Our collection of resources based on what we have learned on the ground

Resources

Q&A

Welche �nderungen f�hrt das neue Doppelbesteuerungsabkommen ein?

- March 2015

- Free Access

Durch das DBA haben einige Veränderungen für die Unternehmen stattgefunden. Die Änderungen sind Komplex und sollten genau überprüft werden. Veränderungen gibt es für: • Dividenden • Betriebsstä...

Q&A

Welche Visa-Art ist f�r Gesch�ftst�tigkeiten in China notwendig?

- March 2015

- Free Access

Für Geschäftstätigkeiten gibt es 2 Möglichkeiten ein Visum zu erhalten. Das M-Visum ist das Geschäftsvisum welches für ausländische Geschäftspersonen gilt, die nach China einreisen, um dort Geschäfte zu...

infographic

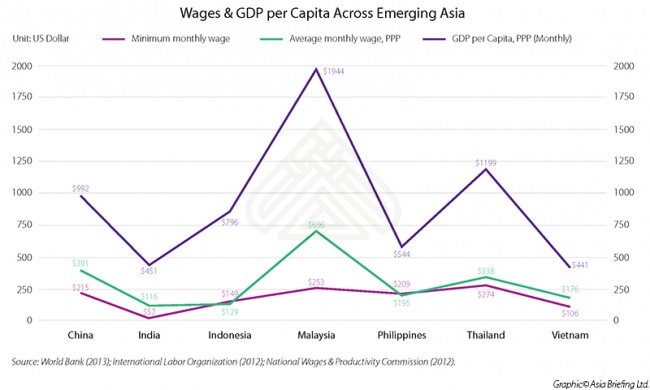

Wages & GDP per Capita Across Emerging Asia

- February 2015

- Free Access

This infographic compares GDP per capita and wages from two perspectives: the average minimum wage and the overall average wage across emerging Asia.

podcast

Deregistering a Representative Office (RO) in China

- February 2015

- Free Access

Kyle Freeman, International Business Advisory Associate in Dezan Shira & Associates' Beijing office, discusses the steps involved in deregistering a representative office in China.

infographic

Code & Industry Names of Entertainment Industry of China

- February 2015

- Free Access

Investing in China's Entertainment Industry - code & industry names

infographic

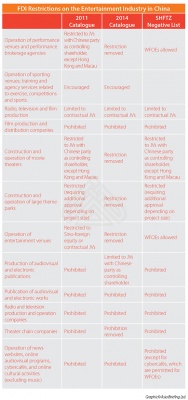

FDI Restrictions on the Entertainment Industry in China

- February 2015

- Members Access

List of FDI restrictions on the entertainment industry in China and its 2011, 2014 catalogs and SHFTZ negative list.

infographic

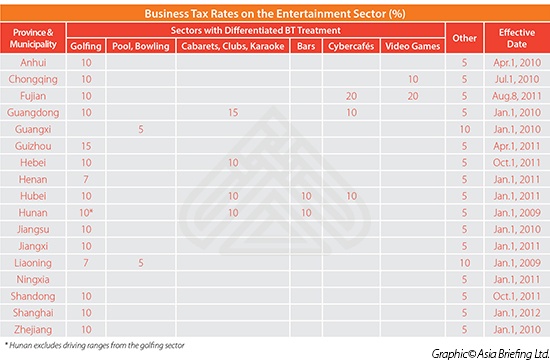

Business Tax Rates on the Entertainment Sector (%)

- February 2015

- Members Access

List of provinces and municipalities and their business tax rates on different entertainment sectors in China.

infographic

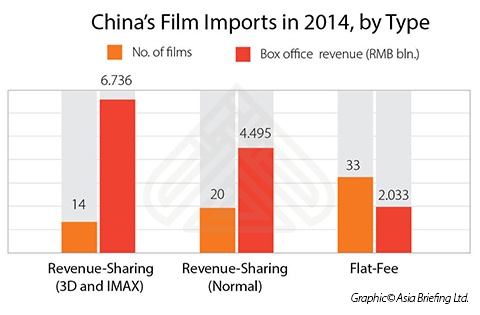

China's Film Imports in 2014, by Type

- February 2015

- Free Access

This infographic is China's film imports in 2014 and includes number of films and box office revenues by type.

infographic

Timeline of the foreign film quotas

- February 2015

- Free Access

Timeline of the foreign film quotas from 1994 to 2017.

magazine

China Investment Roadmap: The Entertainment Industry

- February 2015

- Members Access

In this special edition China Briefing Industry Report, we cast our gaze over the broad landscape of Chinaâs entertainment industry, identifying where the greatest opportunities are to be found and why. Next, we detail some of the most important...

Q&A

What are the future e-commerce trends for the Asia-Pacific?

- February 2015

- Free Access

Global B2C e-commerce sales will grow by more than 20 percent this year to reach US$1.5 trillion, and surpass US$2.3 trillion by 2017. This projected growth will be driven by five of the largest online retail markets in the Asia-Pacific region &ndash...

Q&A

What country in the Asia-Pacific is estimated to have the fastest growing intern...

- February 2015

- Free Access

The Philippines is estimated to have the fastest growing internet population in the world, with recent statistics estimating 530% growth over the past five years. Close behind the Philippines in global rankings are Indonesia with 430% growth, India i...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us