Our collection of resources based on what we have learned on the ground

Resources

article

HR and Payroll in Vietnam - An Overview

- January 2019

- Free Access

After setting up a business in Vietnam, the next big hurdle is hiring the staff that you will need to help grow your operation. The initial hiring process and, ultimately, payroll administration can quickly become a complex and confusing process. Lab...

magazine

Growing Opportunities for Foreign Investors in Indonesia

- January 2019

- Members Access

In this issue of Indonesia Briefing magazine, we focus on emerging FDI opportunities in Indonesia and highlight the country’s potential as a sound investment destination, including for those looking to shift a part of their production lines from Ch...

article

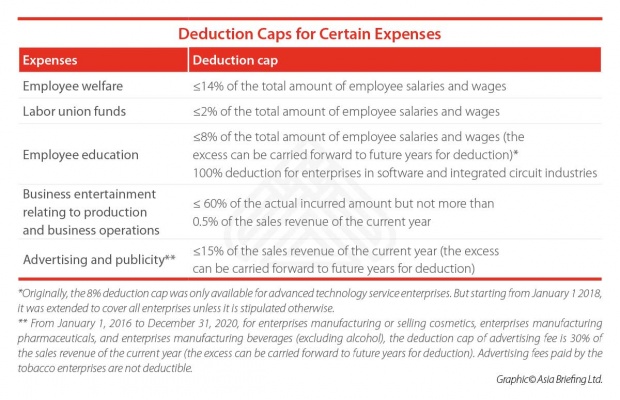

HR and Payroll in China: Eight Quick Tips That Can Make a Difference

- January 2019

- Free Access

A firm understanding of China’s laws and regulations relating to human resources and payroll management is essential for foreign investors who want to establish or are already running foreign-invested entities in China. In China, there are a w...

article

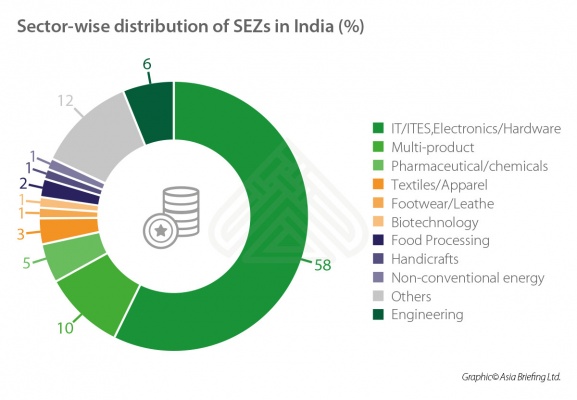

HR and Payroll in India: 10 Best Practices for Employers

- January 2019

- Free Access

As India integrates into the global market, foreign firms entering the country have to strike a balance between following their own best practices while adapting to local norms and having a firm understanding of legal requirements in the country. &nb...

Q&A

¿Qué es la tecnología en la nube y cómo funciona en China?

- January 2019

- Free Access

La tecnología en la nube (también conocida como "computación en la nube" o simplemente "la nube") es cuando los servidores, el almacenamiento, las bases de datos, las redes, el software y los procesos de análisis se alojan...

DTA

Double Taxation Avoidance Agreement Between Hong Kong and India

- January 2019

- Free Access

On March 19, 2018, India and the Hong Kong Special Administrative Region (HKSAR) of China signed a double tax avoidance agreement (DTAA). The DTAA offers protection from double taxation to over 1,500 Indian businesses with a pres...

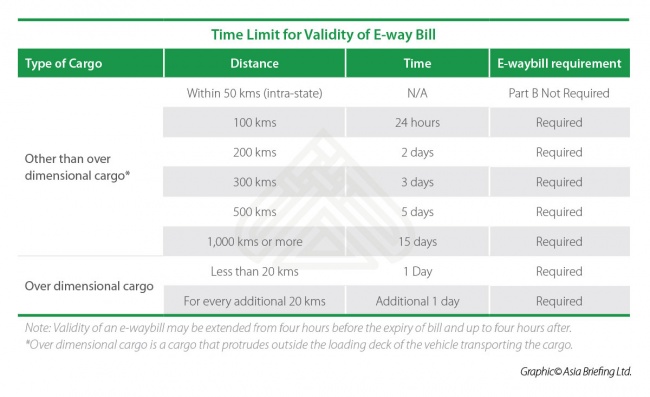

infographic

Time Limit for Validity of E-way Bill in India

- January 2019

- Free Access

An E-way bill is an electonic way bill required for the interstate movement of goods where the value of goods exceeds Rs. 50,000 (US$716), in motorized conveyance. The transportation of goods through a non-motor vehicle is exempted from the e-way bil...

Q&A

¿Cuáles son las actividades que puede llevar a cabo una Oficina de Enlace en I...

- January 2019

- Free Access

De acuerdo con el Banco de la Reserva de la India (RBI, por sus siglas en inglés), las siguientes actividades son las que una Oficina de Enlace puede realizar en India: -Representación de la empresa matriz en India. -Promoción de...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us