Our collection of resources based on what we have learned on the ground

Resources

Q&A

Top Tips and Common Misconceptions - Filing Taxes under China's New IIT Law

- March 2019

- Free Access

Dezan Shira & Associates' Assistant Manager for International Business Advisory, Ines Liu, discusses some tips and misconceptions while filing individual income taxes under China's New IIT Law.

video

ECA Italia with Dustin Daugherty on Tax in Vietnam

- March 2019

- Free Access

Dezan Shira & Associates Head of North America Business Development speaks to ECA Italia on personal income tax in Vietnam among expats.

Q&A

Tips for Filing Taxes in Vietnam

- March 2019

- Free Access

Here are a few tips from our Coporate Accounting manager, Vinh Le, on how to file taxes in Vietnam. When are annual financial statements and tax finalization reports due? Annual finalization of financial statements, corporate income tax and p...

magazine

China’s New IIT Rules: A Guide for Employers

- February 2019

- Members Access

China introduced the biggest changes to its individual income tax (IIT) system since at least 2011 with the passing of a new IIT law in 2018. The new law brought forward a host of changes to individual taxation in China, including by revising tax bra...

presentation

What You Need to Know About China's New IIT Law - Part II (Chinese)

- February 2019

- Free Access

Q&A

China's New IIT Law

- February 2019

- Free Access

China revised Individual Income Tax ("IIT") becomes effective on 1 January 2019. What are the key impacts for foreign individuals working in China? New Definition of tax residency rule In determining the tax residency status of individ...

presentation

Hot Topic: Key Components of China's New IIT Law (Chinese)

- February 2019

- Free Access

On February 24, 2019, Dezan Shira and Associates (Shanghai Office) conducted a seminar discussing key insights and changes to the Individual Income Tax (IIT) Laws in China. This three hour seminar targeted recently graduated students that are ...

Q&A

¿Cuáles son los nuevos gastos deducibles para el Impuesto sobre la Renta de la...

- January 2019

- Free Access

En las primeras enmiendas del borrador de la Ley del IRPF en China, los contribuyentes residentes podrán deducirse ciertos artículos extra de sus ingresos integrales. Estas partidas deducibles extra se clasifican como “deduccione...

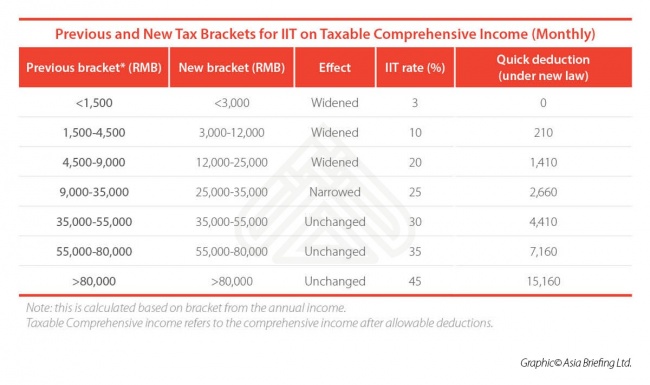

infographic

Previous and New Tax Brackets for Individual Income Tax in China

- January 2019

- Free Access

This infographic compares the new and old tax brackets for individual income tax on monthly taxable comprehensive income.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us