Our collection of resources based on what we have learned on the ground

Resources

infographic

Value Added Tax (VAT) Calculation in China

- January 2014

- Free Access

Value added tax (VAT) calculation in China consists of two parts: output VAT and input VAT.

Q&A

What are allowances and what do they include in India?

- January 2014

- Free Access

Allowances are categories of expenditures in India that are not taxable, provided they match certain specifications and do not exceed a certain amount. Allowances in India include those for: House Rent Transport Medical Meal Coupons Leave Tra...

Q&A

What is the house rent allowance in India?

- January 2014

- Members Access

If a company chooses to provide House Rent Allowance (HRA) to its employees, the amount of this allowance exempt from tax is the lowest of three numbers: 50 percent of salary in metropolitan areas (40 percent in non-metropolitan areas) Total rent...

infographic

Automatic and Governmental-Approval Routes for FDI in India

- January 2014

- Free Access

FDI in India can be done through two routes-the automatic route and the government route- with most done through the former.

Q&A

What is the transport allowance in India?

- January 2014

- Members Access

Transport payments of up to INR800 (US$14.22) per month for an employee commuting between residence and place of work are exempt from tax. In the case of blind or orthopedically handicapped employees, INR1,600 (US$28.61) per month is exempt from...

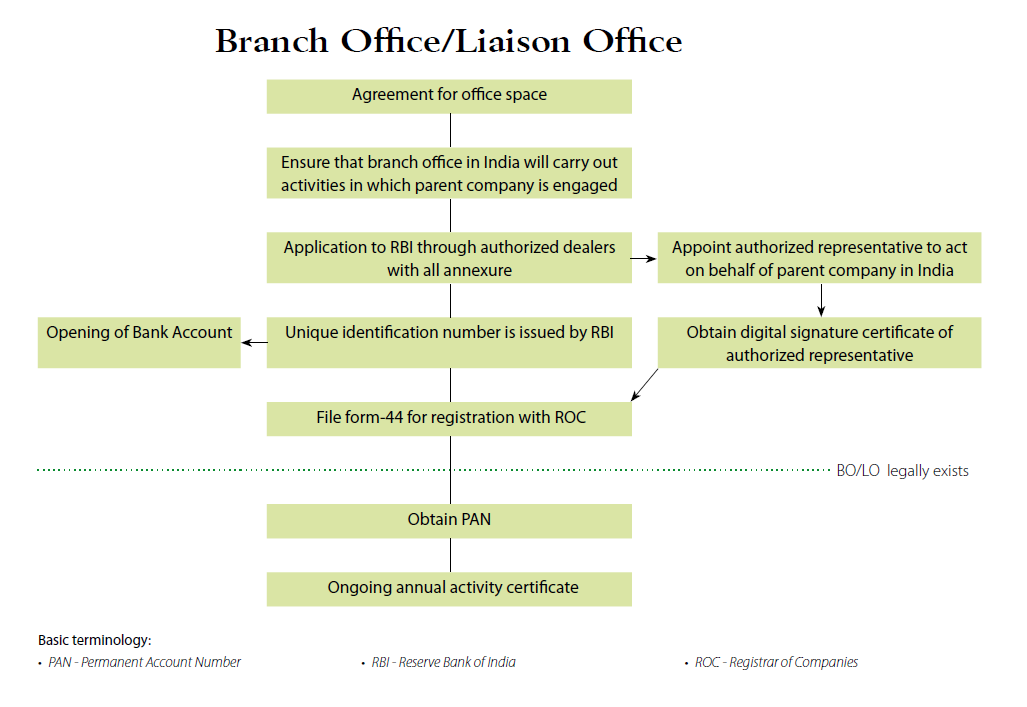

infographic

Setting up a Branch or Liaison Office in India

- January 2014

- Free Access

A flowchart showing the necessary steps to set up a branch or liaison office in India.

Q&A

What is the medical allowance in India?

- January 2014

- Members Access

An exemption for medical expenses is allowed for: Reimbursement up to INR15,000 (US$266.66) for medical treatment of the employee and family members Reimbursement of expenses sustained by an employee and family members in approved hospitals, etc....

Q&A

What is the allowance for medical treatment abroad for employees of Indian compa...

- January 2014

- Members Access

For medical treatment abroad, the actual expenditure incurred includes the travel and stay abroad of the patient and one attendant (if permitted by the Reserve Bank of India). The ceiling for the gross total income excluding the amount to be reimburs...

Q&A

What is the allowance for meal coupons in India?

- January 2014

- Free Access

Lunch and refreshments that the employer provides to the employee at free or concessional rates is not taxable.

Q&A

What is the allowance for leave travel in India?

- January 2014

- Free Access

Leave travel is remunerated for meeting travelling expenses incurred by an individual and family members (this includes only the spouse, two children and dependent parents, brothers and sisters) while on holiday in India. The amount excluded depen...

infographic

Key Points of Circular 110 National Value Added Tax (VAT) Reform in China

- January 2014

- Members Access

There are three key points in the Circular 110 National Value Added Tax (VAT) Reform in China.

infographic

Representative Office (RO) Document Checklist in China

- January 2014

- Free Access

Document Checklist for Representative Office (RO) in China

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us