Our collection of resources based on what we have learned on the ground

Resources

Q&A

What is withholding tax and what are the three types of it?

- May 2016

- Members Access

A withholding tax is a tax applied to funds that companies wish to send aboard. Countries in Asia typically divide withholding tax into dividends, interest, and royalties payments, with the amount of each varying considerably in each country. These a...

Q&A

How is Corporate Income Tax (CIT) carried out in ASEAN and what are the differen...

- May 2016

- Members Access

How CIT tax is carried out varies across ASEAN countries and is determined by a myriad of factors such as priorities of government, the nature of its economy, the country’s size and its level of development. Depending on the tax residency of th...

Q&A

What changes or improvements can be expected from the taxation system in ASEAN c...

- May 2016

- Free Access

In the next five years, taxation in ASEAN will largely be characterized by two trends: convergence and transparency. While lowered rates will likely prevail in ASEAN’s developing economies to attract investment, countries such as Singapore and ...

Q&A

Why do companies need a thorough due diligence about Corporate Income Tax when i...

- May 2016

- Free Access

With capital flooding into ASEAN countries as a result of reduced trade barriers, ASEAN countries have subsequently propelled CIT into the spotlight as a key driver of competitiveness. Countries such as Indonesia and Vietnam have reduced their CIT ra...

Q&A

What is the current trend of Personal Income Tax (PIT) in ASEAN countries?

- May 2016

- Free Access

Individual income tax rates in ASEAN have for the most part been experiencing a downward turn in recent years. However, many countries have increased taxation in upper tax brackets to make up for this loss of revenue. For rapidly growing economies, t...

Q&A

How could businesses benefit from a Double Taxation Avoidance Agreement?

- May 2016

- Members Access

Depending on the countries to which profits are remitted, companies may benefit from lowered withholding rates if the origin and recipient country have signed a Double Taxation Agreement (DTA). Since DTAs are negotiated on a bilateral basis, countrie...

Q&A

Besides identifying optimal tax jurisdictions, what are some of the other factor...

- May 2016

- Members Access

Besides analyzing and identifying optimal tax jurisdictions, there are other variables that determine the tax environment of a given market. Time, effort, and compliance required when filing taxes, in conjunction with the effectiveness of a governmen...

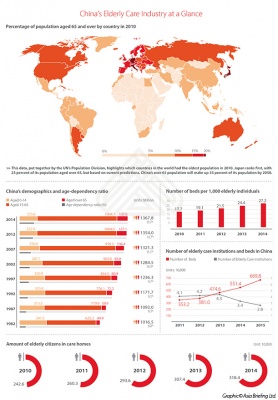

infographic

China's Elderly Care Industry at a Glance

- May 2016

- Members Access

This infographic shows the demographic information and statistics of elderly care institutions in China.

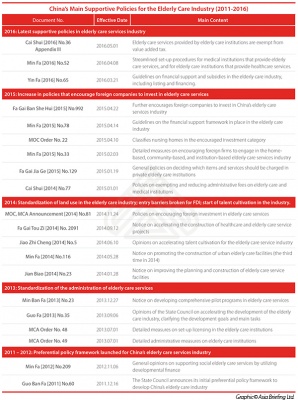

infographic

China's Main Supportive Policies for the Elderly Care Industry (2011-2016)

- May 2016

- Members Access

This infographic lists out main supportive policies that incentivize the development of the elderly care industry in recent years.

presentation

Restructuring Your Business in China

- May 2016

- Free Access

Federico Paolucci, Associate on Dezan Shira & Associates' International Business Advisory team, advises on restructuring options for a business in China.

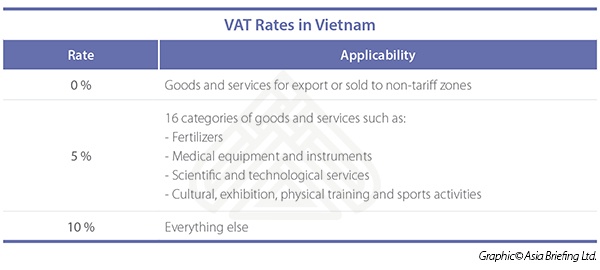

infographic

VAT Rates in Vietnam

- May 2016

- Free Access

Complete list of VAT imposed on the supply of goods and services at three different rates in Vietnam.

infographic

Documents Required to Open a Foreign Currency Account in Vietnam

- May 2016

- Members Access

In order to open the foreign currency account, the following documentation should be prepared.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us