Our collection of resources based on what we have learned on the ground

Resources

infographic

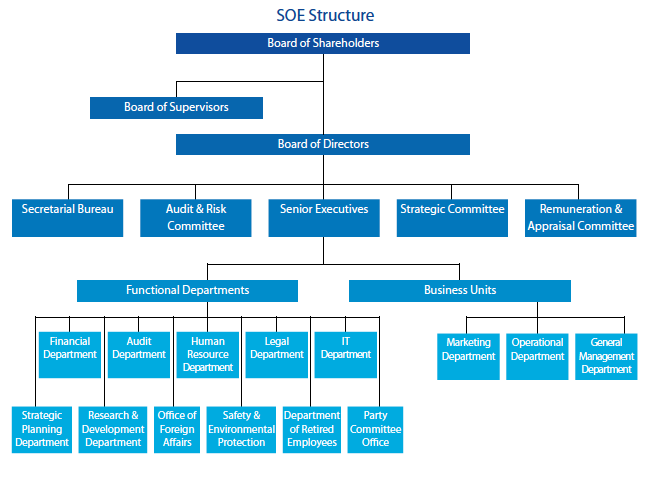

State-Owned Enterprise Structure

- May 2014

- Free Access

Structure for an State-Owned Enterprise.

Q&A

How are State-Owned Enterprise (SOE) structured in China?

- May 2014

- Free Access

SOEs in China maintain close contact with the government in a variety of ways, many of which the average investor or employee is unaware. Before making any systemic decisions likely to effect change to the company, the senior executives of SOEs must ...

Q&A

What is the difference between a State-Owned Enterprise and a State-holding ente...

- May 2014

- Free Access

A State-Owned Enterprise (SOE) is an enterprise entirely owned by the state while a State-holding enterprise is an enterprise in which a majority of shares are held by the State.

Q&A

How does one qualify for an Interest Charge Domestic International Sales Corpora...

- May 2014

- Free Access

Interest Charge Domestic International Sales Corporation (IC-DISC) is a measure solely for U.S. companies. Export companies can qualify for this to help save on taxes. A U.S. domestic corporation must pass two main tests: The qualified export rece...

infographic

Maximum period for collecting unemployment benefits in China

- May 2014

- Free Access

Maximum unemployment benefits collection period for different level of cumulative unemployment premium payment period in China.

infographic

Simplified Monthly Mandatory Welfare Payments Reference

- May 2014

- Free Access

Simplified Monthly Mandatory Welfare Payments Reference for main cities in China (Year 2013)

infographic

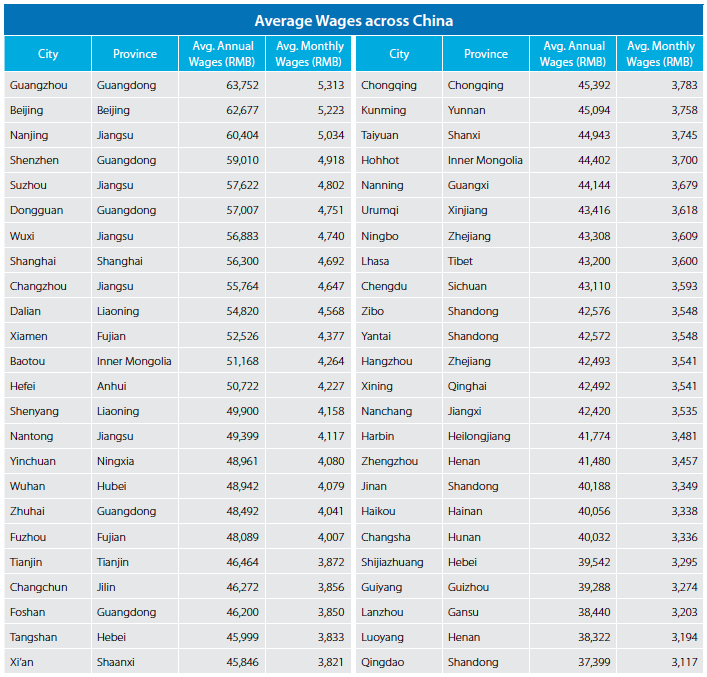

Average wages across China

- May 2014

- Free Access

Average wages for main cities across China.

Q&A

When was China?s first Social Insurance Law issued?

- May 2014

- Free Access

China’s first comprehensive Social Insurance Law was passed in 2010 and came into effect on July 1st, 2011. By issuing this law, the government consolidated previous rules and regulations under a standardized national social security framework ...

Q&A

Does the Chinese Social Insurance Law cover the housing fund?

- May 2014

- Free Access

The housing fund is generally included within the scope of mandatory welfare and regarded as a form of social insurance in China because the additional costs are mandatory, with contributions coming from both the employer and the employee. However, s...

Q&A

Do foreign companies in China need to pay insurance for their employees?

- May 2014

- Free Access

All companies registered in China are required to pay the insurance premiums for and on behalf of their employees. Premium payments can add more than 30 percent to the salary cost of each employee for the employer, and take up about 10 percent of an ...

Q&A

How many medical insurance programs does China have and which ones are mandatory...

- May 2014

- Free Access

China currently has three medical insurance programs: Urban employee basic medical insurance; Urban resident basic medical insurance; and New rural cooperative medical insurance. The urban employee basic medical insurance is mandatory for urb...

Q&A

How many pension programs does China have and which ones are compulsory?

- May 2014

- Free Access

China has three pension programs: Basic pension insurance scheme for urban employees Urban residents pension program Rural pension program. The basic pension insurance scheme for urban employees is compulsory, the other two programs are for r...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us