Our collection of resources based on what we have learned on the ground

Resources

legal

The Indian Contract Act, 1872

- January 2019

- Free Access

The Indian Contract Act, 1872 governs the law concerning contracts in India. The law regulates the conditions in which commitments made by parties to a contract shall be legally binding, and the enforcement of these rights and duties. These laws are ...

Q&A

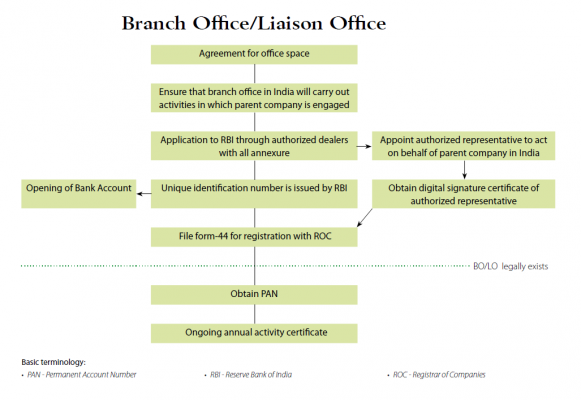

Liaison Offices in India

- January 2019

- Free Access

Setting up a Liaison Office in India is a popular choice for foreign companies looking to enter the Indian market. Foreign corporations may set up a Liaison Office to promote business activities of the parent company without incurring the costs of r...

Q&A

Setting Up a Liaison Office in India

- January 2019

- Free Access

Setting up a Liaison Office in India is a popular choice for foreign companies looking to enter the Indian market. Foreign corporations may set up a Liaison Office to promote business activities of the parent company without incurring the cost...

article

HR and Payroll in India: 10 Best Practices for Employers

- January 2019

- Free Access

As India integrates into the global market, foreign firms entering the country have to strike a balance between following their own best practices while adapting to local norms and having a firm understanding of legal requirements in the country. &nb...

DTA

Double Taxation Avoidance Agreement Between Hong Kong and India

- January 2019

- Free Access

On March 19, 2018, India and the Hong Kong Special Administrative Region (HKSAR) of China signed a double tax avoidance agreement (DTAA). The DTAA offers protection from double taxation to over 1,500 Indian businesses with a pres...

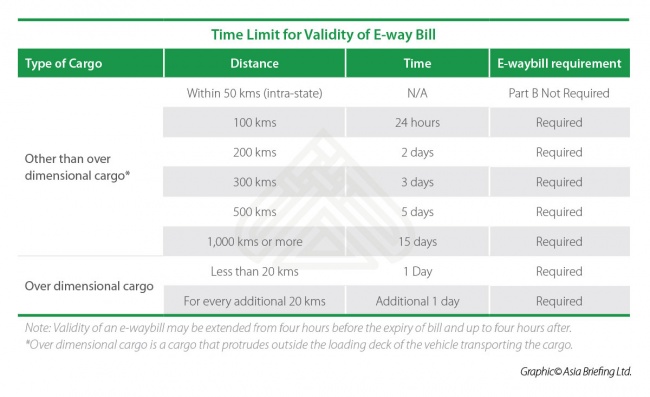

infographic

Time Limit for Validity of E-way Bill in India

- January 2019

- Free Access

An E-way bill is an electonic way bill required for the interstate movement of goods where the value of goods exceeds Rs. 50,000 (US$716), in motorized conveyance. The transportation of goods through a non-motor vehicle is exempted from the e-way bil...

Q&A

¿Cuáles son las actividades que puede llevar a cabo una Oficina de Enlace en I...

- January 2019

- Free Access

De acuerdo con el Banco de la Reserva de la India (RBI, por sus siglas en inglés), las siguientes actividades son las que una Oficina de Enlace puede realizar en India: -Representación de la empresa matriz en India. -Promoción de...

article

Transfer Pricing in India - An Explainer

- December 2018

- Free Access

In taxation and accounting, transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. According to the Indian Income-tax Act, 1961, income ari...

podcast

India: Make in India - Four Years Later

- December 2018

- Free Access

Now in the fourth year of the Make in India initiative, we take a look at the impact it has had on the country and what the future holds.

magazine

Where to Invest in India

- December 2018

- Members Access

In this issue of India Briefing magazine, we emphasize on the significance of a state-based approach to market entry in India. Further, we provide an economic overview of India’s top five investment destinations – Gujarat, Maharashtra, Karnataka,...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us