Our collection of resources based on what we have learned on the ground

Resources

infographic

Joint Venture (JV), Wholly Foreign-Owned Enterprise (WFOE) and Foreign-Invested ...

- January 2014

- Free Access

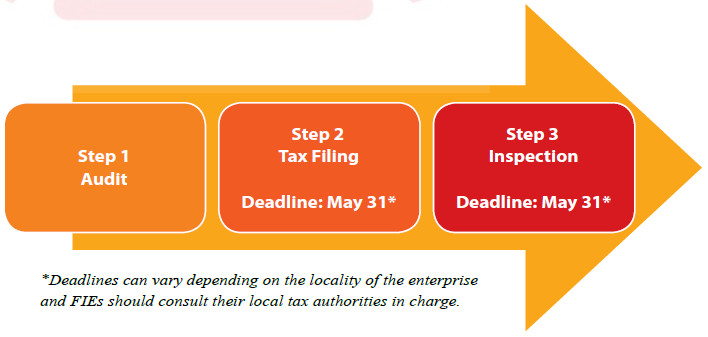

Annual Compliance for Joint Venture (JV), Wholly Foreign-Owned Enterprise (WFOE) and Foreign-Invested Commercial Enterprise (FICE) in China

infographic

Joint Venture (JV), Wholly Foreign-Owned Enterprise (WFOE) and Foreign-Invested ...

- January 2014

- Free Access

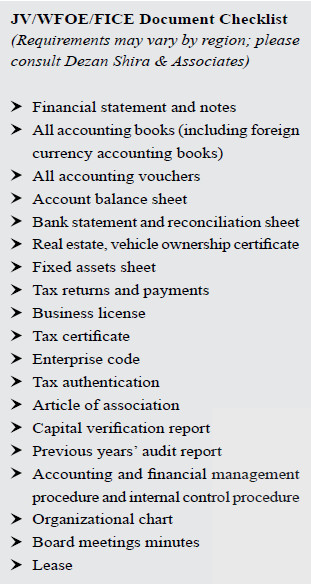

Document Checklist for Joint Venture (JV), Wholly Foreign-Owned Enterprise (WFOE) and Foreign-Invested Commercial Enterprise (FICE) in China

infographic

Process to Become a Value Added Tax (VAT) General Taxpayer in China

- January 2014

- Free Access

Process of how to become a Value Added Tax (VAT) General Taxpayer in China

infographic

Value Added Tax (VAT) Rate in Shanghai in the Transport and Modern Services

- January 2014

- Members Access

For different services, value added tax (VAT) rate in the Transport and Modern Services is different in Shanghai.

Q&A

What is the allowance for education in India?

- January 2014

- Members Access

Education payment of INR50 (US$0.97) per month per child (INR150, US$2.92, in special cases) for up to two children of the employee is exempt from tax.

infographic

Deductions Ceiling and Calculation Bases for the Tax Deduction of Insurance Expe...

- January 2014

- Free Access

For different types of companies, deductions ceiling and calculation bases for the tax deduction of insurance expenses in China are different.

infographic

China Residence and Individual Income Tax (IIT) Income Source Applicability Time...

- January 2014

- Free Access

Applicability Timeline for China Residence and Individual Income Tax (IIT) Income Source.

infographic

Individual Income Tax (IIT) Rate by Annual Taxable Income in China

- January 2014

- Members Access

For different annual taxable income in China, the individual income tax rate is different.

infographic

Calculation of Monthly Salary for Individual Income Tax (IIT) Purposes in China

- January 2014

- Members Access

A table showing the formula for calculating monthly salaries after tax based on the duration of stay in China.

infographic

Individual Income Tax (IIT) Tax Rates and Deductions in China

- January 2014

- Free Access

For different levels of income in China, the Individual Income Tax (IIT) tax rates and deductions are different.

Q&A

What are the allowances available in India, other than the main ones, such as tr...

- January 2014

- Free Access

Apart from the major ones, the following allowances are exempt from tax: Uniforms (not merely clothing) Books and Periodicals (unlimited) Work-related transportation expenses; Cost of travel on tour or on transfer; ...

infographic

Individual Income Tax Return in China

- January 2014

- Free Access

A template of an individual income tax return in China.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us