Our collection of resources based on what we have learned on the ground

Resources

magazine

The 2016/17 ASEAN Tax Comparator

- June 2016

- Members Access

In this issue of ASEAN Briefing, we examine regional taxation in ASEAN through a comparison of corporate, indirect, and withholdings taxation. We further present an overview of the compliance environments found across the region and analyze ASEAN’s...

podcast

Managing ASEAN Expansion from Singapore

- May 2016

- Free Access

Richard Cant, the Director of Dezan Shira & Associates North America, takes a look at the benefits of using Singapore a hub for management of regional operations throughout ASEAN.

magazine

Managing ASEAN Expansion from Singapore

- March 2016

- Members Access

For the second issue of our ASEAN Briefing Magazine, we look at the benefits of using Singapore a hub for the management of regional operations throughout ASEAN. We firstly focus on the position of Singapore relative to its competitors, such as the N...

magazine

La Cintura Economica della Via della Seta

- February 2016

- Members Access

In questo numero di Asia Briefing presentiamo le principali caratteristiche della Cintura Economica della Via della Seta, evidenziando nel dettaglio il percorso via terra in Asia Centrale e quello via mare nel Sud-Est Asiatico. Nei prossimi decenni, ...

Q&A

What is the audit process for small medium enterprises in Singapore?

- February 2016

- Free Access

According to World Bank’s Ease of Doing Business Index, annual audit and compliance in Singapore is less burdensome for investors than in many other ASEAN countries especially for small medium enterprises (SMEs). Once SMEs qualify as Exempt Pri...

infographic

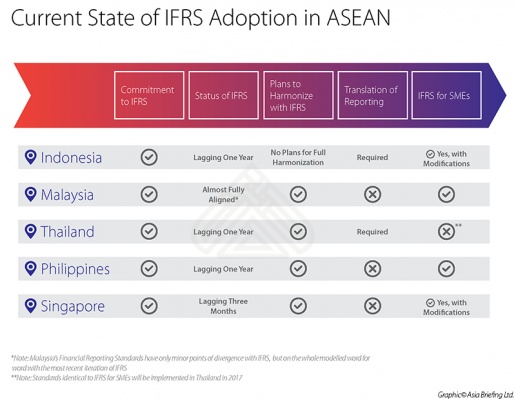

Current State of IFRS Adoption in ASEAN

- February 2016

- Free Access

This infographic is about the current state of IFRS adoption in ASEAN, including Indonesia, Malaysia, Thailand, Philippines, and Singapore.

magazine

Annual Audit and Compliance in ASEAN

- January 2016

- Members Access

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Mala...

infographic

Trans-Asia Railway Network

- September 2015

- Free Access

This infographic shows the Trans-Asia Railway project - how China will be connected with South-East Asia in terms of railway network.

report

Payroll in Asia 2015

- June 2015

- Members Access

Payroll covers all aspects of paying a companyâs employees. This includes making sure that salaries are paid in the correct amount and on time, that income tax is withheld, and that social security contributions are made. With a region as fast-p...

DTA

Agreement Between The Government Of The Republic Of Singapore And The Government...

- June 2015

- Free Access

Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income between Singapore and Latvia.

DTA

Agreement Between The Republic Of Singapore And The Principality Of Liechtenstei...

- June 2015

- Free Access

Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income between Singapore and Liechtenstein.

DTA

Agreement Between The Government Of The Republic Of Singapore And The Government...

- June 2015

- Free Access

Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income between Singapore and Luxembourg.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us