Our collection of resources based on what we have learned on the ground

Tax calculation for Imports & Exports in Vietnam

InfographicThe unit volume of each actually imported or exported goods item is listed in the customs declarations. This is then multiplied by the tax calculation price and tax rate of each item (at the time of trade), which can be found in the tariff tables.

Method to Calculate Tax

Payable Tax = Unit volume (of each imported or exported goods item)×Tax calculation price ×Tax rate of each item at time of calculation

Payable Tax = Unit Volume (of each imported or exported goods item) × Absolute tax rate (for a goods unit at time of tax calculations)

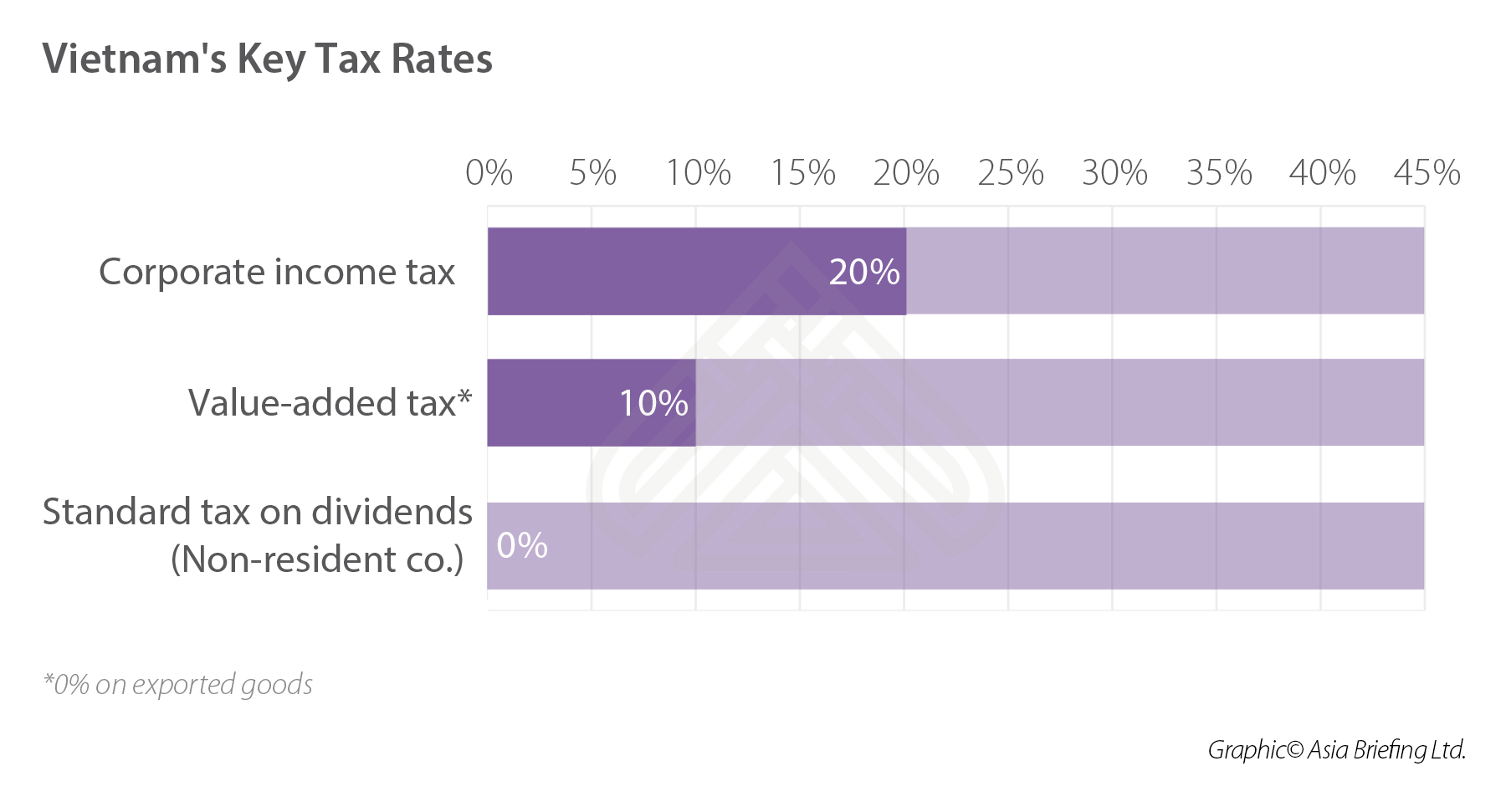

Imports into Vietnam are subject to import tax, Value-added tax (VAT) and, for certain goods, Special Consumption Tax (SCT). The below infographic shows the VAT rate as well as the corporate income tax rate and the standard tax on dividends for non-resident companies:

< BACK TO LIBRARY

Subscribe to receive latest insights directly to your inbox

Subscribe NowOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us