Our collection of resources based on what we have learned on the ground

Resources

infographic

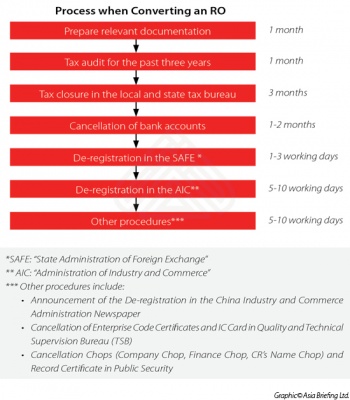

Process When Converting a RO in China

- June 2015

- Free Access

7 steps to follow when converting a RO in China - from preparing the document to cancelling chops and security of the company.

infographic

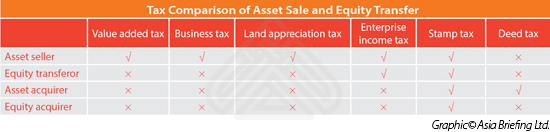

Tax Comparison of Asset Sale and Equity Transfer in China

- June 2015

- Free Access

This infographic shows which tax is needed to be applied to asset seller, equity transferor, asset acquirer and equity acquirer in China.

infographic

Process When De-registering Business in China

- June 2015

- Free Access

This infographic shows 17 steps to follow when de-registering business in China. From submitting termination application to cancelling chops and certificates of the business.

videographic

What You CAN and What You CAN'T Invest in China, Vietnam, and India

- May 2015

- Free Access

This prezi leads you through the foreign investment restrictions in various industries in China, Vietnam, and India

infographic

Foreign Investment in China, India and Vietnam

- May 2015

- Free Access

This infographic shows you the basic statistics about foreign investment in China, India and Vietnam.

infographic

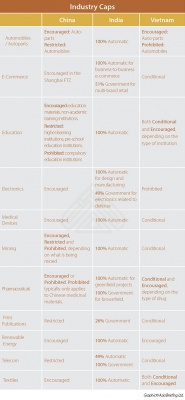

Comparison of Industry Caps in China, India and Vietnam

- May 2015

- Members Access

This infographic compares the foreign investment restrictions on various industries in China, India, and Vietnam.

infographic

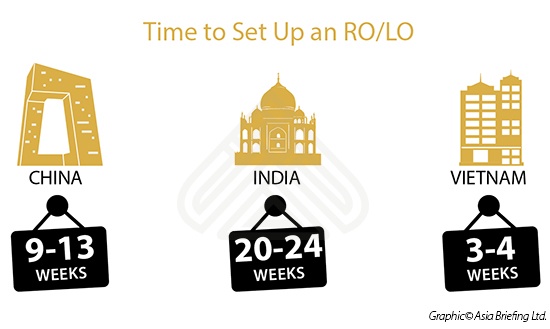

Time to Set Up an Representative Office / Liaison Office in China, India and Vie...

- May 2015

- Free Access

This infographic shows you the time to set up a Representative Office/Liaison Office in China, Vietnam, and India.

infographic

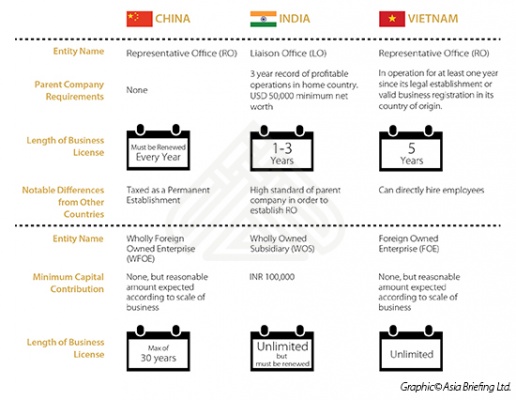

Comparison of Investment Options in China, India, and Vietnam

- May 2015

- Members Access

This infographic compares the different investment models available for foreign investors in China, India, and Vietnam.

infographic

China, India & Vietnam Taxes at a Glance

- May 2015

- Members Access

This infographic compares various tax categories in China, India, and Vietnam.

Q&A

What role does the automotive parts industry play in the growth of the Chinese e...

- May 2015

- Free Access

Named as one of the “pillar industries”, the car manufacturing industry is core to China’s economic policy and contributes over 5 percent of the country’s GDP. Car companies benefit from various preferential policies and incen...

Q&A

What steps have the Chinese government taken to improve traffic conditions?

- May 2015

- Free Access

The rapid growth of car use has resulted not only in traffic jams in many of China’s major cities but also in heavy air pollution which has become an everyday concern in recent years. Accordingly, city officials decided to limit the issuing of ...

Q&A

How does the Chinese government regulate foreign investment in the automotive in...

- May 2015

- Members Access

China maintains a list of regulations regarding foreign investment in certain sections of its economy in a document known as the Catalogue for the Guidance of Foreign Investment. It defines foreign investment in certain industries as either enc...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us