Our collection of resources based on what we have learned on the ground

Resources

legal

Notice from China's Ministry of Finance for Revising the Implementation Regulati...

- December 2018

- Free Access

article

China’s IIT Reform: Seven Key Points from the Draft Implementation Rules

- November 2018

- Free Access

Many taxpayers in China have had questions about how the government would change the individual income tax (IIT) law since the amendment was passed earlier this year. Recently, however, the tax authorities released a draft of the amendment&...

report

Введение в ведение бизнеса в Индии 2020

- November 2018

- Free Access

Вступление к ведению бизнеса в Индии в 2020 году предоставит читателям обзор основных принципов инвестирования и ведения бизнеса в Индии....

infographic

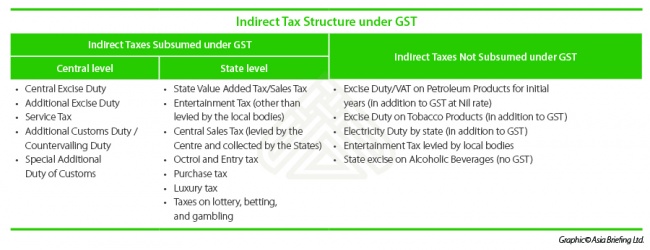

Indirect Tax Structure Under India's GST Regime

- October 2018

- Free Access

For more information, visit India Briefing or contact us.

Q&A

What are the new items that will be deductible for Individual Income Tax in Chin...

- August 2018

- Free Access

Under the first draft amendments to IIT Laws in China, resident taxpayers will be allowed to deduct certain additional items from their comprehensive income. These additional deductible items are categorized as ‘additional itemized deductions ...

infographic

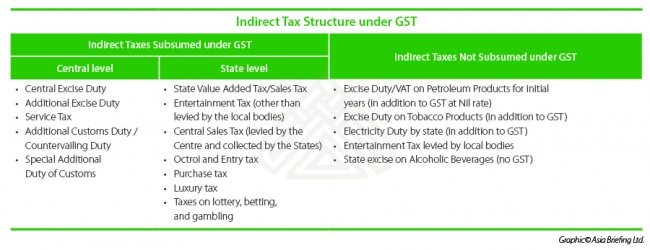

Singapore's Corporate Income Tax – Quick Facts

- August 2018

- Free Access

Singapore is globally renowned for its competitive tax structure. The country imposes a flat rate of 17 percent corporate income tax (CIT) – lowest among the ASEAN member states. The single-tier corporate tax system reduces compliance cos...

Q&A

What must I do to stay in compliance with China's new three-tier documentation f...

- July 2018

- Free Access

In 2016, China introduced a three-tiered contemporaneous documentation framework (set out in Circular 42) that replaced previous documentation rules. Under the new regulations, entities with related party transactions above certain thresholds must pr...

presentation

Global Mobility: Managing a Global Workforce in China

- June 2018

- Free Access

A major challenge facing investors entering the Chinese market, or even fully-established enterprises is HR and legal concerns. Whether you are an employer or an employee in China it is essential that you stay in compliance with the relevant labor la...

magazine

Transfer Pricing in Vietnam

- April 2018

- Members Access

In this issue of Vietnam Briefing, we introduce the concept of transfer pricing and outline its importance to foreign investors operating in Vietnam. We highlight current compliance requirements, outline changes that have been made in recent months, ...

magazine

The 2018/19 ASEAN Tax Comparator

- March 2018

- Members Access

In this issue of ASEAN Briefing magazine, we discuss both the continuity and change in ASEAN’s tax landscape and what it means for foreign investors. We begin by highlighting the salient features of the taxation regimes of the individual member sta...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us