Our collection of resources based on what we have learned on the ground

Resources

Q&A

What is the corporate income tax rate in Vietnam?

- December 2012

- Members Access

The corporate income tax rate is currently 25 percent. However, starting from January 2014, it will be reduced to 22 percent. But for companies engaging in prospecting, exploring, and mining of petroleum and gas and other rare and precious natural re...

Q&A

How is value-added tax defined in Vietnam?

- December 2012

- Free Access

It is applicable on most goods and services rendered during the process of production, circulation and consumption in Vietnam. There are indeed 3 tax rates – 0 percent, 5 percent and 10 percent: • 0 percent – applicable to exp...

magazine

The Asia Tax Comparator

- November 2012

- Members Access

In an increasingly inter-connected Asia, many foreign investors are looking beyond China, using the lens of their China experiences to understand the investment environment in countries like India and Vietnam.

magazine

Human Resources for Foreigners in Vietnam

- August 2012

- Members Access

A Vietnamese entity is permitted to recruit foreign workers in order to work as managers, executive directors and experts where local hires are not yet able to meet production and business requirements.

guide

Doing Business in Vietnam

- May 2012

- US $8.99

Earlier in its development process than many countries, Vietnam is learning from other countriesâ reform experiences and utilizing its late mover advantage in technology introduction. As labor costs rise elsewhere, many investors look to Vietnam...

magazine

Vietnam's Provinces, Regions and Key Economic Zones

- May 2012

- Members Access

While not a large country in terms of area, Vietnamâs longitudinal breadth and variations in terrain allow the country to utilize its topographical advantages to simultaneously support a wide range of industries.

magazine

100% FOEs, JVs and the Promotion of Supporting Industries

- January 2012

- Members Access

For investors looking to make forays into Vietnam, choosing between a wholly foreign-owned enterprise (100% FOE) and a joint venture (JV) can have significant implications, as both have their pros and cons and the permissible establishment details (s...

magazine

Vietnam’s International Taxation Agreements

- October 2011

- Members Access

As Vietnam increasingly finds itself on the receiving end of foreign investment and becomes progressively integrated into the global economy, the pace of changes to trade and tax policies can be difficult to keep up with.

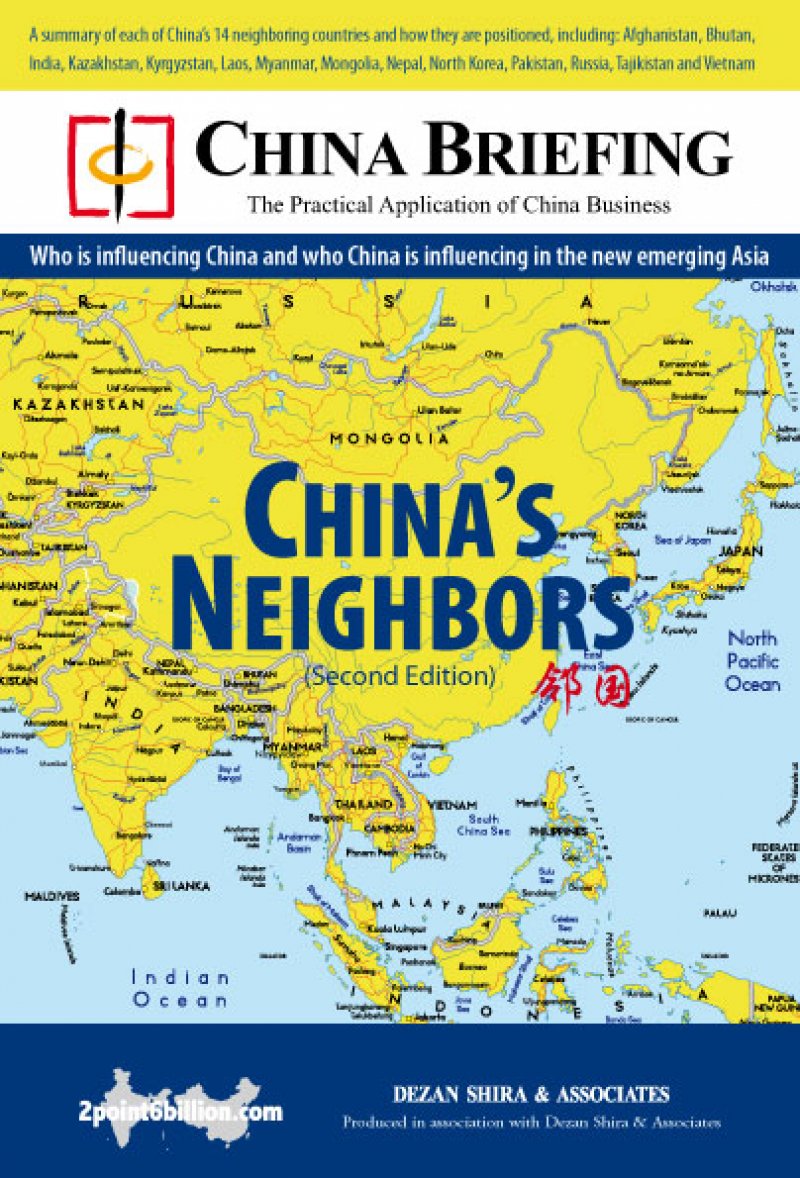

guide

China’s Neighbors (Second Edition)

- September 2011

- US $8.99

A look at Chinaâs relationship with its 14 neighbor countries: Afghanistan, Bhutan, India, Kazakhstan, Kyrgyzstan, Laos, Myanmar, Mongolia, Nepal, North Korea, Pakistan, Russia, Tajikistan and Vietnam.

magazine

Vietnam and China: A Comparative Look for Foreign Investors

- June 2011

- Members Access

Finally, courtesy of the tax and accounting specialists at Dezan Shira & Associates, a comparison of FDI-contributing countries and foreign investment structures and taxes.

magazine

Tax and Foreign Exchange Control

- March 2011

- Members Access

In this issue of Vietnam Briefing, we discuss the issues of tax and foreign exchange control. Tax finalization is compulsory for foreign invested enterprises in Vietnam,

magazine

Vergleich: Statistiken zu Handel, Lohnkosten und Steuern in Asien

- December 2010

- Members Access

In dieser Ausgabe von China Briefing wird der zweite jährliche Vergleich der Handelsbedingungen in Asien gemacht. Im ersten Asienvergleich aus dem November des letzten Jahres haben wir bereits Lohnkosten und Lebenshaltungskosten in verschiedenen L...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us