Our collection of resources based on what we have learned on the ground

Resources

magazine

Choosing an Effective Entry Model for Vietnam Investments

- July 2017

- Members Access

In this issue of Vietnam Briefing we detail the structure of Vietnam’s investment landscape and outline of the most prudent market entry models for foreign enterprises seeking to take advantage of ongoing reforms. We highlight opportunities for 100...

infographic

Tax Incentives for Government-Encouraged Sectors in Vietnam

- July 2017

- Members Access

This table shows the preferential tax rates and exemptions for enterprises investing in Vietnam's government-encouraged sector-category A.

infographic

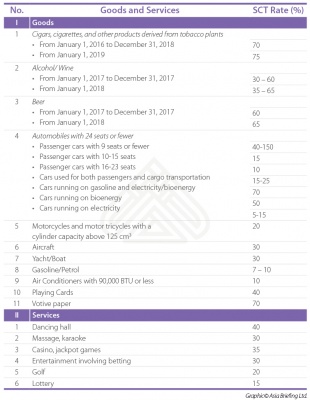

Special Consumption Tax (SCT) Tax Rates for Goods and Services in Vietnam

- July 2017

- Members Access

This table shows the Special Consumption Tax (SCT) rates for specific goods and services in Vietnam.

infographic

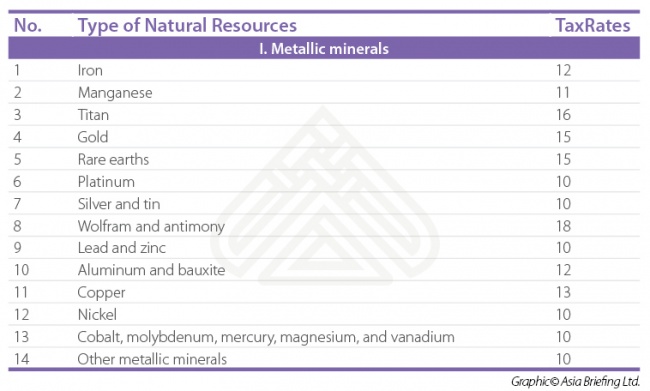

The Natural Resources Tax (NRT) Rates in Vietnam

- July 2017

- Members Access

This table shows the Natural Resources Tax (NRT) rates for different types of natural resources in Vietnam.

infographic

Environment Protection Tax Rates in Vietnam

- July 2017

- Members Access

This table shows the Environment Protection Tax (EPT) rate variation for specific goods in Vietnam.

infographic

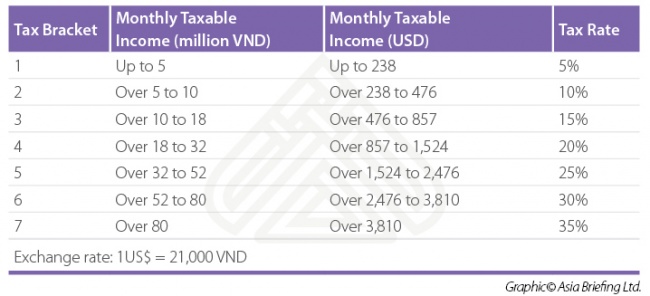

Personal Income Tax (PIT) Rates for Resident Taxpayers in Vietnam

- July 2017

- Members Access

This table shows Personal Income Tax (PIT) rate variation according to resident taxpayer income in Vietnam.

presentation

Role of SMEs in the Transportation Infrastructure Development

- June 2017

- Free Access

In this presentation DSA's Senior Associate Oscar Mussons discusses the role of SMEs in the development of the transportation infrastructure, with a particular focus on Vietnam's.

magazine

Gestire la contabilità in Vietnam

- June 2017

- Members Access

In questo numero di Vietnam Briefing delineiamo la struttura di base delle norme contabili in vigore, approfondiamo il tema dei principi contabili vietnamiti esistenti evidenziando le differenze esistenti con i principi contabili internazionali. Infi...

Q&A

What is the role of minimum wages in Vietnam's payroll compliance?

- May 2017

- Members Access

Vietnam’s minimum wage rates play a significant role in payroll compliance: they provide a basis for the calculation of individual income tax and assist in the determination of social insurance payments. Currently, there are two kinds of minimu...

Q&A

What are the types of mandatory social security in Vietnam?

- May 2017

- Members Access

There are three types of mandatory social security in Vietnam that must be covered by foreign enterprises seeking to hire local staff: social insurance; health insurance; and unemployment insurance. Minimum contributions are required by both the empl...

Q&A

How does Vietnam’s social security system differ for domestic and internationa...

- May 2017

- Members Access

Social and unemployment insurances are mandatory only for Vietnamese employees, whereas health insurance applies to both Vietnamese and foreign workers employed in accordance with Vietnam’s Labor Code. Employers register and pay insurance contr...

Q&A

Which deductions can be made from an employee's salary according to the Vietname...

- May 2017

- Members Access

Currently, the following deductions are permitted under the Vietnamese tax code: Personal allowances of VND 9 million (US$395); Dependent allowances of VND 3.6 million (US$158) per dependent; All mandatory contributions to Vietnam’s social...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us