Our collection of resources based on what we have learned on the ground

Resources

Q&A

How can companies limit their exposure to value-added tax (VAT) in Vietnam?

- June 2014

- Members Access

To limit VAT exposure, a VAT taxpayer using the tax credit method should be aware of the guidelines that will help them determine input VAT credit. These guidelines are as follows: The input VAT on goods or services used for the production of and ...

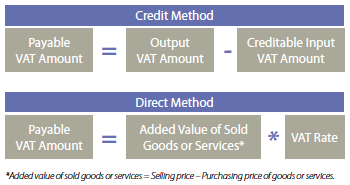

infographic

Two Methods for Calculating VAT in Vietnam

- June 2014

- Free Access

This infographic details the two methods for calculating value-added tax in Vietnam

Q&A

Who can be subjected to value-added tax (VAT) in Vietnam?

- June 2014

- Free Access

Taxable persons in Vietnam are: Organizations and individuals producing or trading in VAT-liable goods and services in Vietnam, regardless of their business lines, forms and/or organizations; and Organizations and individuals importi...

Q&A

What are the value-added tax (VAT) rates for enterprises in Vietnam?

- June 2014

- Members Access

Vietnam has three VAT rates: zero percent, five percent and 10 percent. 10 percent is the standard rate applied to most goods and services, unless otherwise stipulated. Zero percent tax rate The zero percent tax rate applies to exported goods and se...

magazine

E-Commerce Across Asia: Trends and Developments 2014

- May 2014

- Members Access

In this issue of Asia Briefing Magazine, we provide a comprehensive overview of e-commerce trends across the Asia-Pacific region with a focus on developing markets in Southeast Asia. In addition to analyzing macro-level economic and development indic...

magazine

Developing Your Sourcing Strategy for Vietnam

- May 2014

- Members Access

In this issue of Vietnam Briefing Magazine, we attempt to clarify the decision making process involved with moving your sourcing business to Vietnam. We first take you through the important factors to consider when choosing your sourcing partner bef...

magazine

A Guide to Understanding Vietnam's VAT

- February 2014

- Members Access

In this issue of Vietnam Briefing, we attempt to clarify the entire VAT process by taking you through an introduction as to what VAT is, who and what is liable, and how to pay it properly. We first take you through the basics of VAT in Vietnam before...

Q&A

Which law will prevail if domestic tax law is in conflict with the double tax ag...

- February 2014

- Free Access

If there's a conflict between the domestic tax laws and the tax provisions in a double tax agreement, those in the double tax agreement will prevail. However, domestic tax laws will prevail when the relevant tax obligations included in the double tax...

podcast

Asia Briefing Magazine, January 2014 Issue: "Payroll Processing Across Asia

- January 2014

- Free Access

Sisi Xu, Senior Manager in Dezan Shira and Associates Shenzhen office, introduce payroll from a financial and legal perspective.

Q&A

How should debts be resolved when a Vietnamese business is to close down?

- January 2014

- Free Access

A company will be allowed to dissolve after it ensures to discharge any and all debts and property obligations in certain order. The company must also set up a meeting to liquidate its assets, and the subsequent meeting minutes should include the fo...

infographic

Total Dividend Tax in Direct Investment vs Singapore Holding Co.

- January 2014

- Members Access

Total Dividend Tax in Direct Investment vs Singapore Holding Co. in China.

infographic

Corporate Taxes in Vietnam

- January 2014

- Members Access

Introduction to Corporate Taxes in Vietnam, including corporate income tax, value-added tax and standard tax on dividends.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us