Our collection of resources based on what we have learned on the ground

What is withholding tax in India?

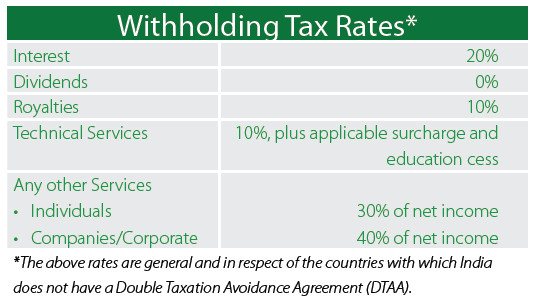

Q&AWithholding tax is one that is applied when the income is paid to outside India, which is also applicable if the payment is made to non-residents. When an income is paid out of India, the person responsible for payments to non-resident should deduct tax at source at the time of payment or at the time of credit of the sum to the account of the non-resident.

< BACK TO LIBRARY

Subscribe to receive latest insights directly to your inbox

Subscribe NowOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us