Our collection of resources based on what we have learned on the ground

Resources

infographic

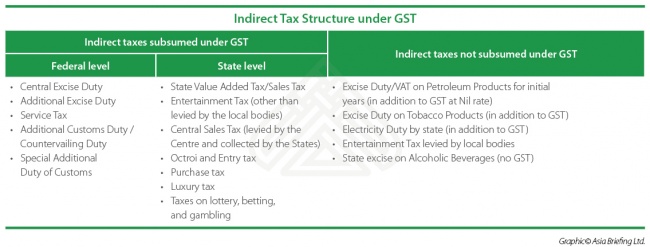

Indirect Tax Structure under Goods and Services Tax (GST) in India

- July 2017

- Members Access

This table shows the aggregation of India's new Goods and Services Tax (GST).

infographic

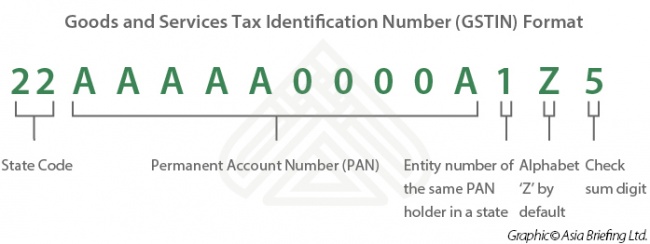

India's Goods and Services Tax Identification Number (GSTIN)

- July 2017

- Free Access

This infographic shows the elements that compose India's Goods and Services Tax Identification Number (GSTIN)

infographic

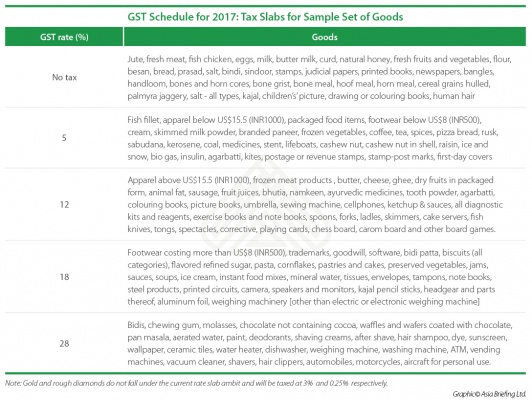

Goods and Services Tax (GST) Rates for Goods in India

- July 2017

- Members Access

This table shows the Goods and Services Tax (GST) rates applicable for different goods in India.

infographic

Goods and Services Tax (GST) Rates for Services in India

- July 2017

- Members Access

This table shows the Goods and Services Tax (GST) rates applicable for different services in India.

infographic

Export Procedure Steps in India

- July 2017

- Free Access

This infographic shows the steps required to export goods in India.

infographic

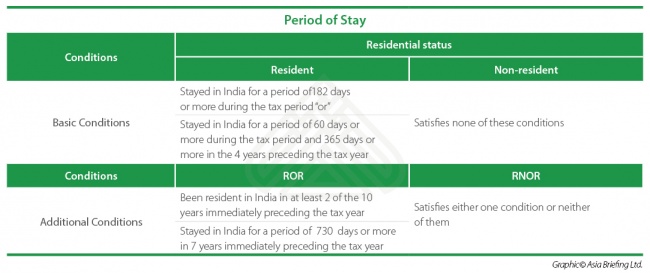

Determining Individual Income Tax (IIT) for Expatriates based on Residence Statu...

- July 2017

- Members Access

This table shows the conditions on the different residential status to determine expatriates Individual Income Tax (ITT).

presentation

The Goods and Services Tax: Behind the Biggest Tax Reform in Independent India

- July 2017

- Free Access

In this presentation, International Business Advisory Manager Sahil Aggarwal and Senior Associate Shashi Verma outline how your business can take advantage of the newly introduced GST regime.

Q&A

What are the types of pension offered monthly in India?

- May 2017

- Free Access

Widows' pension for death while in service. Pension uppon superannuation or disability. Orphan's pension. Children's pension. It should be noted that there are different pension funds for seamen, civil servants, employees in tea plantations i...

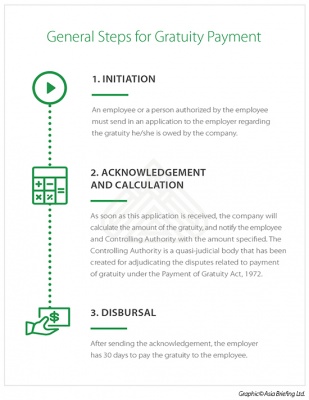

infographic

General Steps for Gratuity Payment

- May 2017

- Members Access

This infographic shows the steps needed to calculate gratuity payment.

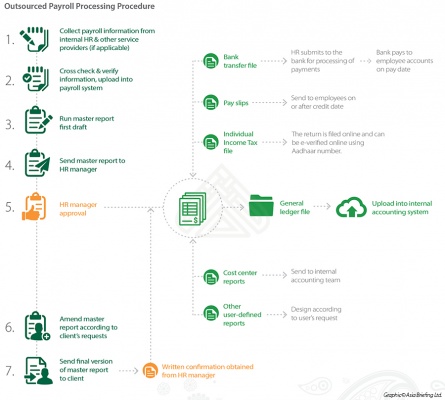

infographic

Outsourced Payroll Processing Procedure

- May 2017

- Members Access

This infographic shows the 7 steps in outsourcing payroll processing.

magazine

Payroll Processing and Compliance in India

- May 2017

- Members Access

In this issue of India Briefing Magazine, we discuss payroll processing and reporting in India, and the various regulations and tax norms that impact salary and wage computation. Further, we explain India’s complex social security system and gratui...

infographic

Taxable Allowances

- May 2017

- Members Access

This infographic shows fully and partly taxable allowances.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us