Our collection of resources based on what we have learned on the ground

Resources

magazine

Verwaltung von Verträgen und Kündigungen in den ASEAN-Staaten

- January 2019

- Members Access

In dieser Ausgabe des ASEAN-Briefing Magazins diskutieren wir die Verwaltung von Arbeitsverträgen sowie Kündigungen in den fünf wirtschaftsstärksten ASEAN-Staaten. Zu Beginn beschreiben wir die zentralen Merkmale von Arbeitsverträgen und Sozialv...

magazine

Export and Import Procedures in ASEAN: Best Practices

- December 2018

- Members Access

In this issue of ASEAN Briefing magazine, we highlight the region’s export and import procedures for the benefit of trading businesses. We begin by outlining the export procedures in each ASEAN member state. Next, we focus on import procedures in e...

webinar

Singapore's Transfer Pricing Laws - 2018

- September 2018

- Members Access

On 25 September 2018, an international audience tuned-in to hear our Head of International Tax and Transfer Pricing, Paul Dwyer, our Singapore Tax Manager Richelle Tay and Transfer Pricing Associate Filippo Bortoletti, summarise the new transfer pric...

webinar

Singapore's Transfer Pricing Laws - 2018

- September 2018

- Members Access

On 25 September 2018, an international audience tuned-in to hear our Head of International Tax and Transfer Pricing, Paul Dwyer, our Singapore Tax Manager Richelle Tay and Transfer Pricing Associate Filippo Bortoletti, summarise the new transfer pric...

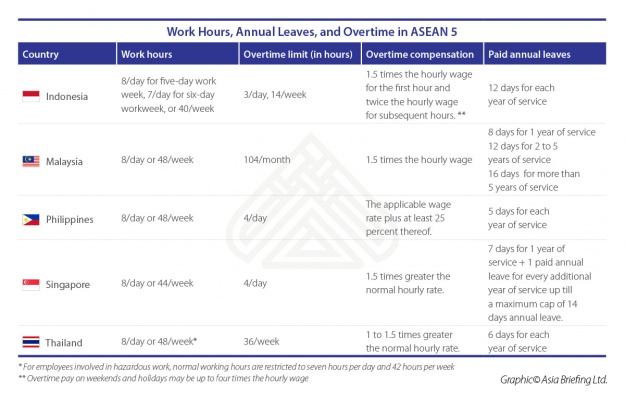

infographic

Work Hours, Annual Leaves, and Overtime - A comparison between the ASEAN 5 count...

- September 2018

- Free Access

A well-drafted labor contract protects both the employee and the employer from unnecessary risk. These contractual obligations, for both parties, are also mandated by various labor laws enacted by the governments of the respective countries. The inf...

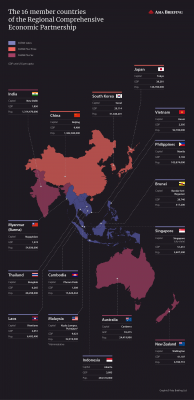

infographic

The 16 Member Countries of the Regional Comprehensive Economic Partnership

- September 2018

- Free Access

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us