Our collection of resources based on what we have learned on the ground

Resources

podcast

Vietnam y sus acuerdos de libre comercio, ¿ocasión para invertir en el país?

- August 2016

- Free Access

Oscar A. Mussons, asociado de Dezan Shira & Associates en Vietnam, explica la relevancia de los acuerdos de libre comercio negociados y firmados recientemente por Vietnam, así como su significado para la inversión extranjera directa.

magazine

Comparador de los tipos impositivos en ASEAN para los años 2016/2017

- August 2016

- Members Access

En esta edición de ASEAN Briefing, examinamos la fiscalidad regional de ASEAN a través de la comparación de impuestos de sociedades, impuestos indirectos y retención de impuestos. Además les presentamos el resumen de los diferentes marcos de cum...

podcast

The Case for Manufacturing in Vietnam

- August 2016

- Free Access

Presented by ASEAN Business Intelligence Associate Dustin Daugherty, this podcast discusses opportunities for FDI in Vietnam’s manufacturing sector and the steps needed to be taken by foreign investors to establish a manufacturing company in the co...

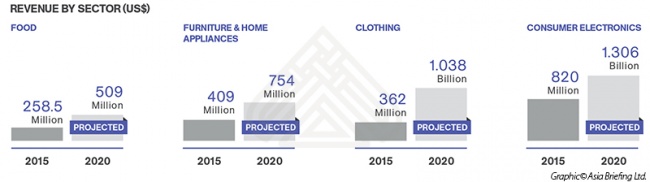

infographic

Revenue by Sector in Vietnam

- July 2016

- Members Access

This infographic lists the revenues earned by four main sectors in Vietnam during 2015 and their projected sales in 2020.

report

E-Commerce in Asia

- July 2016

- Members Access

As the digital revolution transforms shopping habits worldwide, emerging markets in Asia stand out as enormous opportunities for foreign investment. Rising internet penetration, a growing consumer base, and rapidly developing logistics infrastructure...

webinar

Investment Opportunities in Vietnam's Healthcare Industry

- July 2016

- Free Access

Dusitn Daugherty, ASEAN Business Intelligence Associate, discusses investment opportunities within Vietnam’s pharmaceutical, medical device, and hospital markets.

podcast

How to Remit Profits from Vietnam

- June 2016

- Free Access

Learn how to remit profits from Vietnam as Richard Cant, the Director of Dezan Shira & Associates North America, covers the necessary steps in this podcast.

magazine

Bekannte Routen, neue Ziele - Chinas Initiative ,Neue Seidenstraße'

- June 2016

- Members Access

Zum zweiten Quartal 2016 veröffentlichen wir das Magazin „Bekannte Routen, neue Ziele – Chinas Initiative ‚Neue Seidenstraße´“, in der wir über die institutionelle Ausrichtung der Volksrepublik China auf der OBOR berichten. Hierbei gehen ...

magazine

Revisione contabile e compliance in Vietnam

- June 2016

- Members Access

In questo numero di Vietnam Briefing, mostriamo le più recenti modifiche alle procedure di revisione e forniamo indicazioni su come garantire che le attività di compliance siano completate in modo efficiente ed efficace. Ci soffermeremo in particol...

magazine

The 2016/17 ASEAN Tax Comparator

- June 2016

- Members Access

In this issue of ASEAN Briefing, we examine regional taxation in ASEAN through a comparison of corporate, indirect, and withholdings taxation. We further present an overview of the compliance environments found across the region and analyze ASEAN’s...

webinar

Come aprire una società commerciale in Vietnam

- June 2016

- Free Access

Erasmo Indolino, International Business Advisory presso l'ufficio di Hanoi di Dezan Shira & Assocates, fornisce informazioni sulla costituzione di una società commerciale in Vietnam.

Q&A

Which governmental bodies and general restrictions should be noted with regard t...

- May 2016

- Members Access

The Ministry of Finance (MOF) and State Bank of Vietnam (SBV) are two main governmental bodies investors have to take note of. MOF has the power to adjust tax rates and regulate remittances, whereas SBV is in charge of regulating banking and fo...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us