Our collection of resources based on what we have learned on the ground

Resources

infographic

Livelli minimi salariali in Cina

- July 2015

- Free Access

La seguente tabella mostra i livelli minimi salariali mensili e orari nelle principali città di ogni provincia cinese.

infographic

Import & Export Taxes in China

- July 2015

- Free Access

This infographic shows import taxes and the process of calculation and export VAT rebates and the process of calculation.

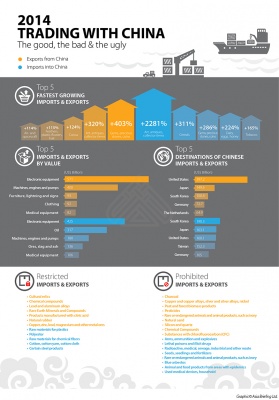

infographic

Exports & Imports of China - Trading with China in 2014

- July 2015

- Free Access

This infographic shows top 5 fastest growing imports & exports, importers & exporters by value and destinations.

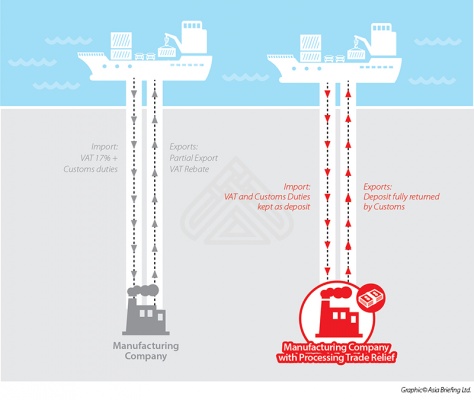

infographic

Processing Trade Relief in China

- July 2015

- Free Access

This infographic shows the process of trade relief in China by comparing the two models - 1. Processing of consigned imported material and 2. Processing of purchased imported materials.

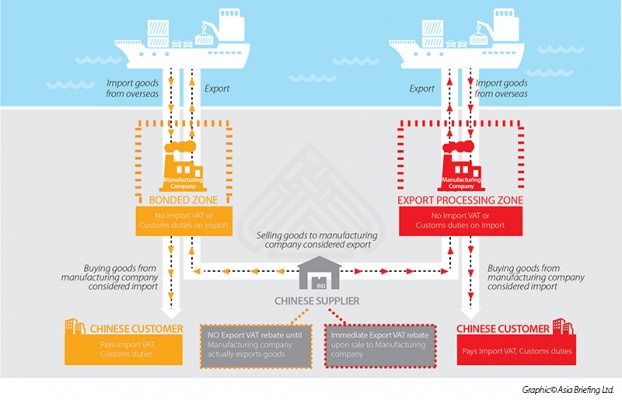

infographic

Foreign Investment Zones and its processes in China

- July 2015

- Free Access

This infographic shows processes of export processing zones in China. The parties are Chinese customer and Chinese supplier - explained in both ways; bounded zone and export processing zone.

Q&A

What are common causes that lead to business restructuring in China?

- June 2015

- Free Access

Causes that lead to business restructuring may be internal or external to the business itself. Oftentimes, business owners make the mistake of assuming that the business model of the parent company at home will share the same success in China. Howeve...

videographic

Closure and De-registration of Business in China

- June 2015

- Free Access

This Prezi presents general overview on how to restructure an underperforming business in China

podcast

Marketing Moments Episode 1: Traditional vs Content Marketing

- June 2015

- Free Access

In this podcast Associate Director of Marketing and Operations Nicholas Clement and Digital Marketing Associate Joonas Jukkara in Dezan Shira & Associates' Shanghai Office, discuss the key differences between traditional and content marketing.

report

Payroll in Asia 2015

- June 2015

- Members Access

Payroll covers all aspects of paying a companyâs employees. This includes making sure that salaries are paid in the correct amount and on time, that income tax is withheld, and that social security contributions are made. With a region as fast-p...

magazine

How to Restructure an Underperforming Business in China

- June 2015

- Members Access

In this issue of China Briefing magazine, we explore the options that are available to foreign firms looking to restructure or close their operations in China. We begin with an overview of what restructuring an unprofitable business in China might en...

Q&A

What does it mean for a company to be dormant?

- June 2015

- Free Access

There is no official term used to express a company’s state of dormancy in Chinese corporate law. However, for a company to become dormant, it must temporarily bring its activities to a halt. A reduction of operations may seem detrimental, but ...

infographic

Investment & Business Trends in China

- June 2015

- Free Access

This infographic shows brief investment and business trends in China - such as FDI inflow, expansion of American businesses, rising costs, profit margin.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us