Our collection of resources based on what we have learned on the ground

Resources

magazine

Freihandelsabkommen in Asien wirksam nutzen

- September 2016

- Members Access

In unserem aktuellen Magazin „Freihandelsabkommen in Asien wirksam nutzen“ beschäftigen wir uns mit Freihandelsabkommen in Asien. Debatten über den Abbau von Zöllen und anderen Handelsbarrieren zur Erleichterung des Handels werden oft auf mult...

infographic

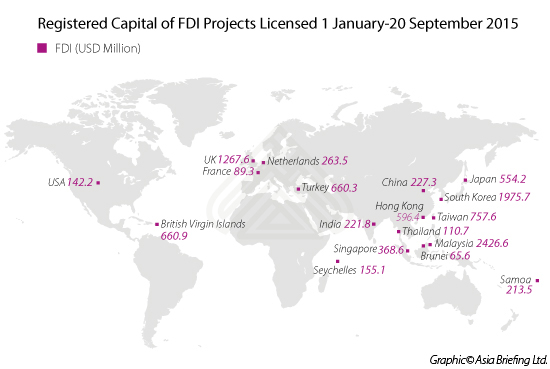

Registered Capital of FDI Projects Licensed 1 January-20 September 2015

- October 2015

- Free Access

This infographic compares the registered capital for foreign direct investment projects licensed in various countries between January 1, 2015 to September 20, 2015.

presentation

Explaining Monthly Payroll Work in China: What Does Your Payroll Manager Do?

- May 2015

- Free Access

This presentation by David Niu, Corporate Accounting Services Manager in Dezan Shira and Associates' Beijing office, discusses the basics of a monthly payroll system, with a sample timeline illustrating every step that should be taken.

DTA

Agreement Between The Government Kingdom Of Thailand And The Government Of The H...

- May 2015

- Free Access

Convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income between Thailand and Hong Kong.

infographic

K�rperschaftsteuer: Anforderung und Pr�fung

- May 2015

- Free Access

Eine Übersicht der Anforderungen der Körperschaftsteuer in ASEAN sowie den Ländern China, Hong Kong und Indien

infographic

Ease of Paying Tax Rankings

- May 2015

- Free Access

Ein Ranking des Schwierigkeitsgrades Steuern zu zahlen "Ease of Paying Tax", der ASEAN Länder sowie Hong Kong, China, Deutschland, den U.S.A., Italien und Indien

infographic

Einkommensteuer und Durchschnittseinkommen

- May 2015

- Free Access

Daten zum Durchschnittseinkommen von der Internationalen Arbeitsorganisation.

Q&A

What are the differences between the Chinese Accounting Standard (CAS) and the I...

- May 2015

- Free Access

Despite the ongoing convergence towards international standards, one must be aware of the following differences: Choosing a valuation method; China Accounting Standards (CAS) only allows fixed assets to be valued according to their historical cost...

Q&A

What are the expectations for the Generally Accepted Accounting Practices (GAAP)...

- May 2015

- Free Access

The 2014 Generally Accepted Accounting Practices (GAAP) is expected to be adopted by all medium and large-sized enterprises across Mainland China. The new PRC GAAP consists of: One basic standard providing guidance on practical issues 41 specific...

Q&A

What is 'mapping' in China?

- May 2015

- Free Access

As foreign companies follow different standards, the information from the Chinese subsidiary must be translated to fit into overseas parent company books. This procedure is known as mapping. There are two points to consider: 1. The divergence of Ch...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us