Our collection of resources based on what we have learned on the ground

Resources

infographic

New Requirements for Preparing Local File Documentation in China

- September 2016

- Members Access

This infographic offers an extensive list of new requirements for taxpayers preparing their transfer pricing documentation in China.

infographic

Remitting Profits from an Indian Subsidiary

- September 2016

- Free Access

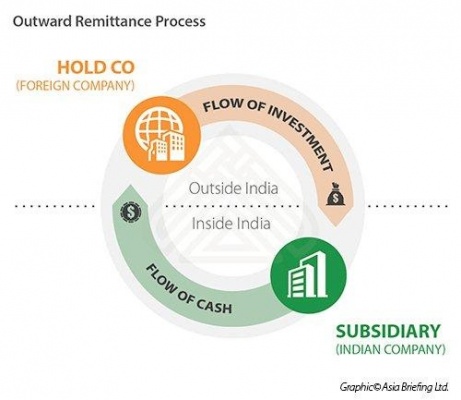

This infographic shows the relationship between a foreign holding company and an Indian subsidiary through the continuous flow of cash and investment.

infographic

Methods for Remitting Profits from India

- September 2016

- Members Access

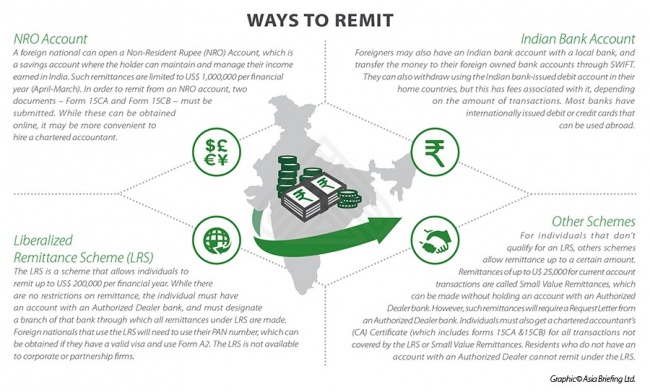

This infographic offers valuable insights for expats looking to remit profits from India.

infographic

The Cost of Using Dividends to Repatriate Profits from India

- September 2016

- Members Access

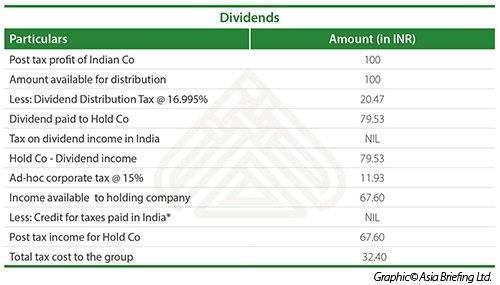

This infographic shows the taxes applied to dividends being remitted from an Indian subsidiary to its foreign holding company. Under the Dividends Distribution Tax, dividends distributed by an Indian entity are subject to a 15% tax.

infographic

Repatriation Strategies for Expats in India

- September 2016

- Free Access

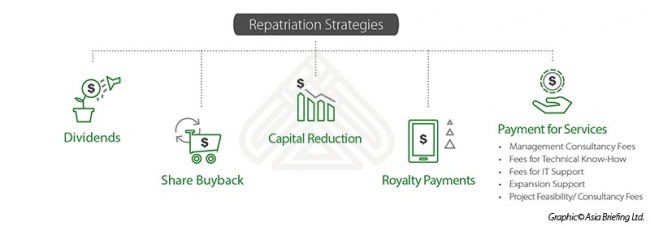

This infographic offers strategies for repatriating profits from India, such as royalty programs and capital reduction.

Q&A

What is the arm’s length principle of transfer pricing?

- September 2016

- Members Access

The arm’s length principal states that that the price charged for goods or services between two related parties must be the same as the price that would be charged if the two parties were unrelated. Therefore the arm’s length p...

Q&A

What is contemporaneous documentation in China?

- September 2016

- Members Access

Tax authorities across the world define contemporaneous documentation in different ways. In China, contemporaneous documentation comes in the form of either a master file, local file, or a special file. If tax authorities request document...

Q&A

What effects will China’s new transfer pricing regulations have on the present...

- September 2016

- Members Access

On June 29, 2016, China’s State Administration of Taxation issued Announcement No.42, updating the requirements concerning related company transfer pricing. These new regulations have been put into effect in an effort to help Chinese tax ...

Q&A

What is the significance of the comparable uncontrolled price method (CUPM) in C...

- September 2016

- Members Access

The Comparable Uncontrolled Price Method (CUPM) is used to establish the arm’s length price of a Related Party Transaction (RPT). The CUPM does this by taking the given price of a transaction between two unrelated parties taking part in a...

Q&A

How is the resale price method (RPM) used to determine the arm’s length price ...

- September 2016

- Members Access

The Resale Price Method (RPM) establishes the arm’s length price of related party transactions (RPT) concerning the purchase of merchandise. The Resale Price Method generally applies to transactions regarding products rather than services...

Q&A

What is the significance of India's 2013 Companies Act?

- September 2016

- Free Access

The Companies Act, 2013, updates the information that must be included in the statement of repatriation of profits from a foreign company. Additionally, the Act affects the statement of transfer of funds and the information that it should inclu...

Q&A

What is the significance of India’s Foreign Exchange Management Act (FEMA)?

- September 2016

- Free Access

India’s Foreign Exchange Management Act (FEMA) was put into place in 1999 in an effort to promote the foreign exchange market in India. Through FEMA, the Indian government and the Reserve Bank of India (RBI) work to adjust India’s t...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us