Our collection of resources based on what we have learned on the ground

Resources

Q&A

How long should an enterprise operating in Vietnam retain relevant documentation...

- November 2016

- Members Access

Enterprises operating in Vietnam are required to retain certain documentation for periods of five or ten years, while other documentation must be retained indefinitely. The government of Vietnam requires that a company retain all documents used...

Q&A

In what areas do Vietnamese Accounting Standards (VAS) deviate from Internationa...

- November 2016

- Members Access

Vietnamese Accounting Standards (VAS) differ from International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) through out of date standards, ineffective implementation, and issues regarding translation. The I...

Q&A

When will the Accounting Law of 2015 go into effect, and what impact will it hav...

- November 2016

- Members Access

The Accounting Law of 2015 was passed on November 30, 2015, and is set to go into effect on January 1, 2017. This law will act as an update to the Law on Accounting of 2003, and although the changes to the law are not substantial, changes have ...

magazine

Evaluating China's VAT Reform

- November 2016

- Members Access

At the beginning of 2012, China began a massive overhaul of its tax system by initiating the replacement of business tax (BT) with value-added tax (VAT). Prior to the reform, VAT was levied only on the sale and import of tangible goods and on the pro...

videographic

China's VAT Reform Implementation Timeline

- November 2016

- Members Access

This Prezi provides a timeline of China's VAT reforms since the promulgation of it's Five Year Plan in 2008.

infographic

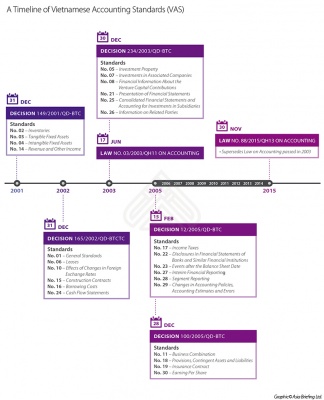

A Timeline of Vietnamese Accounting Standards (VAS)

- November 2016

- Members Access

This infographic provides information concerning the implementation of Vietnamese Accounting Standards (VAS) since 2001.

infographic

VAS Convergence with International Reporting and Accounting Requirements

- November 2016

- Members Access

This infographic shows the convergence between international reporting and accounting requirements on the international scale, and those included in the Vietnamese Accounting Standards (VAS).

webinar

Diagnosing China’s Healthcare Industry

- November 2016

- Free Access

In this webinar, international business advisory manager Riccardo Benussi provides an introduction to the healthcare industry in China, breaking down investment trends, market entry concerns and regulations, current hurdles, and case studies in the m...

presentation

Diagnosing China's Healthcare Industry

- November 2016

- Free Access

In this webinar, international business advisory manager Riccardo Benussi will provide an introduction to the healthcare industry in China, breaking down investment trends, market entry concerns and regulations, current hurdles, and case studies in t...

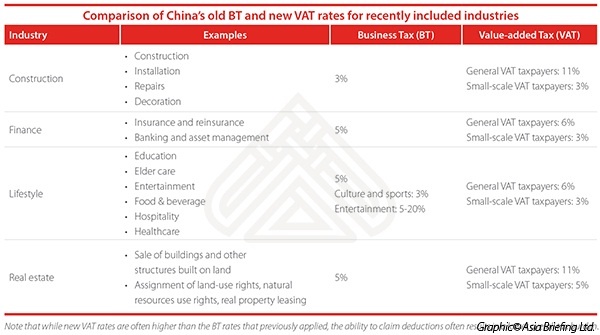

infographic

Comparison of China's Old Business Tax and New Value-added Tax Rates for Recentl...

- November 2016

- Members Access

This infographic offers information on the percentage rates of the Value-added Tax (VAT) for General VAT as well as Small-scale VAT taxpayers.

infographic

China's VAT Reform Implementation Timeline

- November 2016

- Members Access

This infographic provides a timeline of China's Value-added tax reform from 2008 to 2018.

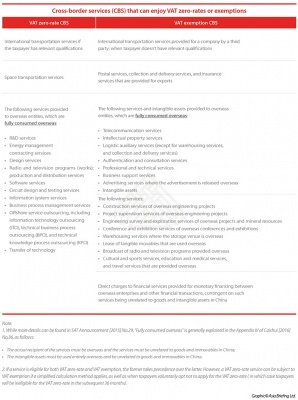

infographic

Cross-border Services (CBS) That Can Enjoy VAT Zero-Rates or Exemptions in China

- November 2016

- Members Access

This infographic breaks down the services falling under China's Value-added Tax (VAT) zero-rate and exemption VAT.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us