Our collection of resources based on what we have learned on the ground

Resources

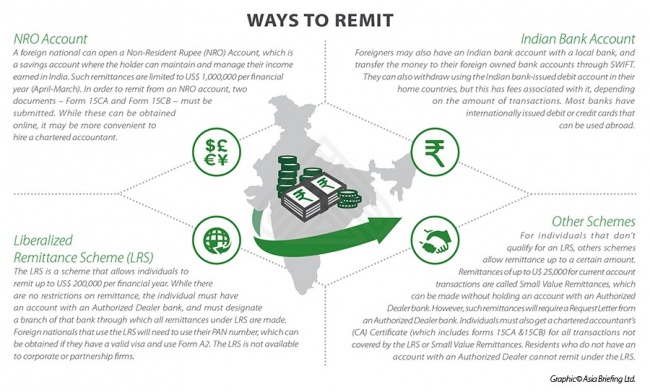

infographic

Methods for Remitting Profits from India

- September 2016

- Members Access

This infographic offers valuable insights for expats looking to remit profits from India.

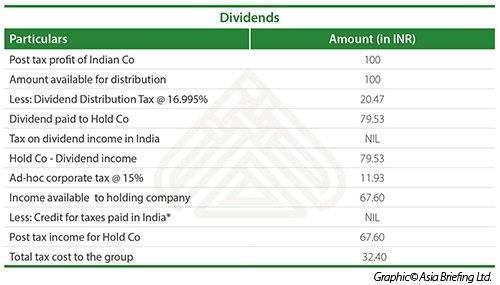

infographic

The Cost of Using Dividends to Repatriate Profits from India

- September 2016

- Members Access

This infographic shows the taxes applied to dividends being remitted from an Indian subsidiary to its foreign holding company. Under the Dividends Distribution Tax, dividends distributed by an Indian entity are subject to a 15% tax.

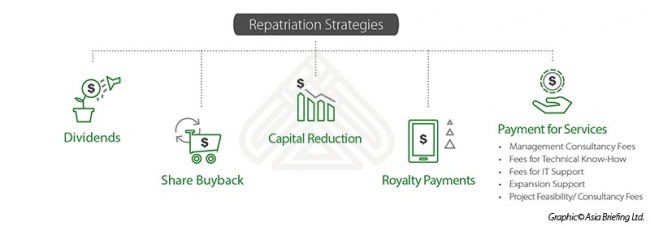

infographic

Repatriation Strategies for Expats in India

- September 2016

- Free Access

This infographic offers strategies for repatriating profits from India, such as royalty programs and capital reduction.

Q&A

What is the significance of India's 2013 Companies Act?

- September 2016

- Free Access

The Companies Act, 2013, updates the information that must be included in the statement of repatriation of profits from a foreign company. Additionally, the Act affects the statement of transfer of funds and the information that it should inclu...

Q&A

What is the significance of India’s Foreign Exchange Management Act (FEMA)?

- September 2016

- Free Access

India’s Foreign Exchange Management Act (FEMA) was put into place in 1999 in an effort to promote the foreign exchange market in India. Through FEMA, the Indian government and the Reserve Bank of India (RBI) work to adjust India’s t...

Q&A

What is the significance of India's 1961 Income Tax Act (ITA)?

- September 2016

- Free Access

The Income Tax Act (ITA) states that all companies residing in India are subject to tax, whether their income is earned within the nation of India or abroad. The government determines the residential status by the location from which a majority...

Q&A

What are a company’s options for repatriating funds from a Wholly Owned Subsid...

- September 2016

- Members Access

Foreign companies with long-term goals in the Indian business environment often choose to establish a Wholly Owned Subsidiary (WOS), as it offers a company more flexibility, longevity and a stronger legal foundation. All funds repatriated throu...

Q&A

What is a Limited Liability Partnership (LLP), and what are their options for re...

- September 2016

- Free Access

Limited Liability Partnerships (LLPs) were first introduced in India in 2008. LLPs are given legal entity status and limited liability of stakeholders. They receive the advantages of a company, as well as the operational flexibilities of ...

magazine

Strategies for Repatriating Funds from India

- September 2016

- Members Access

In this issue of India Briefing Magazine, we look at issues related to repatriating funds from India. We highlight the unique regulations for sending funds back from India, examine the various strategies companies can make use of while repatriating, ...

magazine

Freihandelsabkommen in Asien wirksam nutzen

- September 2016

- Members Access

In unserem aktuellen Magazin „Freihandelsabkommen in Asien wirksam nutzen“ beschäftigen wir uns mit Freihandelsabkommen in Asien. Debatten über den Abbau von Zöllen und anderen Handelsbarrieren zur Erleichterung des Handels werden oft auf mult...

report

E-Commerce in Asia

- July 2016

- Members Access

As the digital revolution transforms shopping habits worldwide, emerging markets in Asia stand out as enormous opportunities for foreign investment. Rising internet penetration, a growing consumer base, and rapidly developing logistics infrastructure...

videographic

Establishing a Company in Singapore

- June 2016

- Free Access

This Prezi explains how to engage and register on behalf of companies

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us