Our collection of resources based on what we have learned on the ground

Resources

infographic

Individual Income Tax Rate in China

- January 2014

- Members Access

For different level of income, Individual Income Tax Rates are different in China

infographic

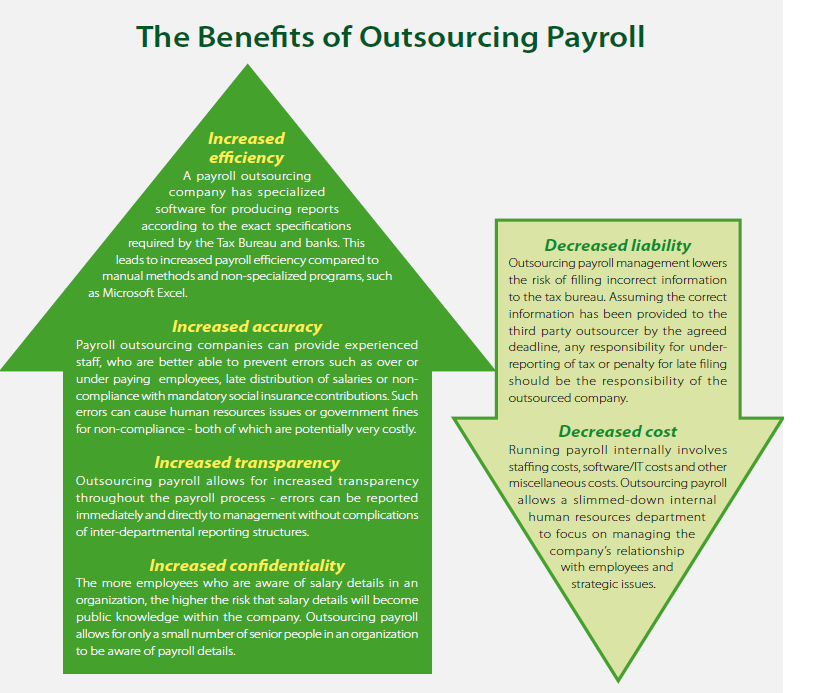

The Benefits of Outsourcing Payroll India

- January 2014

- Free Access

Six Benefits of Outsourcing Payroll in India

infographic

Individual Income Tax Rate in Hong Kong

- January 2014

- Members Access

In Hong Kong, salaries tax payable is the lower of two calculation methods.

infographic

Individual Income Tax Rate in Singapore

- January 2014

- Members Access

Singapore imposes a progressive tax ranging from 0 to 20 percent on the individual income of a tax resident.

infographic

Individual Income Tax Rate in India

- January 2014

- Members Access

India imposes different sets of progressive tax rates, ranging from 10-30 percent.

infographic

Individual Income Tax Rate in Vietnam

- January 2014

- Members Access

In Vietnam, personal income is taxed according to seven progressive rates from 5 to 35 percent.

Q&A

What is a Permanent Account Number (PAN) in India?

- January 2014

- Free Access

A Permanent Account Number (PAN) is a 10-digit alphanumeric code, printed on an identification card, for the reference of the Income Tax Department. Companies are required to obtain a PAN during the establishment process in order to file an income ta...

Q&A

What are the requirements for employee tax deductions at source in India?

- January 2014

- Members Access

All entities in India (including foreign representative offices and Indian setups like wholly owned subsidiaries) are required to make tax deductions at source on employees' salaries on behalf of the Income Tax Department. The payment and complianc...

infographic

Major Advantages for Using Wholly-Owned Subsidiaries in India

- January 2014

- Free Access

Eight Advantages for Using Wholly-Owned Subsidiaries in India

Q&A

What is the Tax Deduction Account Number (TAN)?

- January 2014

- Members Access

The Tax Deduction Account Number (TAN) is a mandatory ten digit alphanumeric code for all persons who deduct tax at source, which must be cited during the process of deduction. Application forms and instructions for obtaining a TAN can be found on go...

infographic

Key Features of Different Entities under Indian Law

- January 2014

- Free Access

For different entities, key features are different under Indian Law.

Q&A

What types of social insurances do India's social security schemes cover?

- January 2014

- Free Access

Generally, India's social security schemes cover the following types of social insurances: Pension Health Insurance and Medical Maternity Gratuity Disability

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us