Our collection of resources based on what we have learned on the ground

Resources

Q&A

To what extent do people falling under the visa category “International Worker...

- March 2017

- Members Access

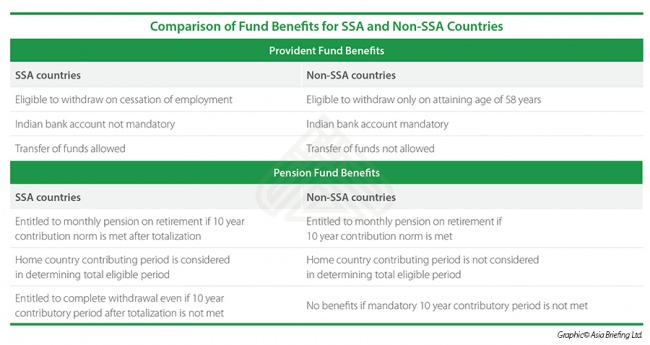

One who is under the visa category of International Worker and employed in India prior to 1September 2014 will contribute 12% of their salary to the Provident Fund Scheme, while the employer will make an equal contribution of 12% but this will be spl...

Q&A

What is the significance of “residential status” for expatriate employees in...

- March 2017

- Members Access

India’s tax year runs from 1 April to 31 March of the following year. Foreign employees must file tax returns by 31 July. When filing, expatriate workers should be aware of their residential status, on which the taxability will be based. There ...

infographic

Social Security Obligations for Foreign Nationals Working in India

- March 2017

- Members Access

Countries with whom India has a Social Security Agreement (SSA) benefit from particular conditions.

infographic

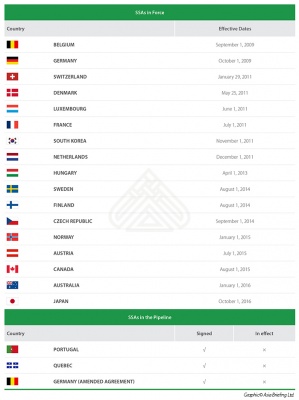

Social Security Agreements (SSA) in Force between India and Other Countries

- March 2017

- Free Access

Currently there are 17 Social Security Agreements (SSA) in force between India and other countries, plus 3 that have been signed but not yet implemented.

infographic

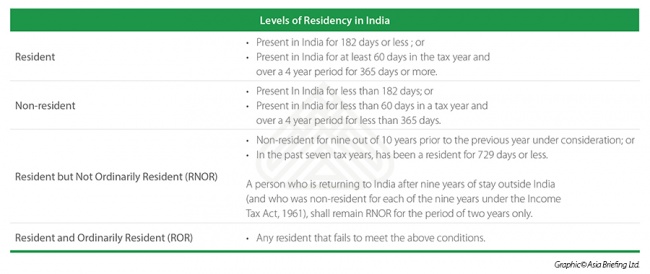

Levels of Residency in India

- March 2017

- Members Access

Foreign employees in India must file tax returns by 31 July. When filing, expatriate workers should be aware of their residential status, on which the taxability will be based.

infographic

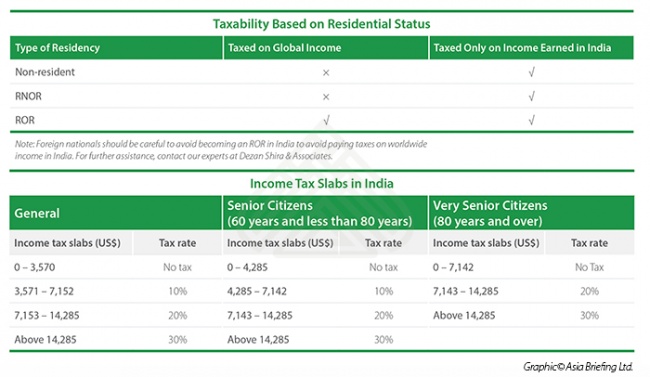

Taxability Based on Residential Status and Income Tax Slabs in India

- March 2017

- Members Access

Foreign employees must file tax returns by 31 July. When filing, expatriate workers should be aware of their residential status, on which the taxability will be based.

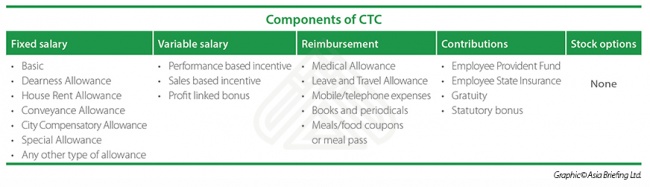

infographic

India's Salary Structure: the Cost to Company (CTC)

- March 2017

- Members Access

India's salary structure consists of basic salary, gross salary, net salary, and cost to company (CTC).

magazine

New Considerations when Establishing a China WFOE in 2017

- February 2017

- Members Access

In this edition of China Briefing, we guide readers through a range of topics, from the reasons behind foreign investors’ preference for the WFOE as an investment model, to managing China’s new regulations. We discuss how economic transformations...

videographic

Steps to Set up online shop in China

- February 2017

- Free Access

This prezi shows procedures on how to set up online shop in China

report

India's Digital Payments Future

- February 2017

- Members Access

In line with government reforms, Prime Minister Narendra Modi has pushed Indians to adopt cashless transactions, giving the digital payments sector a significant boost. The sector is currently experiencing an unprecedented jump in growth since early ...

infographic

Rates and Reduction for Select Asian Treaty Partners

- February 2017

- Members Access

This infographic represents the rates and reductions for select Asia treaty partners, concerning dividends, interest and royalties.

infographic

Comparison Between Taxation in Singapore and Other Countries

- February 2017

- Members Access

This table shows a comparison between tax rate, witholding tax, holding company in Singapore and in other countries.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us