Our collection of resources based on what we have learned on the ground

Resources

Q&A

What is the allowance for medical treatment abroad for employees of Indian compa...

- January 2014

- Members Access

For medical treatment abroad, the actual expenditure incurred includes the travel and stay abroad of the patient and one attendant (if permitted by the Reserve Bank of India). The ceiling for the gross total income excluding the amount to be reimburs...

Q&A

What is the allowance for meal coupons in India?

- January 2014

- Free Access

Lunch and refreshments that the employer provides to the employee at free or concessional rates is not taxable.

Q&A

What is the allowance for leave travel in India?

- January 2014

- Free Access

Leave travel is remunerated for meeting travelling expenses incurred by an individual and family members (this includes only the spouse, two children and dependent parents, brothers and sisters) while on holiday in India. The amount excluded depen...

Q&A

What is the allowance for education in India?

- January 2014

- Members Access

Education payment of INR50 (US$0.97) per month per child (INR150, US$2.92, in special cases) for up to two children of the employee is exempt from tax.

Q&A

What are the allowances available in India, other than the main ones, such as tr...

- January 2014

- Free Access

Apart from the major ones, the following allowances are exempt from tax: Uniforms (not merely clothing) Books and Periodicals (unlimited) Work-related transportation expenses; Cost of travel on tour or on transfer; ...

Q&A

What is gratuity and its basic requirements in India?

- January 2014

- Free Access

Gratuity is a lump sum that a company pays when an employee leaves an organization; one of the many retirement benefits offered by a company to an employee. Basic requirements for gratuity are set out under the Payment of Gratuity Act, 1971. An emplo...

Q&A

Who is gratuity applicable for in India?

- January 2014

- Free Access

The Payment of Gratuity Act, 1971, applies to employees engaged in factories, mines, oilfields, plantations, ports, railway companies, shops or other establishments for at least five full years with ten or more employees. Years of service does not ma...

Q&A

How is Gratuity received under The Payment of Gratuity Act different from any ot...

- January 2014

- Members Access

Gratuity received under the Act is exempt from taxation to the extent that it does not exceed 15 days’ salary for every completed year of service calculated on the last drawn salary subject to a maximum of INR350,000. Any other gratuity is exem...

Q&A

Under which circumstances is gratuity wholly forfeited in India?

- January 2014

- Free Access

The gratuity payable to an employee shall be wholly forfeited if: The service of such employee has been terminated for his lawless or disorderly conduct or any other act of violence on his part; or The service of such employee is ter...

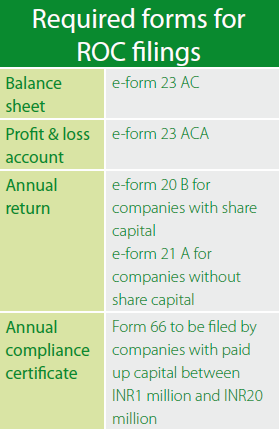

infographic

Required Forms for Registrar of Companies Filings in India

- January 2014

- Members Access

Four forms are required to be filled when registering companies in India.

magazine

Gestione dei Libri Paga in Asia

- January 2014

- Members Access

La riscossione delle entrate fiscali e la gestione della previdenza sociale sono due delle funzioni fondamentali esercitate da un governo. Nel processo di costituzione e nel corso della gestione di un business in Asia, le aziende devono prestare part...

magazine

Payroll Processing Across Asia

- January 2014

- Members Access

In Asia Briefing Magazineâs first issue of 2014, we provide a country-by-country introduction to how payroll and social insurance systems work in China, Hong Kong, Vietnam, India and Singapore. We also compare three distinct models companies use...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us