Our collection of resources based on what we have learned on the ground

Resources

Q&A

What is Vietnam?s E-commerce Administration Portal and how does it aid businesse...

- February 2015

- Free Access

Companies and investors that wish to establish an e-commerce website in Vietnam must first notify the Ministry of Industry and Trade of their intent, and apply to be registered with the government. Vietnam has created the E-commerce Administration Po...

Q&A

Why is Singapore such an important source of Foreign Direct Investment (FDI) int...

- February 2015

- Free Access

Singapore accounted for almost 25% of India’s total Foreign Direct Investment (FDI) in 2013-14. This large share is explained by a provision of Singapore Double Tax Agreement (DTA) with India – the Limitation of Benefit (LoB). The LoB pro...

Q&A

What effect has the ASEAN- China Free Trade area had on China and ASEAN as a who...

- February 2015

- Free Access

The ASEAN–China Free Trade Area is the world’s largest free trade area in terms of population and third largest in terms of nominal GDP after the European Union and NAFTA. The original FTA reduced tariffs on nearly 8,000 product categorie...

Q&A

How is corporate income tax (CIT) calculated in Asia?

- January 2015

- Free Access

Corporate Income Tax (CIT) is levied on the profits of a company. The rate varies considerably for different countries - it can be anywhere between 17 and 40% and is determined by various different factors including the priorities of the government, ...

Q&A

How does indirect tax differ from corporate income and individual income tax in ...

- January 2015

- Free Access

Indirect tax adds to the price of a product which makes the consumer indirectly pay the rate of taxation. For corporate and individual income tax, a business or individual has to pay the necessary amount directly to the government. Also, the indirec...

Q&A

What is withholding tax and how is it paid in Asia?

- January 2015

- Free Access

Withholding tax is kept back from an employee's salary and is subsequently paid to the government to combat tax evasion. It is divided into royalties, dividends and interest in Asia, however the amount varies depending on the country.

Q&A

How is individual income tax (IIT) calculated in Asia?

- January 2015

- Free Access

In Asian countries individuals are taxed according their salary. Therefore those with a higher salary will have to pay higher taxes. However, rates vary in different Asian countries and could be anywhere between 17 and 45%. Exceptions of this are Br...

Q&A

What are the current sales and service tax rates in Malaysia?

- January 2015

- Free Access

In Malaysia, service tax is currently at 6% and is calculated based on the value of taxable services provided by the individual. However, on 1st April 2015 a 6% goods and services tax (GST) will replace the current sales and service tax.

Q&A

How do China's tax treaties affect withholding tax payments for dividends, inter...

- January 2015

- Free Access

If the tax rate written in the relevant treaty is higher than 10%, the tax will be fixed at 10%. If the rate specified in the treaty is lower than 10%, the amount of tax payable will be the amount specified.

infographic

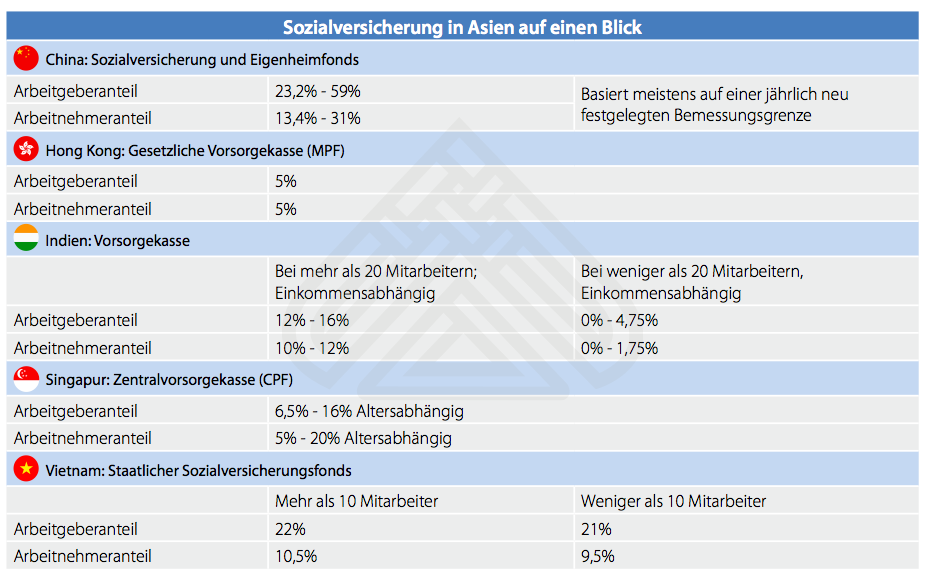

Sozialversicherung in Asien auf einen Blick

- December 2014

- Free Access

Die Sozialsteuersysteme von China, Indien, Hong Kong, Singapur und Vietnam unterscheiden sich in einigen Punkten, wie z.B. die Höhe der Beiträge. Folgende Tabelle gibt einen Überblick über die Sozialsteuersysteme dieser Länder.

Q&A

Welche Kriterien entscheiden die pers�nlichen Einkommenssteuers�tze in China, Ho...

- November 2014

- Free Access

• China: das Einkommen in China wird nach sieben progressiven Tarifen besteuert, der zu zahlende Steuersatz kann von 3 % bis zu 45 % variieren • Hongkong: es gibt zwei Methoden in Hong Kong, das Einkommen zu besteuern. Entw...

infographic

Regelsteuers�tze Singapur

- November 2014

- Free Access

Welche Regelsteuersätze es in Singapur gibt und weitere Informationen zu Währung, Ansässigkeit, Compliance, Investitionsanreize sowie indirekte Steuern und Einkommenssteuer, wird in dieser Grafik beschrieben.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us