Our collection of resources based on what we have learned on the ground

Resources

magazine

Audit and Compliance in India

- February 2021

- Members Access

India’s audit regulations require businesses to comply with various types of audits, governed under different laws. Since the commencement of the Goods and Services Tax (GST) law in 2017, businesses and entrepreneurs in India are also required to c...

webinar

Profit Repatriation from India: Tax Implications, DTAAs, and Transfer Pricing Pr...

- January 2021

- Free Access

On 27 January, International Business Advisory Manager, Sonakshi Sood discussed taxation for foreign companies in India and profit management strategies for avoiding long term tax and regulatory complications. Watch this webinar to learn about taxa...

webinar

2020 Year in Review and What's Next for China, Vietnam and India in 2021

- January 2021

- Free Access

2020 was tumultuous and game changing for businesses everywhere. In particular, companies in Asia have had to deal with a large amount of uncertainty in 2020. From geopolitical trade tensions in Hong Kong and Mainland China, to a global pandemic, com...

infographic

Logistics Network in India

- January 2021

- Free Access

Deciding on which SEZ location is best for a company can often be a difficult process. For companies directly sourcing from or manufacturing in India, the site should be well placed to acquire the raw materials needed for production, while at the sam...

webinar

Understanding India’s Manufacturing Sector – Market Entry, COVID-19 Updates,...

- December 2020

- Free Access

Sunny Makhija, International Business Advisory Assistant Manager, and Neetu Suthar, International Business Advisory Associate, discuss the impact of COVID-19 on India’s manufacturing sector, incentives offered by the government for manufacturers an...

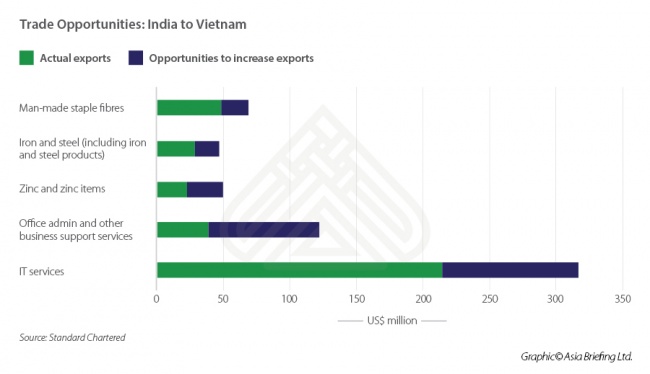

infographic

India-Vietnam Trade Opportunities

- December 2020

- Free Access

India has enormous growth potential to provide IT and business services, zinc, steel, and fibers to Vietnam. Vietnam’s exports to India have a remarkable scope to increase in cotton, business support, and knitted clothing in addition to an already ...

magazine

Due Diligence per le Aziende Straniere in India

- December 2020

- Members Access

In questo numero di India Briefing, presentiamo gli aspetti chiave sui quali le aziende straniere devono puntare l’attenzione nel processo di due diligence relativo ad una società operante in India e analizziamo i diversi tipi di due diligence a c...

webinar

Where to Invest in India 2021: Insights into State Rankings, Focus Sectors, and ...

- November 2020

- Free Access

Watch this webinar to know more about top Indian states for foreign investors and how they compete amongst each other in terms of ease of doing business, industrial policies, and focus sectors.

Q&A

Doing Business in Indian States

- November 2020

- Free Access

States are ranked based on various reforms undertaken by them including land administration, labor regulation, obtaining electricity and water supply permits, environment regulation, among others. In order to improve business climate and attract dome...

infographic

Due Diligence in India

- October 2020

- Free Access

The infographics aim to provide an overview of due diligence process in India.

webinar

Establishing a Joint Venture in India and Understanding its Legal Aspects

- October 2020

- Free Access

On October 22, Business Advisory Services Senior Associate Vikas Saluja and International Business Advisory Manager Sahil Aggarwal discussed the process of setting up a joint venture in India and due diligence for foreign investors.

Q&A

Establishing a Joint Venture in India

- October 2020

- Free Access

Generally, the JV is set up by forming a separate limited company for the Joint Venture so that each party will have the limited liability i.e. up to amount of share capital invested by them. However, the tax position must be assessed as transferring...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us