Our collection of resources based on what we have learned on the ground

Is there tax deduction when payments of withholding tax are paid to non-resident entities?

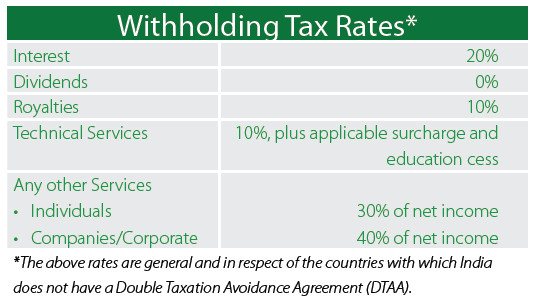

Q&AThe Income Tax Act in India provides for deduction of tax at source on payment for withholding tax. These provisions are also applicable in case of payment made to non-residents. The person responsible for payments to non-resident should deduct tax at source at the time of payment or at the time of credit of the sum to the account of the non-resident.

< BACK TO LIBRARY

Subscribe to receive latest insights directly to your inbox

Subscribe NowOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us