Our collection of resources based on what we have learned on the ground

Resources

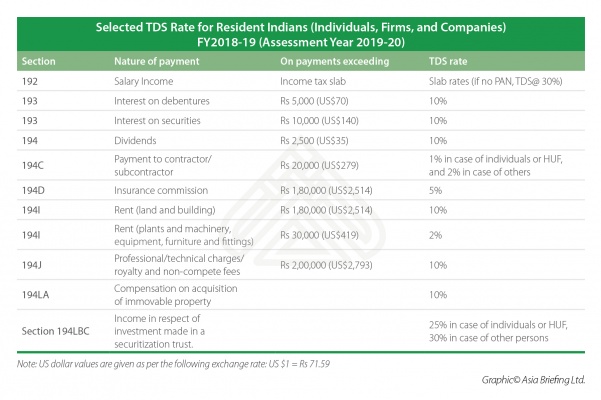

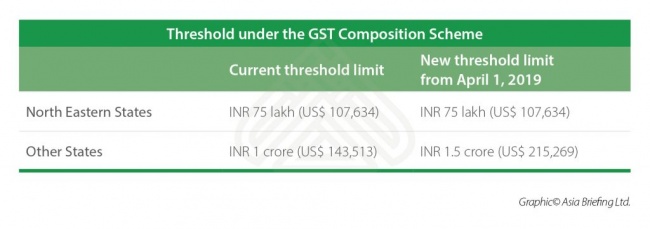

infographic

GST Composition Scheme in India

- March 2019

- Free Access

The composition scheme is a system under the Goods and Services Tax (GST) Act that allows suppliers of goods (other than exempt goods), and service providers to file their GST returns at a fixed rate.

magazine

Audit in India

- March 2019

- Members Access

In this issue of India Briefing, we provide readers with an overview of India’s audit types and processes, including general requirements and materials to be prepared. Further, we explain the different types of audit reports, which can be invaluabl...

legal

The Aadhaar and Other Laws (Amendment) Ordinance, 2019

- March 2019

- Free Access

Ordinance amending the Aadhaar Act - the law governing India's bio-metric identification program.

magazine

L’Industrie et le Commerce en Inde

- February 2019

- Members Access

Dans ce numéro du magazine India Briefing, nous discutons des avantages de choisir l'Inde comme site d'implantation économique : taille du marché, main-d’œuvre et coûts. Ensuite, nous mettons en évidence les informations pertinentes pour les ...

infographic

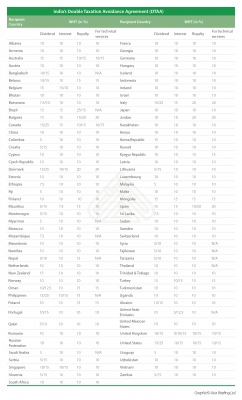

India's DTAA

- February 2019

- Free Access

List of India's Double Taxation Avoidance Agreement

Q&A

¿Cuál es el período de validez de una oficina de enlace en India?

- February 2019

- Free Access

El período de validez de una Oficina de Enlace (OE) en India es generalmente de tres años. Este período puede extenderse por otros tres años a partir de la fecha de aprobación/extensión sólo si la OE c...

Q&A

Branch Offices in India

- February 2019

- Free Access

What are the requirements for setting up a branch office in India? The Foreign Exchange Management Act (FEMA) governs the application and approval process for the establishment of a branch office, requiring that companies receive approval from the R...

infographic

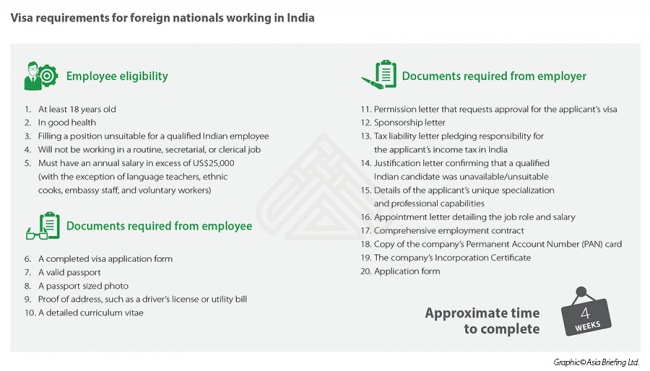

Visa Requirements for Foreign Nationals Living in India

- January 2019

- Free Access

The Indian government is progressively working on simplifying and liberalizing its visa regime.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us