Our collection of resources based on what we have learned on the ground

Resources

magazine

Tax Incentives in India

- March 2018

- Members Access

In this issue of India Briefing magazine, we examine India’s corporate tax structure, analyze the latest trends in India’s tax system, and strategies that companies can use to offset their tax burden. We also answer frequently asked questions on ...

magazine

China Industries Outlook 2018

- December 2017

- Members Access

In China’s new era, socioeconomic issues such as a rapidly aging society, an uneasy transition towards a knowledge-based economy, and a highly polluted environment are becoming more important than relentless economic growth and expansion. And forei...

guide

Establishing & Operating a Business in China 2018

- December 2017

- US $24.99

China’s foreign investment landscaped changed significantly in 2017, where strategic investors will find that their options have broadened significantly. Establishing and Operating a Business in China 2018 is designed to explore the establishment p...

magazine

Tax Incentives in Vietnam

- December 2017

- Members Access

In this issue of Vietnam Briefing, we discuss the importance of taxation to new investment projects and outline the role that corporate tax incentives can play in reducing costs in Vietnam. We highlight Vietnam’s current preferential tax rates and ...

magazine

Managing China's Financial System

- November 2017

- Members Access

Foreign investors often find China’s financial system to be one of the most difficult areas to navigate when establishing or growing their presence in the country. Navigating China’s tax system, and its complexities, requires time and commitment....

magazine

Payroll Processing and Compliance in Singapore

- June 2017

- Members Access

In this issue of ASEAN Briefing, we discuss payroll processing and reporting in Singapore as well as analyze the options available for foreign companies looking to centralize their ASEAN payroll processes. We begin by discussing the various regulatio...

magazine

Payroll Management in Vietnam

- May 2017

- Members Access

In this edition of Vietnam Briefing, we discuss Vietnam’s current statutory requirements regarding payment, social insurance withholdings, and individual income taxation. We go on to explain the areas where compliance is likely to become a concern ...

report

Introducción: Hacer Negocios en China 2017

- May 2017

- Members Access

La guía Hacer Negocios en China 2017 está diseñada para introducir los fundamentos de la inversión en China. Compilada por los profesionales de Dezan Shira & Associates, esta guía es ideal, no sólo para las empresas que buscan entrar en el mer...

infographic

Taxable Allowances

- May 2017

- Members Access

This infographic shows fully and partly taxable allowances.

infographic

Calculation of Tax in Metropolitan and Non-Metropolitan Areas

- May 2017

- Members Access

This infographic shows tax calculations in metropolitan and non-metropolitan areas, based on an annual income of RS 1,500,000.

Q&A

What are some allowances given in India?

- May 2017

- Members Access

Allowances are considered as the financial benefits that are given to the employee from the employer, in addition to their salary. They could include, for example, expenses incurred by the employee during discharge of service. Some allowances are tax...

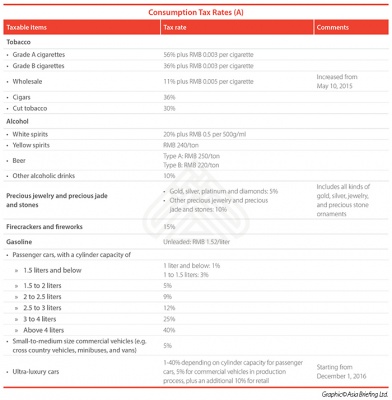

infographic

China's Consumption Tax Rates (A)

- April 2017

- Members Access

This table shows the consumption tax rates for several taxable items.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us