Our collection of resources based on what we have learned on the ground

Resources

Q&A

What is gratuity and its basic requirements in India?

- January 2014

- Free Access

Gratuity is a lump sum that a company pays when an employee leaves an organization; one of the many retirement benefits offered by a company to an employee. Basic requirements for gratuity are set out under the Payment of Gratuity Act, 1971. An emplo...

Q&A

Who is gratuity applicable for in India?

- January 2014

- Free Access

The Payment of Gratuity Act, 1971, applies to employees engaged in factories, mines, oilfields, plantations, ports, railway companies, shops or other establishments for at least five full years with ten or more employees. Years of service does not ma...

Q&A

How is Gratuity received under The Payment of Gratuity Act different from any ot...

- January 2014

- Members Access

Gratuity received under the Act is exempt from taxation to the extent that it does not exceed 15 days’ salary for every completed year of service calculated on the last drawn salary subject to a maximum of INR350,000. Any other gratuity is exem...

Q&A

Under which circumstances is gratuity wholly forfeited in India?

- January 2014

- Free Access

The gratuity payable to an employee shall be wholly forfeited if: The service of such employee has been terminated for his lawless or disorderly conduct or any other act of violence on his part; or The service of such employee is ter...

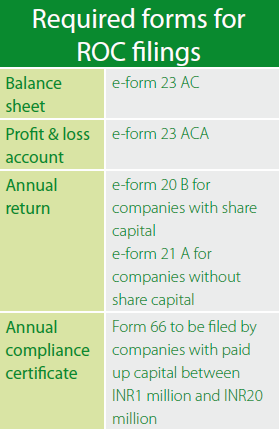

infographic

Required Forms for Registrar of Companies Filings in India

- January 2014

- Members Access

Four forms are required to be filled when registering companies in India.

Q&A

What has it changed after China?s reform on its Value-Added Tax (VAT) System ?

- January 2014

- Members Access

VAT reform is designed to resolve the issue of duplicate taxation on goods and services as a result of the coexistence of BT and VAT systems, as well as to promote the development of modern service industries in China. China officially issued ...

Q&A

What is a benefit of Value-Added Tax (VAT) reform in placement of Business Tax...

- January 2014

- Members Access

BT is a cascading turnover tax for which taxes are paid on the whole cost of the product at every point in the supply chain. By taxing only the “value added” components throughout the supply chain, instead of taxing the entire business tu...

Q&A

Which cities in China have officially applied to participate in the Value-Added ...

- January 2014

- Free Access

Nine other cities and provinces have officially applied to participate in the VAT Reform Pilot Program so far, including Chongqing, Shenzhen, Tianjin, Xiamen, Anhui Province, Fujian Province, Hainan Province, Hunan Province and Jiangsu Province. ...

Q&A

What should foreign investors beware of when relocating within or between tax di...

- January 2014

- Free Access

When possible, relocation should be avoided for cost and time reasons. Meanwhile, foreign investors considering relocation for other reasons should be aware up front that the process is quite likely far more challenging than you anticipate. Re...

Q&A

Besides tax de-registration, what else does a foreign investor have to do in ord...

- January 2014

- Members Access

Beyond tax de-registration, the transfer process requires a foreign investor to re-do essentially all the steps taken in initially establishing the WFOE. Beyond merely the large number of steps required, the need to minimize costs, potential labor li...

Q&A

What is not legally allowed when changing address within a tax district in China...

- January 2014

- Members Access

To cut corners, many investors have been misadvised by other companies to have separate registered and operational addresses (i.e. the company first registers on the outskirts of a city and operate in the downtown). This set-up is not legall...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us