of individuals.

presentation

Indian Income Tax Return Form ITR-6

- April 2017

- Free Access

This form is to be used by companies that do not claim any deductions under Section 11 of the Income Tax Act 1961.

presentation

Indian Income Tax Return Form ITR-7

- April 2017

- Free Access

This form is to be used by people (including companies) that are required to provide income tax returns under specific categories.

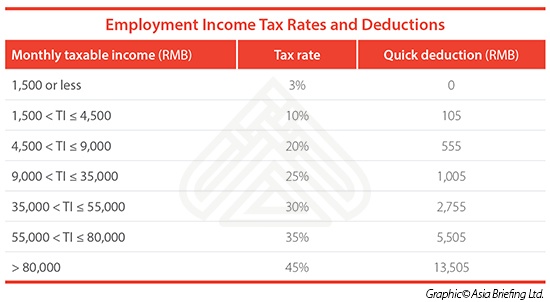

infographic

China's Employment Income Tax Rates and Deductions

- April 2017

- Members Access

The table shows China's employment income tax rates and RMB quick deduction.

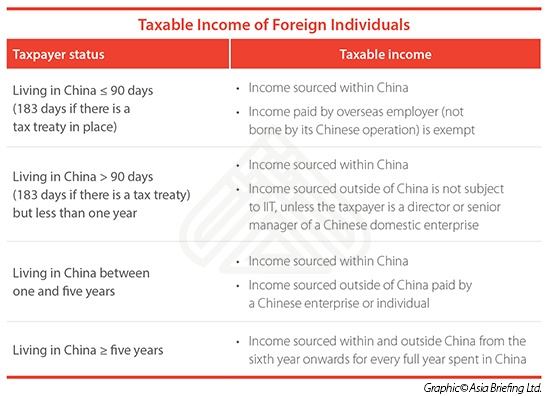

infographic

Taxable Income of Foreign Individuals in China

- April 2017

- Members Access

This table shows the taxable income of foreign individuals working in China by taxpayer status.

magazine

Payroll Processing in China: Challenges and Solutions

- April 2017

- Members Access

Businesses in China have a diverse array of HR and payroll needs, but what different industries have in common is the need to grapple with China’s complex and idiosyncratic payroll environment. In this issue of China Briefing magazine, we begin by ...

Q&A

How is China's social security system structured?

- April 2017

- Members Access

China’s social security system is composed of five different insurance types plus one mandatory housing fund scheme. Each has different contribution rates for employers and employees. Employers need to contribute on behalf of every employee, bu...

Q&A

How can IT solutions help improve efficiency in payroll processing in China?

- April 2017

- Free Access

The HR and payroll processes of many companies operating in China are still paperbased or recorded on obsolete digital archives. Single function software such as tax processing programs can thus be a solution for both small and medium enterprises, bu...

infographic

Taxable Income of Foreign Individuals

- April 2017

- Free Access

The infographic above explains the income sourced within China from less than 90 days starting from income sourced within China

magazine

Working as an Expat in India

- March 2017

- Members Access

In this issue of India Briefing Magazine, we look at India’s living and working environment, HR and payroll laws, and the taxation norms as applicable to foreign nationals. India is the second most favored destination for expatriates that want to w...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us