Export VAT Rebate in China

VAT refunds or “VAT rebates”, as they’re known in China, are an essential tool in any exporter’s arsenal, whether a manufacturer or a trading company. With policies evolving in China, particularly in the first half of 2019, it’s important for companies to keep aware of the changes and how they affect their operations.

We sit down with Daisy Huang, Senior Manager of our Corporate Accounting Services Team in South China, to talk about VAT refunds and how businesses can apply for it.

What is an export VAT refund in China?

Companies formed in China are allowed to apply for a VAT refund when exporting goods overseas. This policy began in 1994 when the Chinese economy opened up to the world. When exporting goods overseas, no VAT will be charged to the exporters and VAT paid in the following transactions will be refundable in full or in portions from the Chinese government:

- VAT paid to customs for the import of materials before processing in China;

- VAT paid to the domestic suppliers for raw materials, overheads, machineries or goods in China;

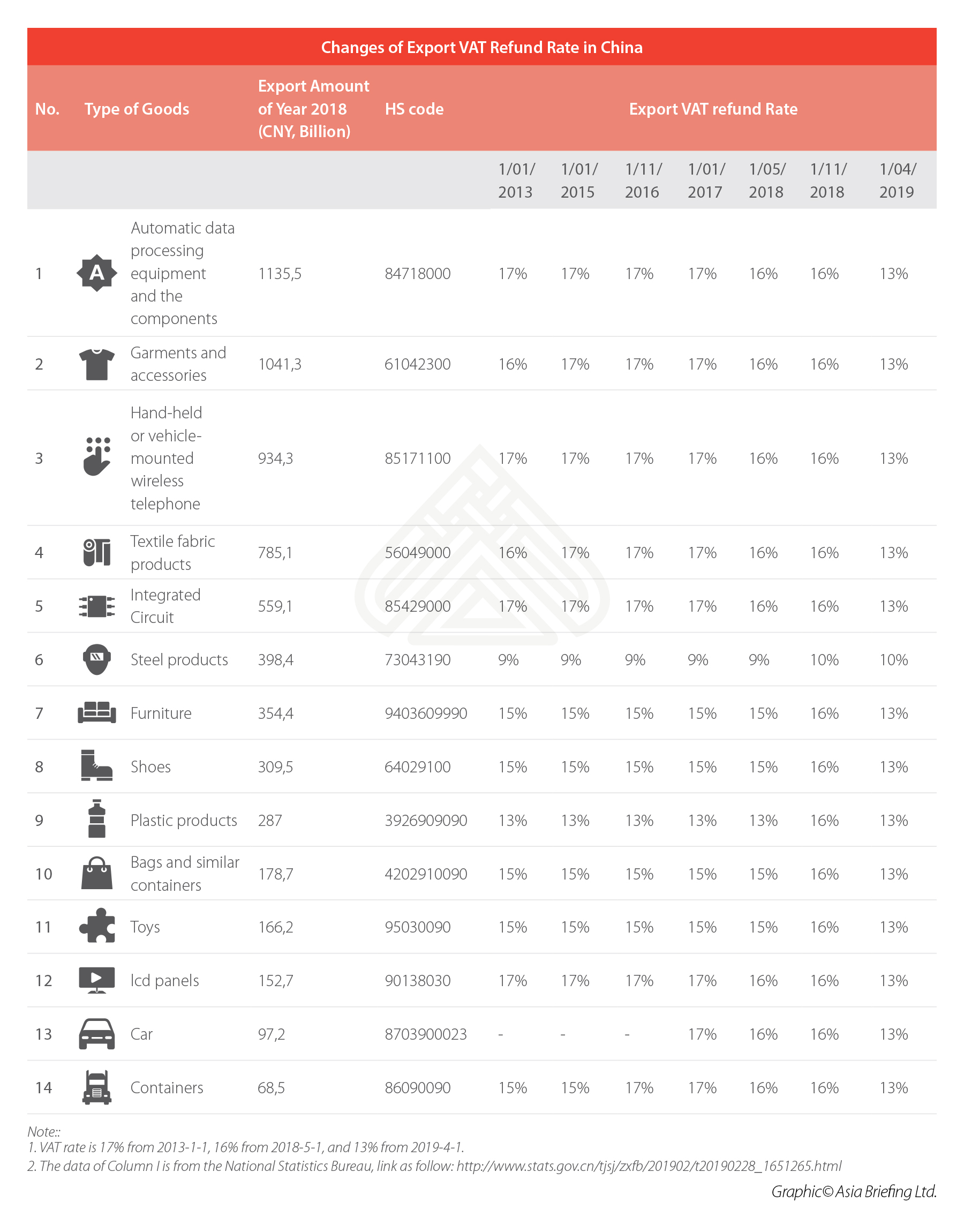

The refund is based on the VAT refund rate which is determined by the custom’s commodity code (HS code).

What’s the difference between a manufacturer and trading company in terms of VAT refunds?

Trading companies have adopted the “Exempt-Refund” system, which means the exported goods are free of VAT and VAT paid to domestic suppliers is refundable based on the VAT refund rate. The actual VAT refund rate (i.e. the percentage of VAT refunded divided by the costs of exported products) is in general the same as nominal VAT refund rate.

Manufacturing companies follow an “Exempt-Credit-Refund” system, due to the fact that the labor costs embodied in the products are not subject to VAT, the actual VAT refund rate is lower than the nominal VAT refund rate.

If the VAT refunds are not fully refunded, the non-refundable part of VAT would increase the cost of overseas business sourcing from China, no matter if it is under the “Exempt-Refund” or “Exempt- Credit- Refund” regime.

How do I apply for export VAT refund?

A company can obtain a VAT refund when the following conditions are satisfied simultaneously:

- The company is qualified as a general VAT payer (GVAT);

- The company has an import and export license;

- The goods are subject to VAT or consumption tax in China;

- The revenue generated from the transaction is booked as export income in the accounts of the company;

- The goods must physically leave the country (except for those shipped to export processing zone or bonded warehouse/logistic zones); and,

- The company has to produce evidence that the payment of export transactions has been settled before the end of April the following year. If a long payment term is agreed in the contracts, special filing on the extension of payment terms is required by tax bureau, which shall be finished before the end of April of following year.

To successfully apply for the VAT refund, the applicant must go through the below procedures:

Preparation

- Register with customs and apply for an import and export license

- Obtain a GVAT license with the tax bureau

- File export business with foreign exchange bureau

- Apply for a VAT refund license with tax bureau

Daily operation

- Purchase blank export invoices

- Export goods through customs and issue VAT exemption invoices for export transactions

- Submit VAT refund data into the tax bureau’s VAT refund system

- Site visit: before releasing the initial VAT refund, the tax bureau may pay a visit to the company to verify whether it has a premise, proper procedure and experienced human resources in place to manage VAT refund

- Documentation, including but not limited to the export declaration form, input VAT invoices obtained from suppliers, export invoices and shipping documents etc., needs to be properly filed and will be reviewed by the tax bureau during an investigation.

Annual filing

In March of the following year, the tax bureau will reconcile the transaction data in the VAT refund system with those in the custom’s system. In case of a discrepancy or missed filing, the tax bureau will require the company to fill in a questionnaire, in which the company may make proper adjustments which then need to be justified properly. Internally, the company may do a health check before submitting such adjustments to the tax bureau. All the export refund applications must be handed-in before the 15th of April the next year, the deadline for closing all the VAT refund transactions in tax system. If any improper filing or missing of documents is confirmed by the tax bureau, the VAT refund may have to be returned and a 13% VAT may be levied much the same as a domestic transaction.

What are some challenges in managing export VAT refunds?

The VAT export refund policy evolves very fast in China in line with the PRC economy. In the past ten years, we have seen a constant decrease in the VAT refund rate of products like consumed precious resources, pollutants, etc. However, in times of economic depression, the government may increase the VAT refund rate to stimulate exports. Therefore, it is important for exporters and importers to keep a close watch on VAT policy as it may have a big impact on pricing.

Starting from three years ago, the Chinese government has been working on a credit system to connect all the bureaus’ systems together for information sharing and cross checking. The tax bureau has introduced a grading system to manage taxpayers. In case of any serious misconduct or improper filing in term of nature or value of transactions, the company can be downgraded by the tax bureau. Once downgraded, the VAT refund applicant will need to submit more paper documents to the tax bureau and the review process will be prolonged. Considering this, a systematic VAT refund management is very essential to an exporter in China.

We provide expert advisory and corporate services across Asia, guiding businesses through complex markets and regulations.