Our collection of resources based on what we have learned on the ground

Resources

podcast

Vietnam Briefing Magazine, February 2014 Issue: ?A Guide to Understanding Vietna...

- January 2014

- Free Access

This issue of Vietnam Briefing aims to clarify the entire VAT, short for value-added tax, process by taking you through an introduction as to what VAT is, liabilities that come with it, and how to pay it properly.

infographic

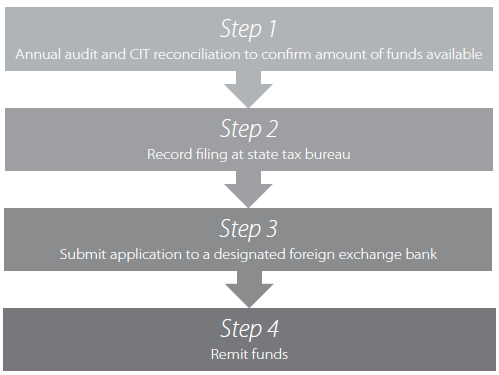

Profit Repatriation Procedure in China

- January 2014

- Members Access

All foreign-invested enterprises in China are required to carry out annual compliance procedures as mandated by various governmental departments. Here are the steps for profit repatriation in China.

Q&A

What would be an ideal location for offshore company to trade with India and wha...

- December 2013

- Free Access

Singapore provides a procedurally easy and inexpensive option. Also, the tax rates are kept relatively low, comparing to other Asian countries and that it only taxes on profits made within Singapore, i.e.: if you make a profit in India, it is not sub...

infographic

Imposte societarie a confronto: Vietnam e Cina

- December 2013

- Free Access

Questo infographic fa un confronto tra Cina e Vietnam in merito alle: imposte sul profitto d’impresa, sul valore aggiunto e sull’imposizione sul rimpatrio dei dividendi.

infographic

Opzioni per l?entrata nel mercato indiano con entit� a partecipazione estera

- December 2013

- Free Access

Questo infographic confronta diversi veicoli d’ingesso per gli investimenti in India.

infographic

Costituire una societ� a partecipazione estera in India: corporate taxes

- December 2013

- Free Access

Questo infographic mette a confronto Cina e Vietnam in merito alle: imposte sul profitto d’impresa, sul valore aggiunto e sull’imposizione sul rimpatrio dei dividendi.

infographic

Valutazione dei mercati dell'Asia emergente: Cina, India e Vietnam

- December 2013

- Free Access

La Cina non è l'unica risposta per la produzione orientata all'export e l'evoluzione del commercio asiatico dimostra che i modelli industriali e la supply chain sono in continua evoluzione e spostamento fra diversi paesi.

infographic

Opzioni per l'entrata nel mercato Vietnamita con entit� a partecipazione estera

- December 2013

- Free Access

Questo infographic confronta diversi veicoli d’ingesso per gli investimenti in Vietnam.

infographic

Hong Kong e Singapore: possibili holdings per investimenti in Asia?

- December 2013

- Free Access

Tassazione a confronto: Hong Kong e Singapore

infographic

Scegliere una zona di sviluppo

- December 2013

- Free Access

Fattori da considerare nella scelta di una zona di sviluppo per i propri investimenti.

infographic

Investire in zone speciali in Cina: le procedure di iscrizione

- December 2013

- Free Access

infographic

Investire nelle Zone Economiche Speciali in India: le procedure di registrazione

- December 2013

- Free Access

Significative zone economiche (Special Economic Zone o SEZ) speciali in India: SEZ Kandla (Gujarat, Costa nord occidentale) - www.kasez.com SEEPZ (Mumbai, Costa occidentale) - www.seepz.com Noida EPZ (vicino Delhi, trasfor...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us