Our collection of resources based on what we have learned on the ground

Resources

Q&A

What is a potential downside of investing in Indonesian Special Economic Zones (...

- October 2016

- Free Access

Indonesia’s Special Economic Zones (SEZs) offer investors preferential regulatory infrastructure and tax policies. Indonesia currently has nine SEZs in place, and President Joko Widodo’s government plans for a total of twenty-five b...

Q&A

In 2016, what percentage of Indonesia’s GDP came from the nation’s manufactu...

- October 2016

- Members Access

In 2016, Indonesia’s manufacturing sector was valued at USD112.8 billion, and made up 23.7% of the nation’s total GDP. Indonesia’s manufacturing sector has seen a slowdown due to a decrease in Chinese demand for commodities.&n...

Q&A

What are the benefits of establishing a Limited Liability Company with Foreign D...

- October 2016

- Members Access

Companies looking to establish themselves in an Indonesian market have four options available to them. They can establish a Representative Office (KPPA), or a Representative Office for Trading (K3PA), which allow for foreign ownership, but do n...

Q&A

As of 2016, what Corporate Income Tax incentives did Jokowi’s government offer...

- October 2016

- Members Access

For investors willing to invest IDR 1 trillion (about 76.75 million USD) into an Indonesian SEZ, Jokowi’s government offers 20-100% tax reductions for up to 25 years. 20-100% tax reductions are also available for those looking to invest I...

Q&A

How will Indonesia’s demographics affect its potential for economic growth in ...

- October 2016

- Free Access

Indonesia is home to more than 255 million people, making it the fourth most populous nation on earth. Of these 255 million, half are under the age of 30. This generation of Indonesians is the largest that the nation has ever seen, and is...

magazine

The Guide to Manufacturing in Indonesia

- October 2016

- Members Access

Choosing if, where, and how to establish foreign manufacturing operations in Indonesia can be a significant challenge. While the archipelago’s vast diversity may initially seem daunting, a number of options are available which will allow entry and ...

magazine

Rimpatriare gli utili dal Vietnam

- October 2016

- Members Access

In questo numero di Vietnam Briefing, presentiamo i regolamenti esistenti in materia di trasferimenti degli utili e forniamo una guida su come rispettare le relative norme. Inoltre, introduciamo gli organi governativi competenti e forniamo consigli e...

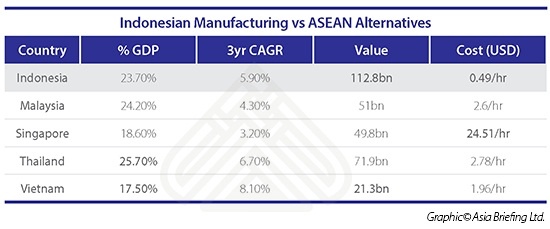

infographic

Indonesian Manufacturing vs ASEAN Alternatives

- October 2016

- Free Access

This infographic provides information on the state of the manufacturing sectors of Indonesia, Malaysia, Singapore, Thailand, and Vietnam.

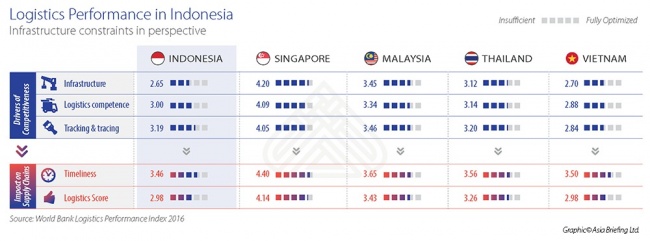

infographic

Comparing Logistics Performance in Indonesia with ASEAN Alternatives

- October 2016

- Free Access

This infographic compares Indonesia's manufacturing infrastructure with the infrastructure of ASEAN alternatives.

magazine

Freihandelsabkommen in Asien wirksam nutzen

- September 2016

- Members Access

In unserem aktuellen Magazin „Freihandelsabkommen in Asien wirksam nutzen“ beschäftigen wir uns mit Freihandelsabkommen in Asien. Debatten über den Abbau von Zöllen und anderen Handelsbarrieren zur Erleichterung des Handels werden oft auf mult...

presentation

Exploring Compensation and Labour Dispute Mediation in Vietnam

- September 2016

- Members Access

This presentation by Oscar Mussons, Associate on Dezan Shira & Associates' International Business Advisory team, gives an introduction to Human Resources in Vietnam, including overtime, a regulatory update and labor disputes and mediation.

presentation

Opportunities and Challenges of the EVFTA

- August 2016

- Members Access

This presentation is brought to you by our in-house specialist Oscar Mussons on opportunities and challenges of the EU-Vietnam Free Trade Agreement for Foreign Direct Investment companies in Vietnam.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us