Our collection of resources based on what we have learned on the ground

Resources

podcast

Introduction to Doing Business in Singapore presented by Dezan Shira Alumni Nath...

- August 2012

- Free Access

Dezan Shira & Associates' Business Manager for the Singapore office, Nathanael Susanto discusses questions relevant to foreign investors setting up businesses in Singapore.

DTA

Double Taxation Avoidance Agreement between Switzerland and Singapore

- August 2012

- Free Access

Double Taxation Avoidance Agreement between Switzerland and Singapore

infographic

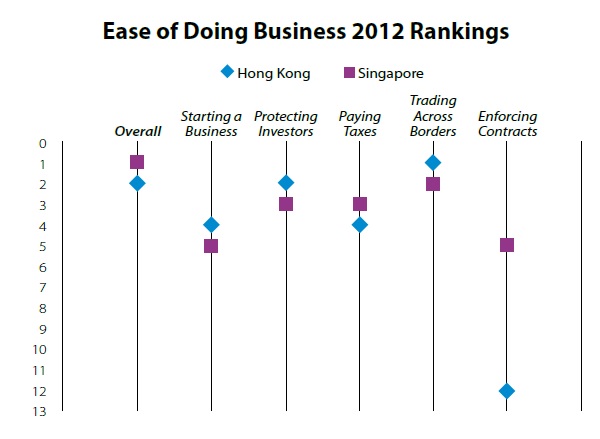

Ease of Doing Business in Hong Kong and Singapore

- May 2012

- Free Access

The graph compares the ease of doing business in Hong Kong and Singapore.

infographic

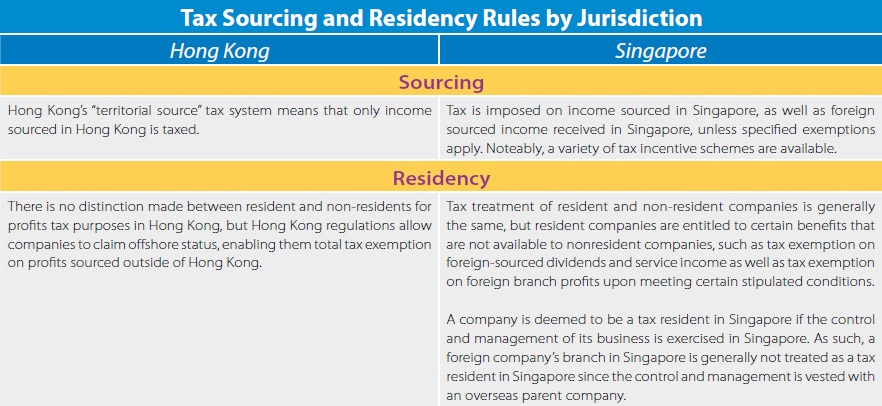

Tax Sourcing and Residency Rules in Hong Kong and Singapore

- May 2012

- Free Access

The table shows the differences of tax sourcing and residency rules by jurisdiction between Hong Kong and Singapore.

magazine

Compañías holding en Hong Kong y Singapur

- May 2012

- Members Access

En esta edición del China Briefing, veremos más de cerca los beneficios de las compañÃas holding tanto de Hong Kong como de Singapur, la forma de establecer y mantener una compañÃa en cada una de estas jurisdicciones, y los acuerdos...

magazine

Holdinggesellschaften in Hongkong und Singapur

- May 2012

- Members Access

Hongkong und Singapur bieten beide sehr ähnliche steuerliche Anreize für ausländische Unternehmen, dennoch gibt es Unterschiede zwischen den beiden im Hinblick auf Steuersätze, strategische Nuancen die Anwendung der verschiedenen Doppelb...

magazine

Hong Kong and Singapore Holding Companies

- May 2012

- Members Access

Hong Kong and Singapore both offer very similar tax incentives for foreign companies, but there are differences between the two and tax rates differ, as do the strategic nuances and their use of various double tax treaties.

DTA

Double Taxation Avoidance Agreement between Singapore and Spain

- February 2012

- Free Access

Double Taxation Avoidance Agreement between Singapore and Spain

DTA

Double Taxation Avoidance Agreement between Panama and Singapore

- December 2011

- Free Access

Double Taxation Avoidance Agreement between Panama and Singapore

DTA

Double Taxation Avoidance Agreement between Albania and Singapore

- July 2011

- Free Access

Double Taxation Avoidance Agreement between Albania and Singapore

DTA

Double Taxation Avoidance Agreement between Saudi Arabia and Singapore

- July 2011

- Free Access

Double Taxation Avoidance Agreement between Saudi Arabia and Singapore

DTA

Double Taxation Avoidance Agreement between Singapore and U.K. Protocol

- January 2011

- Free Access

Double Taxation Avoidance Agreement between Singapore and U.K. Protocol

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us