Our collection of resources based on what we have learned on the ground

India's Auto Component Industry - Business Investment Opportunities

Industry-profile

India’s rapidly increasing domestic demand and proximity to key Asian markets has made it a strong auto components sourcing hub.

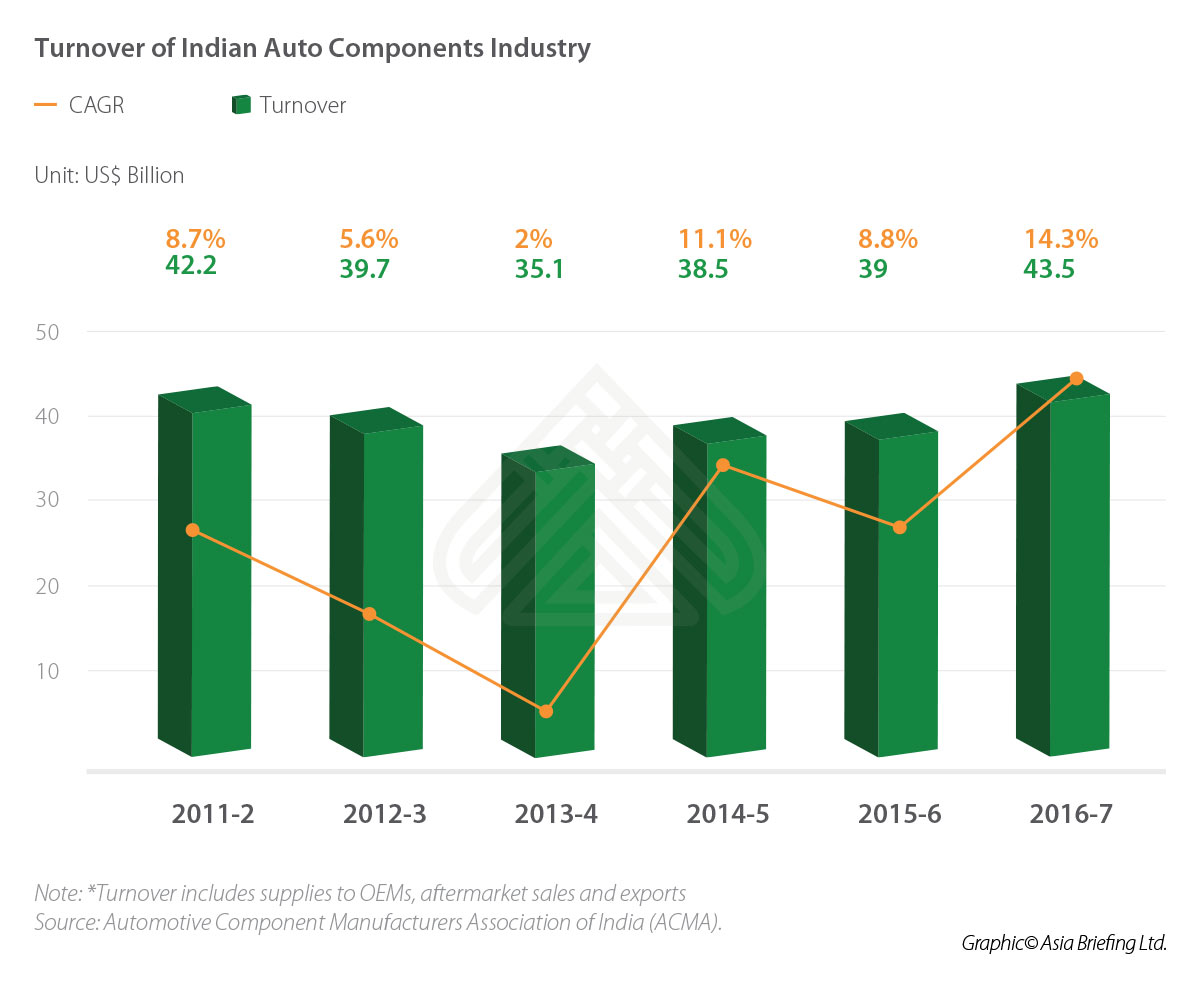

In 2016-17, the annual turnover of the auto component industry in India crossed US$43 billion; it is expected to reach US$115 billion in 2020-21.

This article charts out the incentive-led growth of India’s auto component industry, which now forms the largest segment of the country’s domestic manufacturing capability.

India’s auto components industry

Large original equipment manufacturers (OEMs) in this sector first began operations in India in 1993 when the automotive market was liberalized.

The organized sector accommodates the needs of OEMs through the production of high precision equipment like steering components, while the unorganized sector caters to the after-sales market segment with low valued products for automobile repair and maintenance. The unorganized sector includes second-hand dealerships and garages.

Although the latter far outnumbers the former, the organized sector accounts for a much larger share of the sector.

The auto components industry in India is divided into the following categories:

- Engine and engine parts;

- Powertrain parts;

- Suspension and braking parts;

- Lighting and other equipment;

- Body and chassis; and,

- Others.

Why invest in India?

Companies operating in India save up to 10-25 percent on operational costs, compared to operations in Latin America or Europe.

Multiple factors play into this.

India is the world’s third largest steel producer – a key raw material in the production of auto components, which keeps costs down.

Meanwhile, global OEM sourcing from India is rapidly growing alongside increased indigenization of global OEMs through mergers and acquisitions. The parallel developments make India a preferred designing and manufacturing base.

It also explains the growth in export revenues of Indian auto component makers, which have further been augmented by strong internal demand from automobile manufacturers. India’s automobile sector comprises 45 percent of the total manufacturing GDP, and in February, India became the world’s fourth largest automobile market.

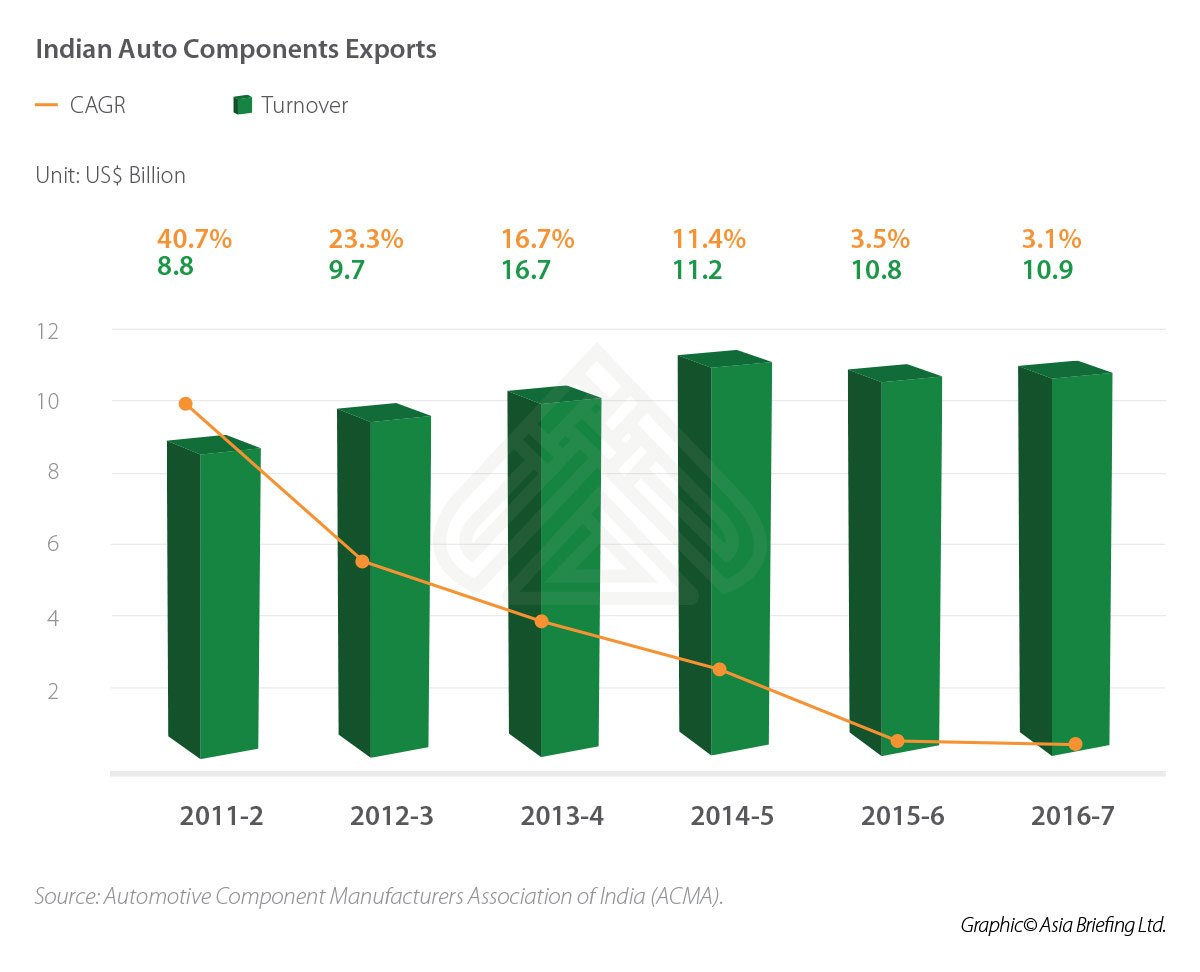

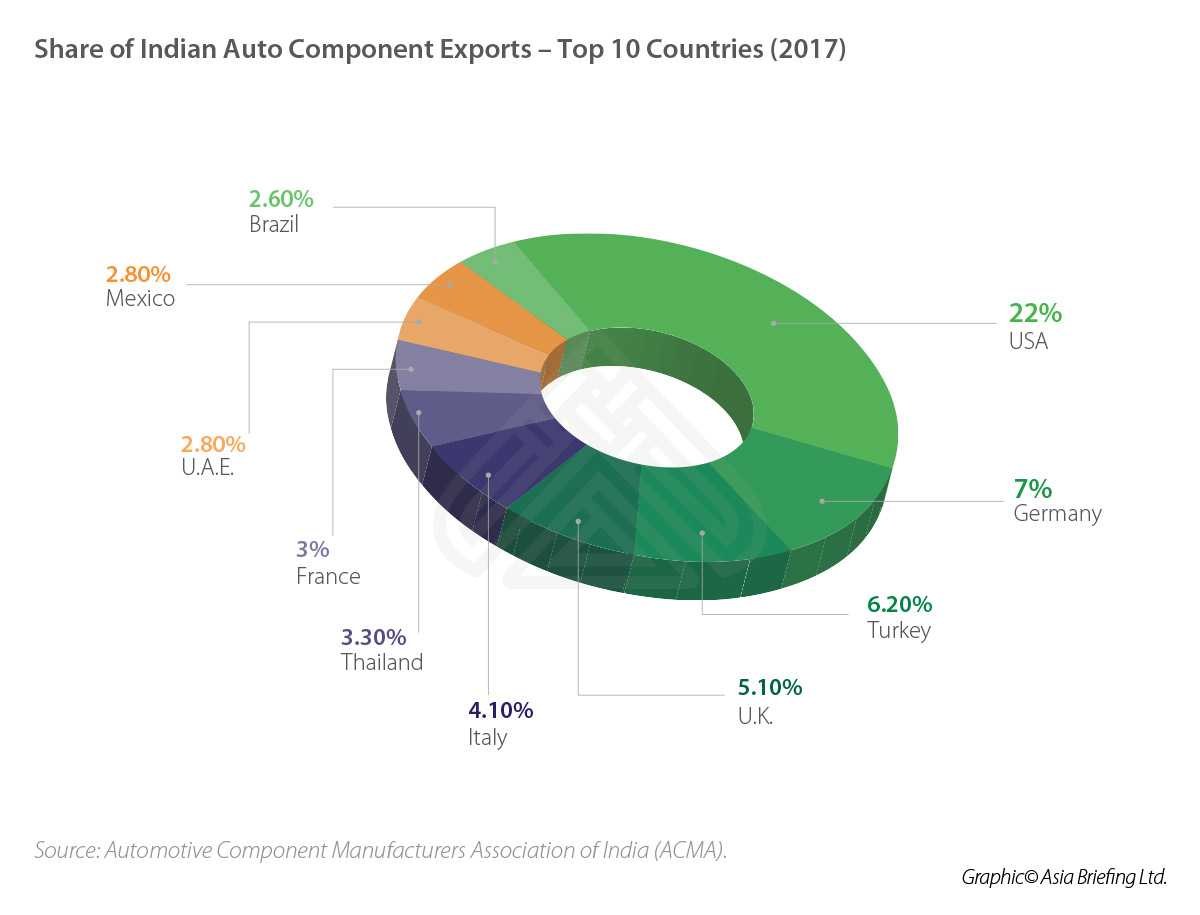

Exports from the auto components industry are therefore robust, and comprise four percent of total Indian exports: the US accounts for the largest share of India’s auto component exports, followed by European markets.

Sunjay Kapur, CEO of the Sona Group, a US$800 million multinational firm and leading Indian auto component manufacturer says, “The auto components sector in India has reached a mature stage, and is well poised for growth. The next few years will see growth in all segments in the domestic industry making India a strong base for the global export market. What is needed now is investments in technology and people in the tier II and tier III space in India. This will be a challenge as we see OEMs grow in India.”

Federal incentives to boost auto components industry

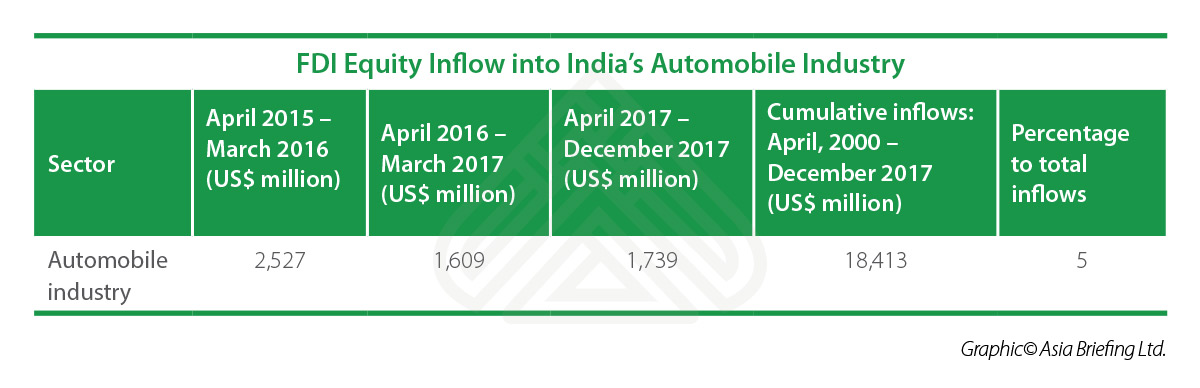

India’s Auto Policy of 2002 allows automatic approval of 100 percent foreign equity investment in facilities that manufacture auto components.

Bolstering the manufacturing prowess of India’s automotive sector – a key beneficiary of which is the domestic auto component industry – is an important goal of the Make in India initiative.

The Automotive Mission Plan 2026 (AMP 2026) seeks to engage with the Make in

The Plan aims to generate the capacity to produce an annual turnover of US$200 billion – with exports worth US$80 billion per year, domestic after-sales market worth US$32 billion, and the creation of 3.2 million jobs in the industry.

To this end, the federal government has invested in enabling infrastructure projects, such as the National Automotive Testing and R&D Infrastructure Project (NATRiP) centers.

In addition, the Department of Heavy Industries & Public Enterprises has created a US$200 million fund that provides manufacturers with low-interest loans and investments in new manufacturing capacity.

Mid-level auto component suppliers are granted export benefits on products against their Duty Free Replenishment Certificate (DFRC).

Investors can also receive incentives for exports through the following schemes:

- Export promotion capital goods (EPGG) scheme;

- Duty remission scheme; and,

- Merchandise Exports from India Scheme (MEIS).

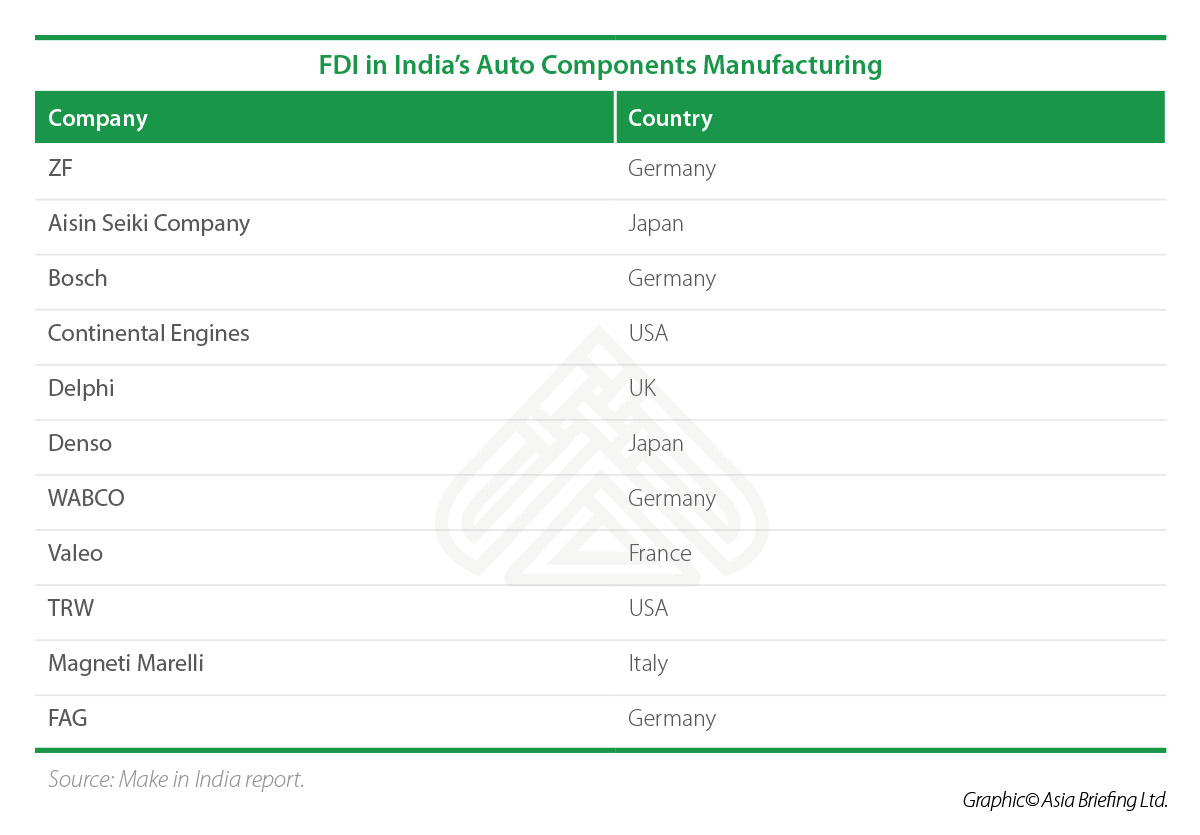

Given the favorable investment environment, major global auto component manufacturers have set up shop in India.

Investment Incentives by Location

India’s auto components sector has evolved to form three main clusters located in the southern, western, and northern regions, respectively.

Although infrastructure for regional connectivity has improved considerably in the last five years, India’s coastal states enjoy a definitive advantage due to their proximity to marine-based transport hubs.

Sunjay Kapur, CEO of the Sona Group, a US$800 million multinational firm and leading Indian auto component manufacturer comments on the status of the sector in India: “The auto component sector is very mature and with the kind of technology several companies in the tier I space have adopted, India can become a global hub for component supplies. The component industry is also readying for the push towards electric vehicles, which should bring more technology to India.”

Large investments in specific Indian states – viewed to be investor-friendly – have created regional hubs for major automobile manufacturing units and ancillary industries.

In this article, we outline key incentives offered by specific states in India who have attracted the bulk of FDI in auto components manufacturing. We also provide a map of India’s rapidly developing logistics network.

Andhra Pradesh

The state has set up two new auto clusters in the districts of Nellore and Chittoor. The state government also plans to set up several industrial parks, which are referred to as Automotive Suppliers’ Manufacturing Centers (ASMC).

An original equipment manufacturer (OEM) hoping to set up a mega integrated project (worth US$230 million and above) in one of these centers may receive another plot, at the same rate for its ancillaries. However, the discounted rate is applicable up to a maximum of 50 percent of the additional land.

Andhra Pradesh offers a 10-year full reimbursement of GST for mega integrated projects and a 20-year SGST reimbursement on the sale of finished goods. It also offers concessional SGST rates on input/raw materials for 20 years.

Developers in the ASMCs and clusters are eligible to receive financial assistance for fixed capital investments, up to a maximum of US$3.5 million.

In the case of micro, small, and medium enterprises (MSMEs), the state will provide financial assistance of up to a maximum of US$38,000 on patent registration charges; it will also provide a maximum of US$7,500 in quality certification assistance.

Andhra Pradesh has 15 deep water ports, including a major port at Visakhapatnam. Visakhapatnam is equipped with modern state-of the-art port infrastructure, capable of handling vessels up to 200,000 deadweight tonnage (DWT). Not only does it have the capacity to handle large cargo, the port also enjoys greater connectivity with nearby Southeast Asian markets.

Gujarat

Situated on the western coast, Gujarat is the most recent auto component manufacturing hub in the country. As of 2017, 15 engineering parks were established around the metropolitan cities of Ahmedabad and Rajkot. Rajkot, in central Gujarat, contains more than 500 auto component manufacturers. 50 of these are OEMs and the rest are SMEs catering to the retail (aftersales) market.

Gujarat’s Industrial Policy of 2015 guarantees projects 10-year tax holidays, ranging between 70 to 90 percent – depending on the location of the site and the amount of fixed capital investments.

Mega projects worth US$153.40 million (Rs 1,000 crore), with a minimum of 2,000 employees, are eligible for financial assistance from the state government and assistance for identifying appropriate project sites by the Gujarat Industrial Development Corporation (GIDC).

The state’s ports of Kandla, Mundra, and Pipavav have dedicated terminals for automotive exports.

Haryana

The Gurgaon-Manesar-Bawal belt is a key emerging auto component hub within the northern state of Haryana.

Manufacturers in this area receive priority in the allotment of developed land by the state government.

Further, its location in the country’s interior has resulted in the construction of dedicated railway sidings, equipped with inventory management and dispatch centers, which connect to the country’s several ports.

Maharashtra

The state of Maharashtra on the western coast has hubs located in the cities of Mumbai, Pune, Nagpur, Aurangabad, and Nashik. Pune, with 4,000 units, is the largest of these locations.

MSMEs and Large Scale Industries (LSIs) are eligible to receive Industrial Promotion Subsidy, Interest Subsidy, and Electricity Duty Exemption on fixed capital investments in the sector. Industrial units may also receive an additional incentive if they employ more individuals (double the number of original employees) from local communities.

The acquisition of land and term loans by MSMEs and LSIs are completely exempt from the payment of stamp duty. MSMEs are also exempt from payment of duty on the electricity consumed.

Tamil Nadu

The auto components hub in the southern coastal state of Tamil Nadu is concentrated around its capital, Chennai. Worth US$6.2 billion, the state produces 35 percent of India’s total auto components manufactured.

Over 350 large suppliers and 4,000 SMEs have their operations here. The ports of Chennai, Tuticorin, and Ennore cater to the unrestricted movement of auto component consignments with dedicated berths.

If power requirements exceed a specified electrical load, investors are assured that the Tamil Nadu Electricity Board will set up a substation at its own expense, on land provided by the developing agency.

Auto component projects receive a five percent rebate on the cost of land purchased from the State Industries Promotion Corporation of Tamil Nadu (SIPCOT). Clusters in industrial areas receive 50 percent reduction in stamp duty. A five percent additional capital subsidy may also be granted.

For instance, a company with 200 employees, investing up to US$15 million in fixed assets is liable to receive US$92,000 (Rs 6 million) in capital subsidy. New units in SIPCOT industrial parks can also receive up to 50 percent capital subsidy, over the eligible limit.

Projects also receive 25 percent of capital cost or a subsidy of US$45,000 (Rs 3 million) for a dedicated Effluent Treatment Plant (ETP) and/or Hazardous Waste Treatment Storage and Disposal Facility (HWTSDF), whichever is less expensive.

Contact Us

< BACK TO LIBRARY

Subscribe to receive latest insights directly to your inbox

Subscribe NowOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us