Our collection of resources based on what we have learned on the ground

Singapore's Corporate Income Tax – Quick Facts

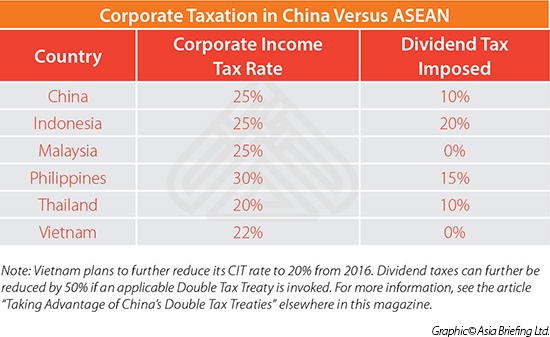

InfographicSingapore is globally renowned for its competitive tax structure. The country imposes a flat rate of 17 percent corporate income tax (CIT) – lowest among the ASEAN member states.

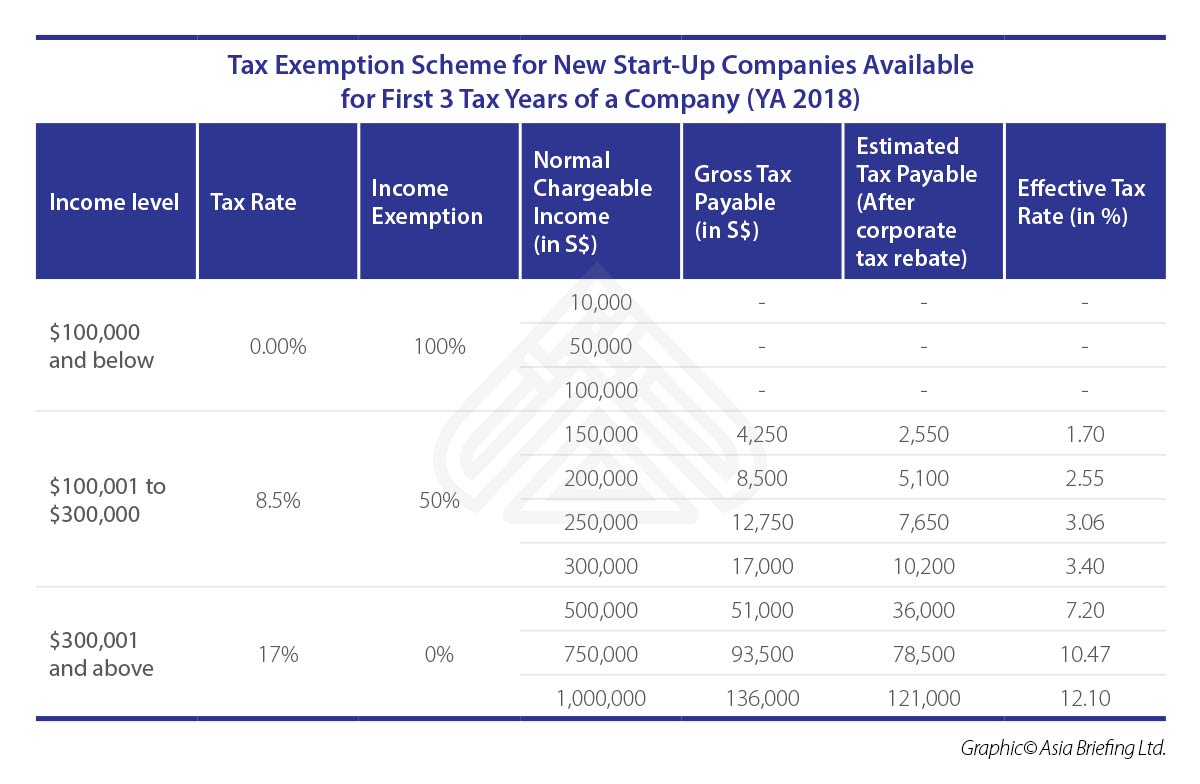

The single-tier corporate tax system reduces compliance costs for businesses.

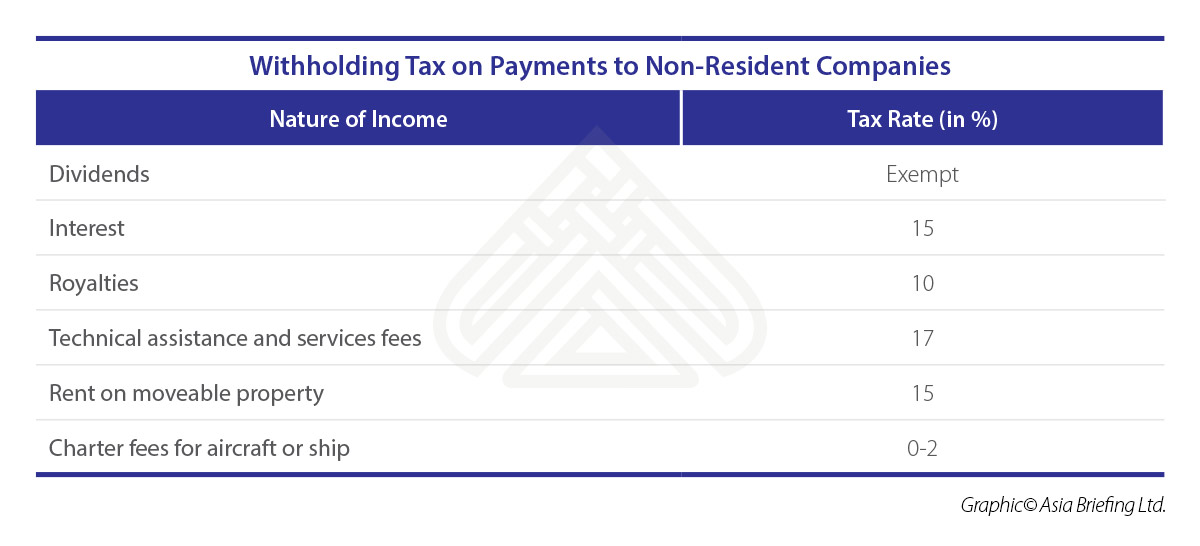

Added to that, certain withholding tax exemptions, tax rebates and incentives as well as several tax schemes for startups and newly established corporations make Singapore a competitive investment market for foreign businesses.

For more information on corporate taxation in Singapore, click here.

To contact our taxation expert, click here.

< BACK TO LIBRARY

Subscribe to receive latest insights directly to your inbox

Subscribe NowOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us