Our collection of resources based on what we have learned on the ground

Resources

infographic

Exports from SEZ's

- February 2017

- Members Access

This infographic shows the exports from SEZ's from 2005-2015.

Q&A

What is "Make in India?"

- December 2016

- Free Access

Launched on September 25, 2014, “Make in India” is the major economic plan of Prime Minister Narendra Modi’s government. With the “Make in India” program, Modi hopes to make India one of the predominant manufacturi...

Q&A

What is India's "Smart Cities Mission?"

- December 2016

- Free Access

The Indian government expects that by 2030, 40% of its population will live in urban areas, and will contribute 75% of the nation’s GDP. The “Smart Cities Mission,” is a plan created by the government in an effort to drive Ind...

Q&A

What is the Digital India policy initiative?

- December 2016

- Free Access

The Digital India policy initiative was launched in 2015 in an effort to transform India into a digitally empowered society. Under the Digital India plan, the government looks to make headway in areas such as establishing broadband highways, universa...

Q&A

What is the significance of India’s Coal Mines Bill, promulgated in 2015?

- December 2016

- Free Access

The Coal Mines (Special Provisions) Bill, promulgated in May of 2015 allows for the e-auction of coal blocks. Whoever wins the bid at these e-auctions, is given the title, rights, and interest over the land, and mining infrastructure that is in place...

Q&A

What is the significance of India’s Aadhaar Act of 2016?

- December 2016

- Free Access

Aadhaar is a unique 12-digit registration number issued by the Indian government to every individual resident of India. Under the Aadhaar Act, passed in 2016, all essential government services and benefits will be linked to the Aadhaar number. Any In...

infographic

Comparing India's Automatic Route and Government Route for FDI

- December 2016

- Free Access

This table lists a few of the sectors under the automatic and government approval routes as of June 2016.

magazine

Taking Advantage of India's Improving Business Environment

- December 2016

- Members Access

In this issue of India Briefing Magazine, we look at the important regulatory reforms, policy initiatives, and increased incentives for investing in the Indian market that have emerged since Prime Minister Narendra Modi took office in 2014. Foreign c...

presentation

Brexit - Dawn of a New Era

- December 2016

- Members Access

In this presentation, Rohit Kapur, Country Manager for Dezan Shira & Associates in India discusses Britain's future relationship with the EU, and the potential impact that it could have on the Indian economy.

presentation

Doing Business in India

- November 2016

- Free Access

This presentation offered by Dezan Shira & Associates India Manager Rohit Kapur, overviews the challenges and benefits for MNCs looking to do business in India.

videographic

Strategies for Repatriating Funds from India

- October 2016

- Members Access

This Prezi offers viewers an introduction to Indian regulations concerning profit repatriation, as well as strategies for repatriation based on the legal nature of your office in India.

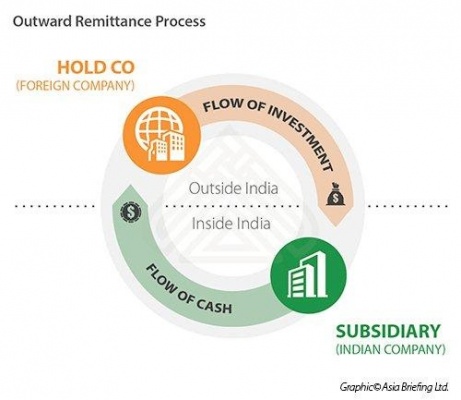

infographic

Remitting Profits from an Indian Subsidiary

- September 2016

- Free Access

This infographic shows the relationship between a foreign holding company and an Indian subsidiary through the continuous flow of cash and investment.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us