Our collection of resources based on what we have learned on the ground

Resources

Q&A

What does being a beneficial owner in China entail?

- July 2014

- Free Access

A beneficial owner refers to a person that has ownership and control over the income and rights or properties from which income is derived. The person is generally engaged in substantive business activities (i.e., manufacturing, trade and management ...

magazine

Manufacturing Hubs Across Emerging Asia

- July 2014

- Members Access

In this issue of Asia Briefing Magazine, we explore several of the regionâs most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand, and Vietnam. Exploring a wide variety of factors such as ...

Q&A

What types of joint ventures (JVs) are available for foreign firms and investors...

- July 2014

- Free Access

Entering into a joint venture (JV) with a local company can provide benefits such as brand exposure for foreign firms in the Indian market while avoiding the risks associated with establishing local branches or subsidiaries. Licensing JVs entail an I...

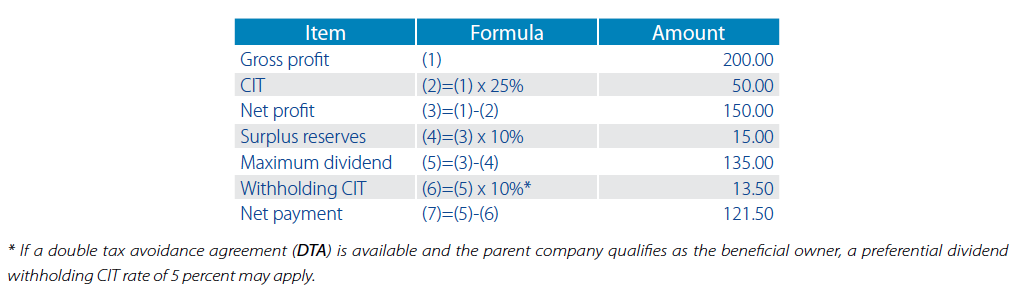

infographic

Tax Burdens of Paying Dividends from China to Overseas

- July 2014

- Free Access

This infographic shows the tax burdens when dividends are being paid out of China to overseas.

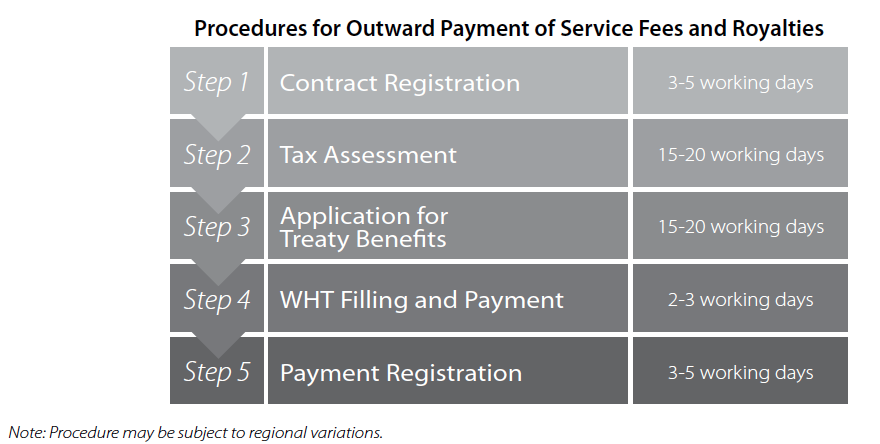

infographic

Procedures for Outward Payment of Service Fees and Royalties

- July 2014

- Free Access

This infographic details the necessary steps which need to be taken for outward payment of service fees and royalties.

infographic

Service Fees between China and Overseas Entities

- July 2014

- Free Access

This infographic details the exchange of service fees between the foreign-invested enterprise in China and its parent company abroad.

infographic

Royalty Remittances between China and Overseas Entities

- July 2014

- Free Access

This infographic details the exchange of royalty remittance between foreign-invested enterprises in China and their parent company abroad.

infographic

Annual Compliance Timeline in China

- July 2014

- Free Access

A timeline outlining the process for annual tax compliance, including the steps which need to be taken and the deadlines which must be met.

infographic

Procedures for the Declaration & Repatriation of Dividends in China

- July 2014

- Free Access

This infographic details the steps that need to be taken during the procedure for declaring and repatriating dividends.

infographic

Countries with which China has a Double Taxation Avoidance Agreement

- July 2014

- Free Access

The infographic details all the countries which have a double tax avoidance agreement with China as of June 2014.

Q&A

What are the restraints for a company?s entity in China to pay dividends directl...

- July 2014

- Free Access

There are several ways of repatriating cash from China, the most obvious being for a company’s entity in China to pay dividends directly to its foreign parent company. However, this is subject to certain prerequisites – only profits th...

Q&A

Are service fees paid to overseas-related parties deductible for or exempt from ...

- July 2014

- Free Access

Service fees paid to overseas related parties are deductible for CIT purposes provided they are directly related to the foreign-invested enterprise’s (FIE) business operations, charged at normal market rates, and all applicable taxes have be...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us