Our collection of resources based on what we have learned on the ground

India's Tax Incentives

Article

SEZ’s and less-developed regions - Location based tax incentives in India

Less-developed regions

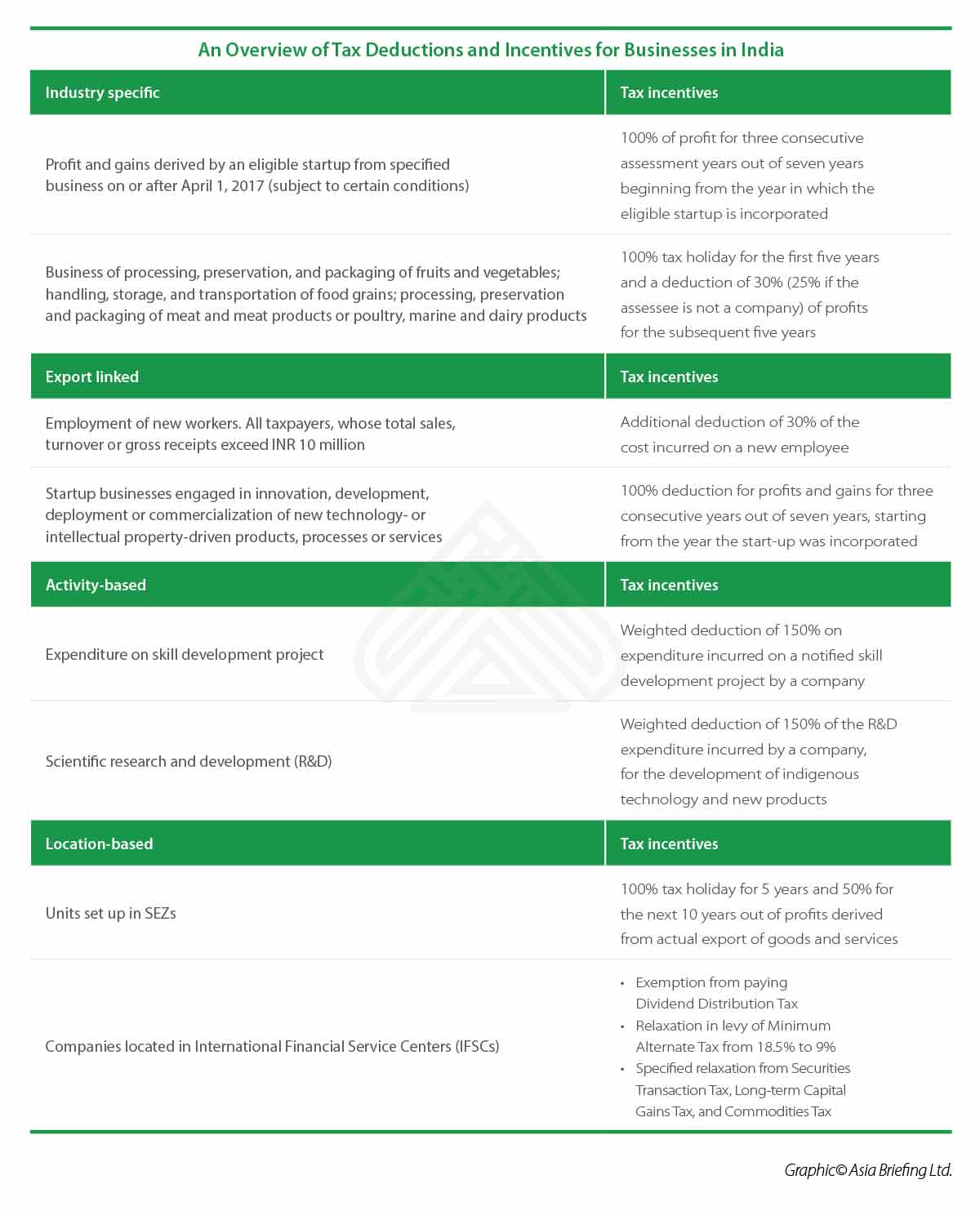

Special tax benefits are given to companies setting up in certain notified regions of India.

This includes - northeastern states of Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, and Tripura and Himalayan states of Jammu and Kashmir, Himachal Pradesh, and Uttarakhand.

Businesses involved with manufacturing, production of goods and certain services or companies undergoing substantial expansion between 2017-2027 can deduct 100 percent of profits from their taxable income for a period of 10 years. Further, refund of excise duty on specific types of value addition is also available for 10 years.

Service sectors qualified for these benefits include:

- hotels (two stars and above);

- nursing homes (25 beds or more);

- old age homes;

- vocational training institutes for hotel management;

- catering and food crafts;

- entrepreneurship development;

- nursing and paramedical;

- civil aviation related training;

- fashion design and industrial training;

- IT related training centers;

- IT hardware manufacturing units; and,

- biotechnology.

However, companies engaged in the production of tobacco, betel leaf, plastic bags of less than 20 microns, or goods produced by petroleum and gas refineries are not eligible for these incentives.

Special Economic Zones (SEZ)

Similarly, companies setting up in Special Economic Zones also receive certain incentives:

- 100 percent income tax exemption on export income for first five years;

- 50 percent income tax exemption on export income for next five years;

- 50 percent income tax exemption on plowed back export profit for another five years;

- refund of Integrated Goods and Services Tax (IGST) on imported goods;

- refund of input GST paid on procurement of goods and services; and,

- minimum compliance requirement and return filing procedures.

Certain SEZ units may receive state-level incentives such as stamp duty exemptions, VAT exemption or refund, or electricity duty exemption.

To avail these incentives, the company must actively participate in the development, operation, and maintenance of SEZs.

India’s National Startup Policy – Tax incentives for startups and angle investors

In line with the Indian government’s efforts to encourage startups in India, several tax benefits are provided to these companies under the National Startup Policy.

Startup tax incentives include:

- tax holiday for a period of seven years, beginning from the year the startup is incorporated;

- exemption from tax on long-term capital gains; and,

- approval to set-off carry forward losses and capital gains in case of a change in shareholding pattern.

In 2012, to further incentivize funding of startups, the government exempted tax on funds received from angel investors or family and friends. Further, Venture Capital (VC) funds set up specifically to invest in startups were exempt from tax on their investment into such companies.

Tax incentives for newly established companies

For newly set-up Indian companies, the government announced a discounted CIT rate of 25 percent – plus applicable surcharge and education cess – with effect from FY 2016-17.

The company may avail the discounted rate, provided it fulfills the certain prerequisites:

- Must have been set up or registered on or after March 1, 2016

- Must not claim any benefits for establishing its unit in an SEZ,

- Must not claim any benefits for accelerated depreciation, additional depreciation, investment allowances, or expenditure on scientific research; and,

- Must not set-off of loss carried forward from any earlier assessment years, provided such loss is attributable to the deductions mentioned in the above condition.

For further information on tax incentives in Asia, contact us.

Visit our India Briefing website for more updates on India’s tax regulations.

< BACK TO LIBRARY

Subscribe to receive latest insights directly to your inbox

Subscribe NowOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us