Our collection of resources based on what we have learned on the ground

Resources

podcast

Overview of China's e-Commerce Industry

- May 2016

- Free Access

Richard Cant, the Director of Dezan Shira & Associates North America, provides insights to China's e-commerce industry, including a consumer analysis of the Chinese market, main industry players and the various investment models available for foreign...

podcast

Hiring and Firing in India

- March 2016

- Free Access

Richard Cant, the Director of Dezan Shira & Associates North America, discusses the challenges of hiring, firing and retaining employees in India. Richard will describe the HR systems in place in India and how to mitigate an employers' risks.

infographic

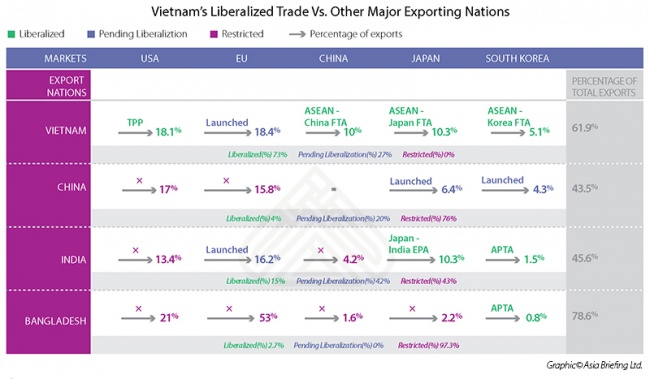

Vietnam's Liberalized Trade Vs. Other Major Exporting Nations

- December 2015

- Members Access

This infographic compares Vietnam's exports with some major global trade partners and the exports of other competing countries.

infographic

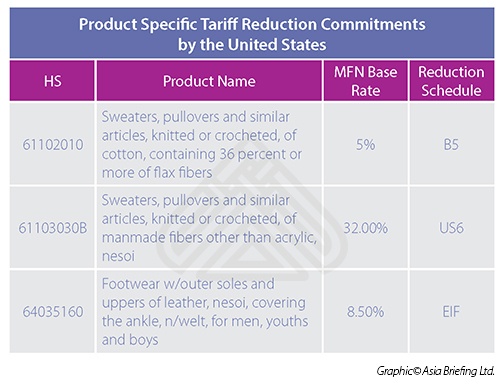

Product Specific Tariff Reduction Commitments by the United States

- December 2015

- Free Access

This infographic lists out the product specific tariff reduction commitments by the United States.

magazine

The Trans-Pacific Partnership and its Impact on Asian Markets

- November 2015

- Members Access

In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

infographic

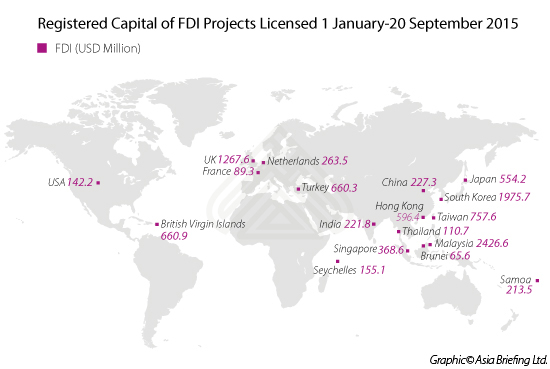

Registered Capital of FDI Projects Licensed 1 January-20 September 2015

- October 2015

- Free Access

This infographic compares the registered capital for foreign direct investment projects licensed in various countries between January 1, 2015 to September 20, 2015.

DTA

Convention On Mutual Administrative Assistance In Tax Matters

- May 2015

- Free Access

Convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and with a view to promoting economic cooperation between OECD member countries and India.

infographic

Ease of Paying Tax Rankings

- May 2015

- Free Access

Ein Ranking des Schwierigkeitsgrades Steuern zu zahlen "Ease of Paying Tax", der ASEAN Länder sowie Hong Kong, China, Deutschland, den U.S.A., Italien und Indien

DTA

Convention Between The Kingdom Of Thailand And Canada For The Avoidance Of Doubl...

- May 2015

- Free Access

Convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income between Thailand and Canada.

DTA

Double Taxation Avoidance Agreement between Indonesia and Canada

- April 2015

- Free Access

Double Taxation Avoidance Agreement between Indonesia and Canada

DTA

Double Taxation Avoidance Agreement between Indonesia and the U.S.

- April 2015

- Free Access

Double Taxation Avoidance Agreement between Indonesia and the U.S.

FTA

Free Trade Agreement between Singapore and U.S

- April 2015

- Free Access

Establishment of a free trade area and definitions.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us